Trending Assets

Top investors this month

Trending Assets

Top investors this month

Do politicians beat the market?

The The Wall Street Journal has been reporting on the conflict of interest concerns about politicians trading on advanced knowledge of material insider information (article link below).

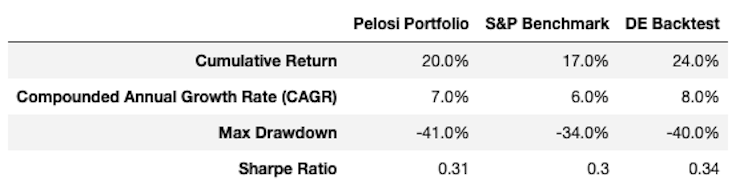

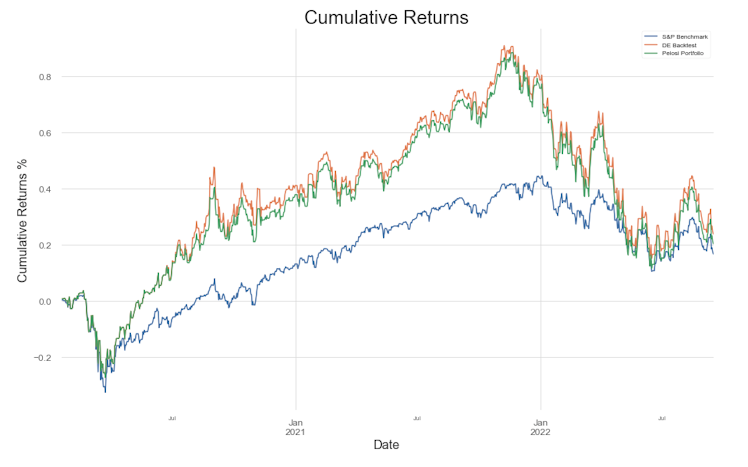

I did my own analysis of Nancy Pelosi’s data and found that:

- Her performance beat the S&P benchmark by 4%: not too shabby, most professionals can’t do that consistently

- Proprietary Disposition Effect (‘selling winners too soon, losers too late’) analysis suggests active management errors reducing her performance (“negative behavioral alpha”); performance delta is rather small relative to others I’ve analyzed

- Larger drawdown than S&P: makes sense given portfolio holdings

Data source: https://housestockwatcher.com/api

Analytics: https://www.profofwallstreet.com/

LinkedIn

LinkedIn Login, Sign in | LinkedIn

Login to LinkedIn to keep in touch with people you know, share ideas, and build your career.

Already have an account?