Trending Assets

Top investors this month

Trending Assets

Top investors this month

CMC Markets $CMCX (LSE) - H1 2023 Results

Source: CMC Markets Plc.

CMC Markets $CMCX (LSE) has just released it's H1 2023 Results in-line with market expectations and also kept it's guidance for the FY unchanged. It declared an interim dividend of 3.50p per share.

Lord Cruddas, Chief Executive Officer:

""I am pleased to report another strong performance for the first six months of the year. We saw an acceleration in activity across FX and commodities in addition to the normal activity across our index flow during a period of heightened focus on monetary policy action around the globe and a pickup in market volatility and trading volumes.

...............

We are on a fast track to diversification, using our existing platform technology to win B2B and B2C investing business. Our strategic growth plans are on track and set to deliver significant new business expansion as we introduce new products across our retail, institutional and stockbroking businesses.”

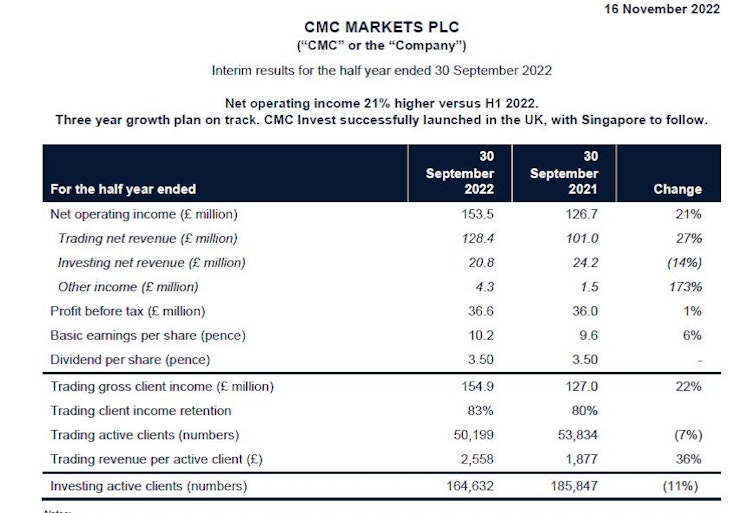

Source: CMC Markets H1 2023 Interim Report

H1 2023 Financial Highlights:

- Net operating income of £153.5 million (H1 2022: £126.7 million +21% yoy).

- Trading net revenue was £128.4 million (H1 2022: £101.0 million +27% yoy).

- Investing net revenue was £20.8 million (H1 2022: £24.2 million -14% yoy).

- Operating costs (excluding variable remuneration) of £106.3 million (H1 2022: £83.1 million1 +28% yoy) and £115.6 million (H1 2022: £89.7 million1 +29% yoy) including variable remuneration. The majority of the cost increase reflects investment for growth across CMC’s investing and trading platforms.

- Regulatory total capital ratio of 610% (FY 2022: 489%) and net available liquidity of £254.2 million (FY 2022: £245.9 million).

- Interim dividend of 3.50 pence per share (H1 2022: 3.50 pence) with a total dividend for the year expected to be in line with policy at 50% of profit after tax.

Operational Highlights:

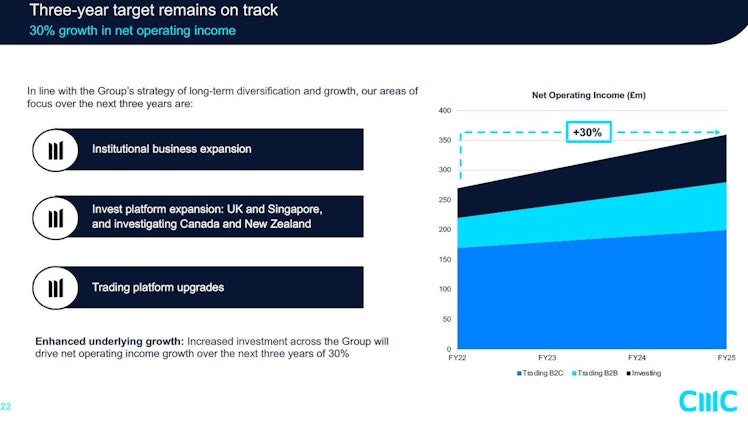

- Plans to grow Group net operating income by 30% over three years based on the 2022 results and underlying conditions, remain on track.

