Trending Assets

Top investors this month

Trending Assets

Top investors this month

TransMedics ($TMDX) Q1 Earnings Recap

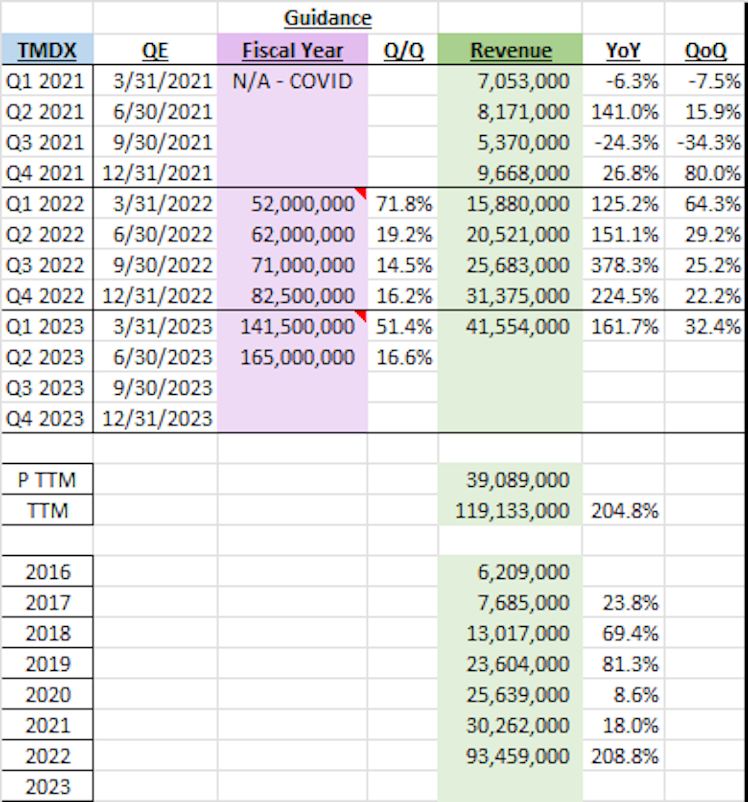

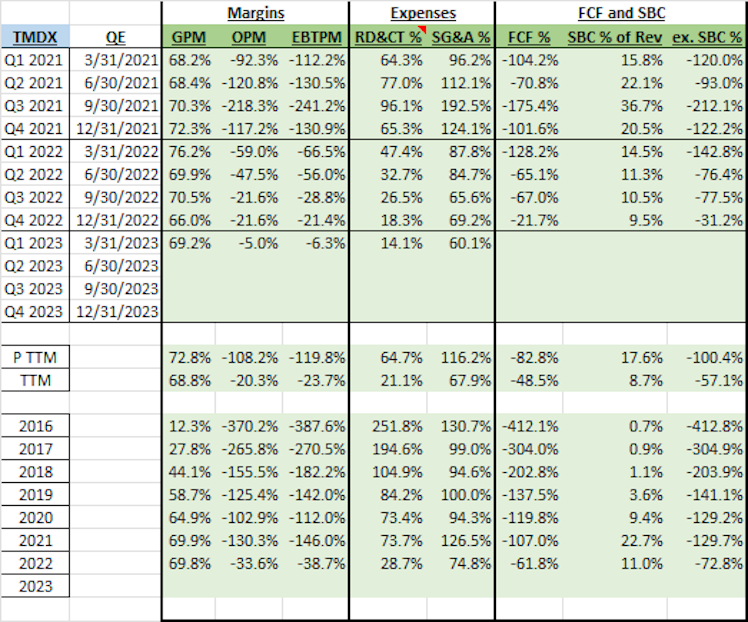

Financials

Revenue increased by 162% YoY and management raised full year guidance by 17% at the midpoint.

The company is on the precipice of positive operating and EBT margins. Cash flow statements are never included on their earnings releases and their 10-Q isn't out yet but I wouldn't be surprised if they were FCF positive, for the first time ever, in Q1.

Highlights from the call

- 91% of their US revenue came from their National OCS Program (NOP), that's up from 70% YoY and 89% sequentially. TransMedics is working to make organ donation into a SaaS industry by managing the procurement and transportation of organs.

- Liver programs using OCS and NOP increased sequentially from 22 programs to 32.

- Heart programs using OCS and NOP increased sequentially from 29 programs to 40.

- Lung programs using OCS and NOP decreased sequentially from 13 programs to 9.

- Established a raw material planning and monitoring team whose duties are to create "a scalable process to close track our growing demand for raw material and proactively replenish our raw materials to meet our near-, mid-, and long-term needs."

- Announced they will be expanding their surgical and field clinical staffing in the US over the next 12-18 months to meet the growing demand for their NOP clinical services.

- They plan to revamp their logistics network for the NOP, driven by the recent hire of a "senior logistics executive" from Amazon.

- They are planning to launch a customer-facing HIPPA-compliant app for surgeons and clinicians that provides them with real-time updates on the organ that is hooked up to an OCS machine along with travel time information.

- They reiterated their goal of creating TransMedics Aviation. The goal is to have their own air charter network so they can cut out the external airplane charter companies and help TransMedics control the organ procurement and transportation from beginning to end. I strongly recommend people read Dr. Hassanein's comments on the current state for organ transportation via flight in the Q1 transcript.

- In response to a Canaccord analyst asking how TransMedics plans to enter the air industry, Dr. Hassanein stated an organic entrance of buying one plane at a time is not an option due to the length of time it'd take them to obtain proper licensing. That leaves a joint venture or an acquisition, both of which they are currently "actively pursuing across the United States." The CFO dodged how TransMedics would pay for the aviation aspect (I'd suspect share dilution and debt) but did say that while gross margins would decrease due to operating their own air network, it would be accretive to both the top and the bottom line.

I remain extremely bullish on TransMedics but it's also a very high-risk company. They're basically flat today (earnings came out last night) but are up 267% over the past year. At just $2.5B market cap, I believe they have a huge runway in front of them. Definitely trading at frothy valuations right now though (21x sales, 31x gross profit).

I'm curious what the other Commonstock $TMDX shareholders (@erickdevore @jaredengeman @johnprocopio @lechisy2008 @mgbravo @naveed @pggalaviz) or people with TransMedics on their watchlist think of Q1.

Already have an account?