Trending Assets

Top investors this month

Trending Assets

Top investors this month

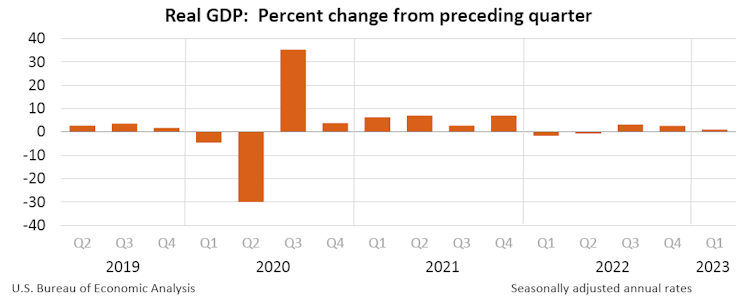

Economic Update - GDP

Stocks are running investors continue to monitor corporate earnings & economic data. Companies continue to outperform earnings expectations, though those expectations were already greatly reduced. Data showed that economic growth began to slow during the start of 2023.

For economic data today, US GDP rose at an annual pace of 1.1% during the Q1, below expectations of 2.0%. Consumer spending was up 3.7% for the quarter. Interestingly, the deceleration in GDP is primarily caused by a downturn in private inventory investment (manufacturing and whole sale trade of machinery equipment, and supplies).

The Personal Consumption Expenditures increased 4.2% this quarter, compared to 3.7%. Core PCE, the Fed’s preferred inflation measure, was up 4.9%, up from 4.4% the previous quarter.

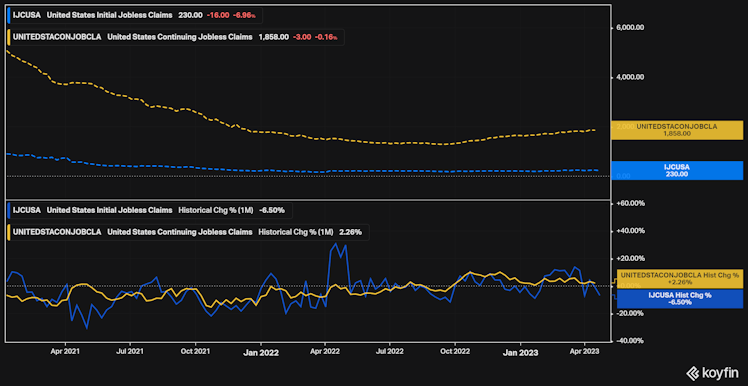

Elsewhere, initial jobless claims fell to 230,000, unexpectedly down 16,000 from last week. Continuing claims were at 1.86 million, also down.

Lastly, pending home sales unexpectedly fell 5.2% in March, versus expectations of increasing 0.8%. Economists equate the move to a continued imbalance between home supply and demand.

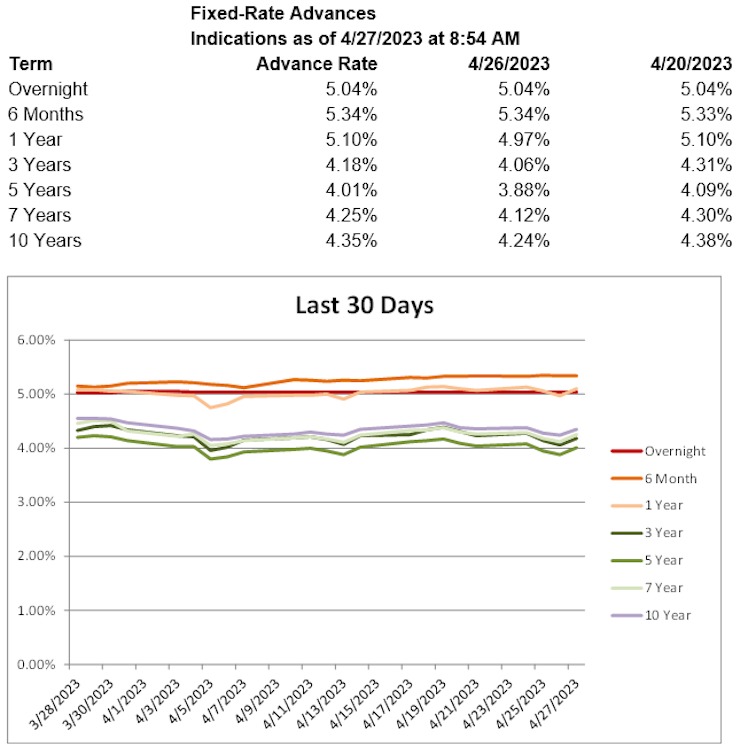

Treasury yields are higher, with the 2-year T yield up 13.6 basis points to 4.06%, the 5-year T yield up 10.7 basis points to 3.57%, and the 10-year T yield up 8.9 basis points to 3.52%. Advance rates are higher throughout much of the curve today.

Already have an account?