Trending Assets

Top investors this month

Trending Assets

Top investors this month

Terminally Ill - Block Inc. (Pt. 1)

Hi everyone - Second post here. Thanks for the kind words on my Etsy piece.

Today I'm a little more directionally focused - I believe Square $SQ (Now Block Inc.) has an incoherent business model and is thus terminally overvalued. To disclose: I have no position, I am not short Block. By contrast, I am an investor in Klarna, a competitor to Block. Therefore, I may have implicit biases in my analyses. This is not advice!

For the uninitiated, Block (formerly known as Square) is a collection of digital commerce services and products built to help business owners evolve and scale. The company's core products: Square - best known for their Point-of-Sale systems (often employed by small businesses) and Cash App, the app that allows users to transmit money on their phone for free. In recent years, Square has overhauled their strategic outlook - making several large acquisitions and changing their name to Block, symbolic of the company's mission of being the "building blocks" to economic empowerment.

Per Square's IR page, the company is characterized by their consortium of subsidiaries: Square - Integrated commerce software for small and medium sized business owners; Cash App - A consumer finance app that enables digital payments, investing, among other services; Spiral (Square Crypto) - which builds & funds open-sourced projects seeking to advance Bitcoin; TIDAL- a music streaming platform; and TBD - An open developer platform built to ease access to Bitcoin and other blockchain technologies. Not mentioned but a very significant part of the Square segment is Afterpay, the Australian "Buy Now, Pay Later" provider that Block bought last year for $29B.

I resonate with Block's mission: I'm a fan of cryptocurrency! I understand that the lack of financial services is a huge issue for lower-income Americans. I also see the appeal in Square's core products - if I am a vendor at a farmer's market, why wouldn't I want a PoS system that connects to my iPhone? The convenience factor is obvious.

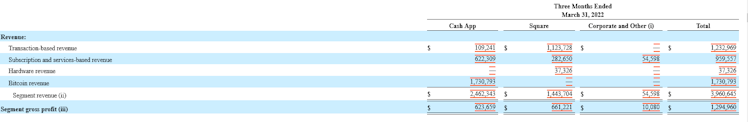

That said, the company's latest acquisitions and strategic pivot are a step in the wrong direction, in my view. Not only that, I believe their core segments are under increasing pressure from better-capitalized and more profitable competitors. This encroaching competition will force Block to expend margins at the benefit of market share, ultimately to the detriment of shareholders. Finally, with a caveat being that I am not an accountant, Block appears to employ an ambiguous method of distinguishing revenue segments, split between *Square * Cash App, as well as Corporate & Other.* These operating segments are subsequently itemized into transaction-, subscription-, hardware-, and bitcoin-based revenues.

From the latest 10-Q:

The fact that transaction-revenues are a smaller segment than Bitcoin-revenues is my first cause for concern. Again, I like Bitcoin! I have no issue with crypto at its root! My concern with this segment is it appears to also be a transaction-driven revenue model, despite not being reported that way. According to the 10-K, Block "purchase[s] bitcoin from private broker dealers or from Cash App customers and applies a small margin before selling it to our customers." Without taking a directional stance on bitcoin, I believe that crypto trading, like stock trading, will eventually succumb to 0% commissions. Even then - the volume of crypto brokers entering this marketplace should only cause headaches for Square as they look to secure market share.

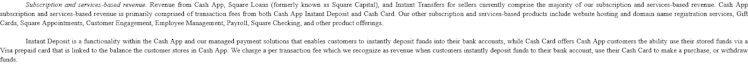

In addition to the disproportionate reliance upon BTC commission, Square's subscription & services segment seems much more transactional than recurring.

From Block's 10-K:

From the reading of this, it appears the "recurring" element of Square's subscription revenue comes mainly from non-core services like website hosting, domain services & other B2B services. Other services mentioned, like Square Loans, the Gift Card, Instant Deposit, and Cash Card should be in the transactions segment, in my view. While I don't accuse Square's management of trying to mislead investors, it is apparent that companies command a premium or multiple expansion with a viable subscription model. The fluctuating gross margins from this segment (80% in '22, 85% in '21, 86 in '20) reflect a profitable, albeit not entirely predictable cost structure, which leads me to believe it should be categorized as transaction-based.

Irregardless of the composition, it's clear that the services segment provides Block with the cushion to eke out gross margins of <30%. Point of Sale hardware - which propels revenue growth in other segments of the company- is a loss leader with negative gross margins. Square's point-of-sale hardware model may also be under attack from the likes of Apple, Amazon, and other merchants experimenting with digital or contactless payments. Apple, for starters, was rumored to be investing in Point-of-Sale tech- making it so that iPhones can accept contact-less payments without any accommodating hardware. Amazon, by extension, has notoriously popularized "cashier-less checkout" in some locations, with ambitions of licensing it to other merchants. While neither appear to be short term risks, it is certainly a concern for Square's terminal growth prospects if consumers grow accustom to this innovation.

There are a few other points I could make, but will save for a future post for brevity's sake. In investing, nothing is personal to me! Block bulls: I welcome the opportunity to discuss why I'm wrong! Thank you for reading.

Tom

investors.block.xyz

Block, Inc. (SQ) Investor Relations - Investor Relations

Block, Inc. (SQ) is a technology company with a focus on financial services. Made up of Square, Cash App, TIDAL, and TBD, we build tools to help more people access the economy.

Already have an account?