Trending Assets

Top investors this month

Trending Assets

Top investors this month

April Taxable Portfolio Summary

Portfolio Value

March '23 Month End: $16,581.73

April '23 Month End: $16,790.50

Value Difference: $208.77

Performance: +0.57%

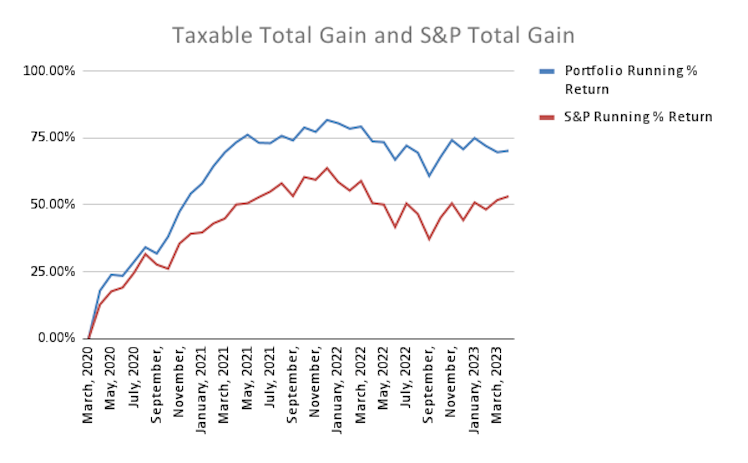

Portfolio vs S&P

March '23 S&P Month End: $4,109.31

April '23 S&P Month End: $4,167.87

S&P % Difference: +1.43%

% Difference Portfolio vs S&P: -0.86%

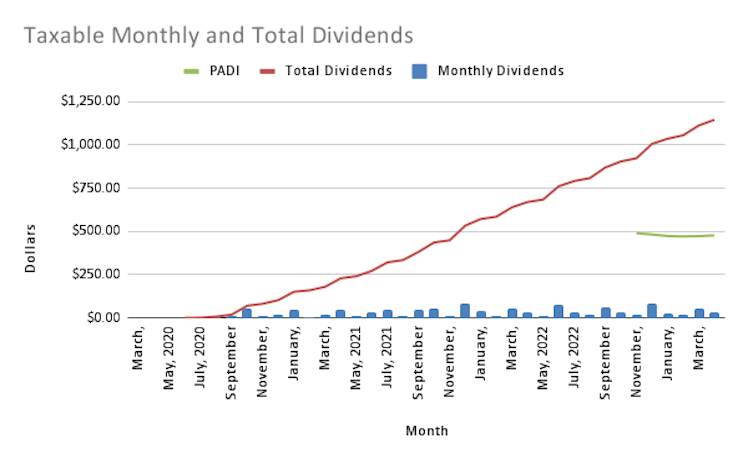

Dividends

April '23: $32.74

April '22: $30.57

% Difference: +7.1%

PADI: $473.20 to $477.65 (+0.9%)

Contributions

$115

Transactions

Buys

4/10

$RTX - 1 share at $97.96

$CARR - 8 shares at $41.80

4/17

$PEP - 1 share at $184.30

Sells

4/4

$VTI - 1 share at $205.00

$SCHF - 3 shares at $35.12

$IEMG - 2 shares at $48.85

Summary & Commentary

I completed my quarterly rebalance in April. This involved trimming positions ($VTI) and liquidating full positions that were less than 1% of my portfolio after my minimum holding period ($SCHF and $IEMG).

I have been implementing a new contribution strategy with this account which is allowing me to contribute some cash and give me some buying opportunities.

Overall, I do not feel any uneasiness with liquidating $SCHF and $$IEMG. These sales allowed me to add to $CARR and $RTX. $RTX was under 1% of my portfolio and was on the liquidate list for my next quarterly rebalance prior to this purchase.

Finally executing my selling strategy will allow me to continue to concentrate my portfolio into my best holdings and let the less attractive holdings slowly fade away.

Would love to hear your thoughts in the comments!

Already have an account?