Trending Assets

Top investors this month

Trending Assets

Top investors this month

We need short sellers!

Hey guys and gals,

I wanted to share why short sellers are awesome (and should not be feared) and how they are needed part of stock market ecosystem with some examples!

I wrote this for Commonstock

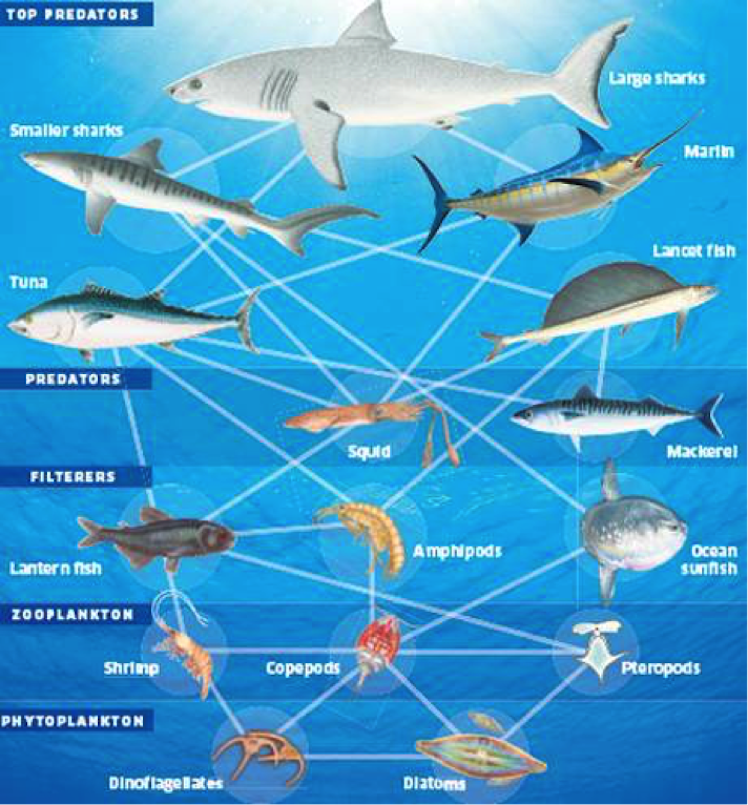

Lets start buy imaging that short sellers are like sharks, they can be scary to look at and there is a lot of media on how "dangerous" they are and yet if you really dig deeper sharks are NOT scary and they don't really hard humans.

Fun fact:

On average sharks are only responsible for an average of ten fatalities per year worldwide, compared to eight deaths every day in the United States from people texting while driving.

When there is too much of anything it is terrible for the system and there is imbalance that creates chaos.

"The loss of sharks has led to the decline in coral reefs, seagrass beds and the loss of commercial fisheries. By taking sharks out of the coral reef ecosystem, the larger predatory fish, such as groupers, increase in abundance and feed on the herbivores." - The Importance of Sharks

AKA CHAOS!

So, how is this related to short sellers?

When there is no one to "police" and take chance on companies that are out of wack, companies do insane things and at the end of the day regular folks like you and me (aka retail investors) are getting hurt because we are not as knowledgeable (for the most part) about what is going on in the companies.

Short sellers (the good kind) love to dig deep into companies and look to find something "bad" to show to the world and at the same time benefit from it via "selling the stock short". (example David Einhorn shorting Allied Capital and voicing his opinion while others kept pushing against it. Allied Capital Corp. )

These people (short sellers) are crazy enough and dedicated enough to take a chance and stand on their belief that company XYZ is doing something "bad" and illegal and that it should NOT be reward for its actions, but rather company and its stock should be punished!

When short sellers announce their thesis, we shouldn't be scared but rather we should be open minded and let our ego be put to the side and listen to what they have to say.

It doesn't mean they are right or wrong, they are expressing what they believe is and its for us to decide if we think they are correct or just trying to take a gamble.

I wanted to share three different examples to show case short sellers.

By calling them The Good, The Bad, and The Ugly

1) The Good

In November-December of 2020 I sold puts on $EHTH thinking it was a great looking company that is "almost" under-valued.

I thought price of $55 is a good starting position based on what company was projecting. Not too much debt, online platform, management has skin in the game, and at that time decent metrics.

After selling puts, I started digging deeper (stock was trading around $70) and I got stumbled on Muddy Waters short thesis report and how basically company is playing too much with the numbers to create a rosy picture.

After that report instead of keep on selling puts I started to listen and read on what management had to say and although I was not convinced that Muddy Waters is correct, from listening to earnings calls and digging deeper somethings didn't click to me and I decide to pass on the company.

As of today here is the chart of $EHTH

I'm just glad that I never executed a position.

2) The Bad

The bad is not so bad for me, but "The Bad" meaning for the short sellers.

In March-April of 2020 I started to buy into $IRBT.

I have one robot in my home and overall believed it was a wonderful purchase in mid $40 range.

My price target was around $80-90 mark and I did not believe that we would get that soon (maybe 3-5 years)

Then a "short squeeze" happened in January 2021

Side note: A short squeeze accelerates a stock's price rise as short sellers bail out to cut their losses.

There wasn't any major short thesis that I was aware of but there was high % of shares shorted, which did not bother me.

I had my own LONG thesis in play and believed that at that time it way silly to short this particular company and I was happy to keep buying below $40 mark.

Short squeeze came out of the blue (for me) and I actually didn't know what was going on as there was no major news but decided that around $120 is a good price to get out as its was way over my $80-90 range and its been over a year so I would be locking in long term gains.

Stock went as high as $197.40!

3) The Ugly

I did no participate in GameStop and Tesla frenzy but it does show that no matter how smart some short sellers can be, sometimes their ego just doesn't let go and that is why they are just parts in this machinery.

GAMESTOP

" GameStop short sellers are still not surrendering despite nearly $20 billion in losses this month " article in CNBC

Low $18ish

High $400+ ish

TESLA

when going back to 2010, the number is closer to $57 billion. " article in QZ

Low $30ish

High $1200+

Market is not always rational, but the rubber band always snaps back and we should learn from the past to take advantage of the future.

You can make your own judgement on short sellers, but just imagine what would happen if there was no sharks in the ecosystem and then think who would protect naive retailer investors. Sometimes protecting them by punishing them and sometimes it's other way around.

Quartz

Even after GameStop, Tesla remains the most shorted stock in the world

Betting against Tesla has cost investors $52 billion and counting.

Already have an account?