- Significant development upgrades delivered across existing trading platforms in H1 2023. These include enhanced FX liquidity functionality, new trading analytics, new pricing functions and enhanced onboarding initiatives. Further product upgrades on track for delivery in H2 2023.

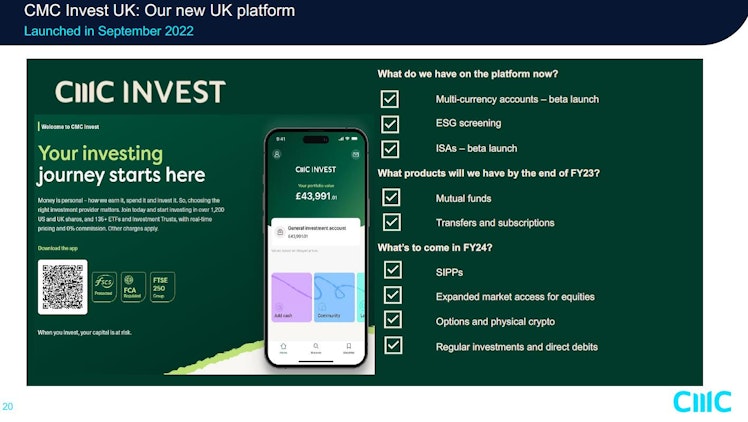

- Expansion of CMC Invest continues. The recent launch of the UK investment platform, CMC Invest UK, which will see new product additions over the coming months, will be followed by the launch of CMC Invest Singapore by the end of FY 2023. Further regional expansion in New Zealand and Canada also being considered.

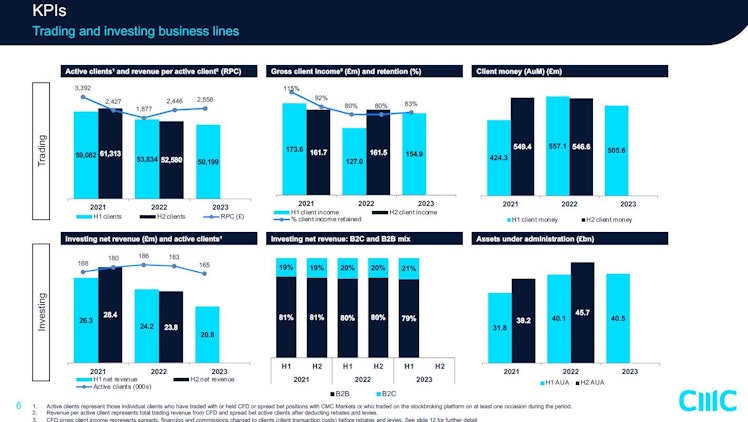

- Trading active client figures decreased by 7% although all regions saw an increase in revenue per client (+36% yoy) largely due to higher client income along with an increase in client income retention to 83% (H1 2022: 80%). CMC’s marketing focus on premium customers continues to act as a successful strategy for the Group.

- Operating cost guidance for FY 2023 remains unchanged at £215 million excluding variable remuneration. Ongoing GBP weakness and the rate of recruitment for the delivery of strategic initiatives could result in higher costs.

Source: CMC Markets H1 2023 Presentation

Source: CMC Markets H1 2023 Presentation

Source: CMC Markets H1 2023 Presentation

DISCLOSURE: This is not a financial advice. This material has been

distributed solely for informational purposes only and is not a solicitation or an offer to buy any security or to participate in any trading strategy. The material may include projections or other forward-looking statements regarding future events, targets or expectations. Past performance is no guarantee of future results. There is no guarantee that any opinions, forecasts, projections, risk assumptions, or commentary discussed herein will be realized or that an investment strategy will be successful. All expressions of opinions are subject to change without notice. Investors should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Already have an account?