Trending Assets

Top investors this month

Trending Assets

Top investors this month

Who is selling luxury goods companies, can retail investors bargain-hunting?

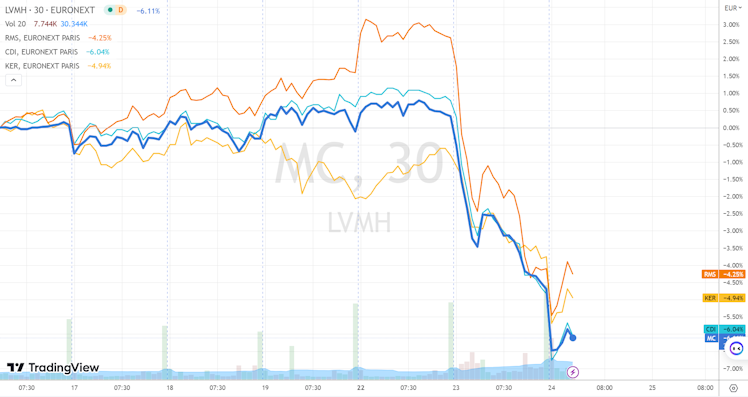

After the opening of European stocks on May 23,$LVMUY $HESAY The share price of European luxury goods group companies, represented by the market, has been falling all the way, and after the opening of US stocks, it has continued to fall sharply because of the market correction. The one-day drop is the biggest in more than a year.

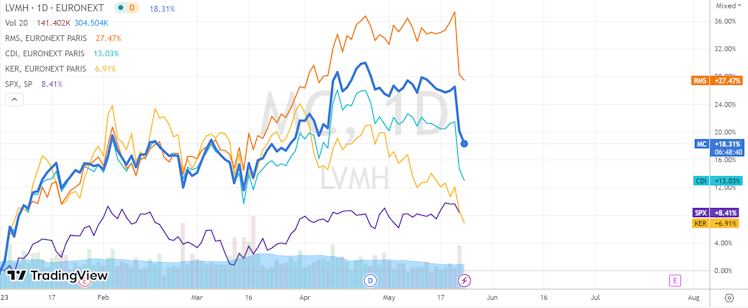

Due to the huge increase since the beginning of the year, most luxury goods companies are still outperforming the broader market in 2023. Because luxury goods are different from other consumer goods, the price is sometimes directly proportional to the demand, so they have a certain anti-inflation effect in the inflation cycle. For example, LVMH raised prices more than five times from 2019 to March 2023, and each price increase can boost sales.

What is the reason for this sharp drop?

1.The price of luxury goods is not the same as the price of luxury goods stock, which reflects investors' expectations of the industry.

It is precisely because investors have seen luxury goods groups raise prices many times and global inflation has declined to varying degrees that future growth expectations must slow down. Investors saw early warning signs before deciding to cut their positions. For example, the growth of the US market, which accounts for 27% of LVMH's global sales, is slowing, and the demand for entry-level luxury goods (products that are relatively accessible to the middle class) is also weakening.

2.The proportion of tradable shares is not high, and the adjustment of positions by institutions brings a chain reaction.

It is no secret that sales expectations are lower, nor is it suddenly revealed yesterday. Luxury stocks are often industries where institutional investors get together and have heavy positions. For example, LVMH stocks listed on the French Stock Exchange have a stock price of 850 euros, which is difficult for ordinary retail investors to participate, and the pricing power is in the hands of institutional investors. When institutional investors adjust their positions, the stock price will easily fluctuate greatly, and at the same time, more quantitative orders will be triggered, resulting in a market with large unilateral fluctuations.

Among the top brokers who traded on May 23rd,$MS $BAC Merrill Lynch ranks very high, accounting for more than 30% of the daily turnover of LV, RMS (Herm è s) and CDI (Dior).

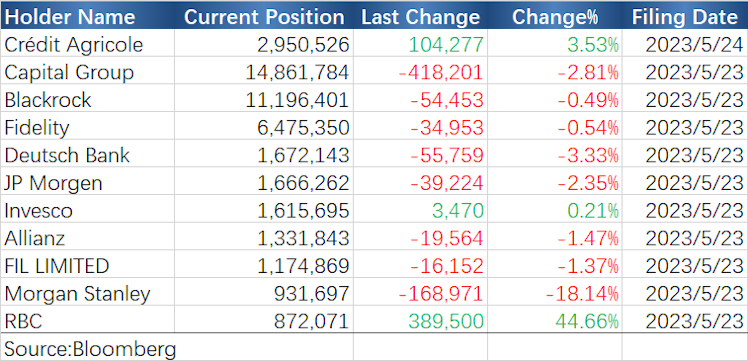

According to the latest filing documents, among LV's major institutional shareholders,Capital Group,$BLK,Fidelity,$DB, $JPM made an opponent's game with them.

It's also a coincidence. Did these institutional investors agree to reduce their positions at the same time on May 23rd? Obviously impossible, it is more a chain reaction that spreads from word to word. Seeing that one company started to reduce its position triggered the quantitative index of the other company, so it was forced to reduce its position.

Can you bargain-hunting?

Fundamentally speaking, at present, only investors are worried about the decline of the "American market", but there is still the support of the newly opened Chinese market.

Moreover, in terms of proportion, the proportion of sales in China market is larger than that in the United States. From this point of view, France is also the least likely Western country to have a bad relationship with China.

If the investment bank lowers its expectations for the next few quarters, it will provide an opportunity for the subsequent performance to "exceed expectations", so this wave of position reduction is unlikely to continue without more performance support, and it is more likely to fluctuate repeatedly.

But luxury stocks have performed very well this year, mostly higher than $SPX , and to a certain extent overdraft future performance expectations, so to continue to hit new highs, or return to the previous high, there is still great resistance.

Luxury stocks can therefore be part of an anti-inflation position (lest CPI exceed expectations again) or a target for liquidity. If you open a position within the previous 2 years and have a lot of floating profits, it is also good to take the opportunity to reduce the position and settle the profit.

Already have an account?