Trending Assets

Top investors this month

Trending Assets

Top investors this month

Alteryx $AYX : Rising From The Ashes?

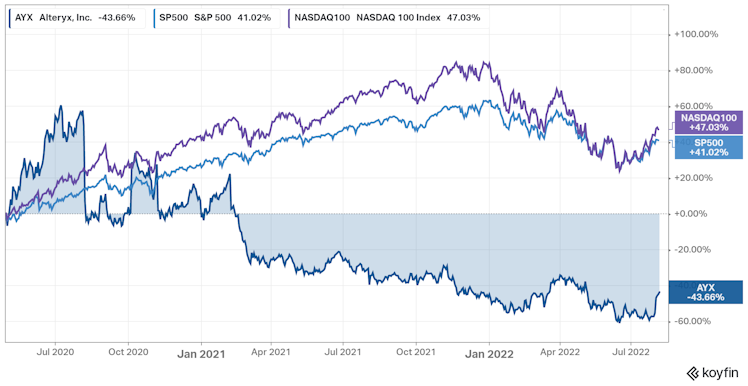

One of the more prominent software stocks over the last few years has been Alteryx $AYX. The company provides a platform for data analytics and automation, with a specific emphasis on ETL/ELT (Extract, Transform, Load) functionality that bridges multiple data sources into an organized format that's ready for analytics/AL/ML etc. For data analysts in the industry, ETL or ELT has typically taken ~70% of their work time. With a platform that automated many of the manual processes, Alteryx gained rapid traction and growth, and so did its stock... until mid-2020.

Somewhere along that period, it not yet cloudified business, the pandemic, and a product lineup that didn't quite work had led sales to falter on growth. As a darling among high-growth stocks, it fell hard as the story diminished and valuation multiples compressed drastically. The founder-CEO spearheading the strategy took a step back and let outside management take over in 2021.

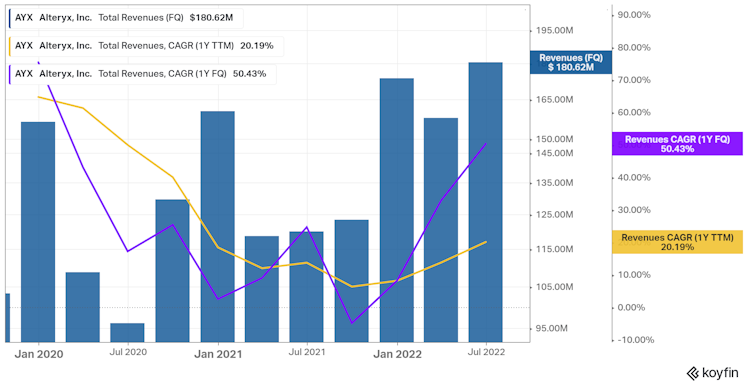

In the last two quarters, things seemed to have fared a lot better. Alteryx sidestepped most of the mega tech crash by posting two consecutive sales beats of increasing magnitude. The last Q2, in fact, recorded 50% YoY sales growth, accelerating 14% QoQ. Not bad at all.

The once decelerating trend has more or less reversed course and is now accelerating. While one would be right to compare the strength and base it on a weak 2021 of transition, the numbers are still impressive. With $400m in liquidity and a roughly flat Free Cash Flow line, things are looking sound on the financial side.

And finally, the forward valuation of 5.8x NTM EV/S is quite reasonable for the financial mix and prospects of Alteryx. If the trend of outperformance on earnings holds, we could see multiple expansion and forecast compression. Competition, however, does appear murky with Tableau, Microsoft's Power BI, and a handful of other platforms now vying for the same space which Alteryx once led with impressive momentum pre-pandemic. FCF might again reach a 20% margin at maturity, or growth could more than make up for shortcomings on the bottom line. Net dollar retention is strengthening, and so are customer counts, and other software KPIs of the sort.

So in my opinion, $AYX is highly attractive for further investigation. When there's a wide range of outcomes at a point in time where there's a lot of change, good research and analysis might lead to a conclusion that's widely distinct from the consensus. As such, a potential opportunity for faster than usual alpha might arise.

While it may have missed my radar a month ago, it's seemingly time to get to work on this name. There are software businesses with 50%+ growth and flat FCF margins trading at 10x forward sales so there's certainly still room for big returns from here.

No position yet.

Already have an account?