Trending Assets

Top investors this month

Trending Assets

Top investors this month

🤝 Deal or No Deal? 🤝

In July, Unity $U announced a deal to buy ironSource $IS. On Tuesday, AppLovin $APP made a bid to acquire Unity for $58.85/share, 18% above the stock’s price at the time. Under the terms of the deal, Unity would have to abandon its deal with $IS.

What should Unity $U do, acquire, or get acquired?!

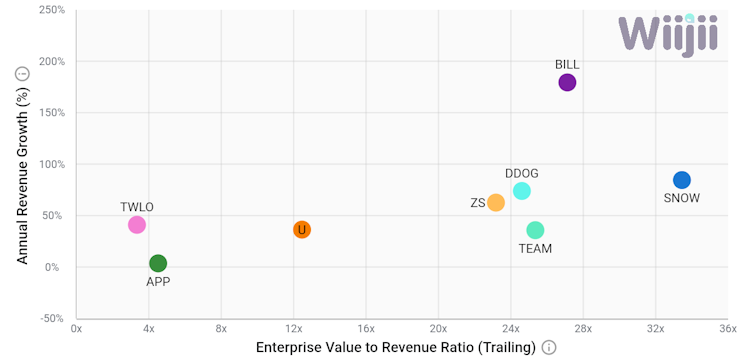

Here is where $U's valuation currently stands against other software stocks.

Leader of the pack?

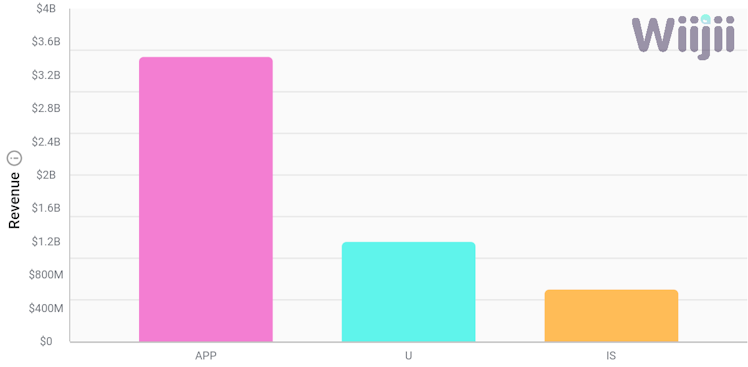

AppLovin $APP generates $3.42B in revenue which is almost three times Unity’s $U $1.2B and almost five times ironSource’s $IS $623m.

You can look at the detail here.

Or falling behind?

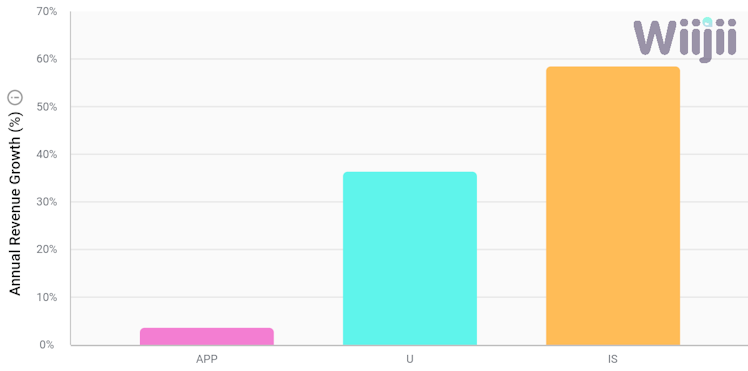

AppLovin $APP has the slowest revenue growth rate at 3.6% compared to Unity $U at 36.3% and ironSource $IS at 58.4%. $APP isn’t exactly operating from a position of strength based on how it stacks up.

Cash is king

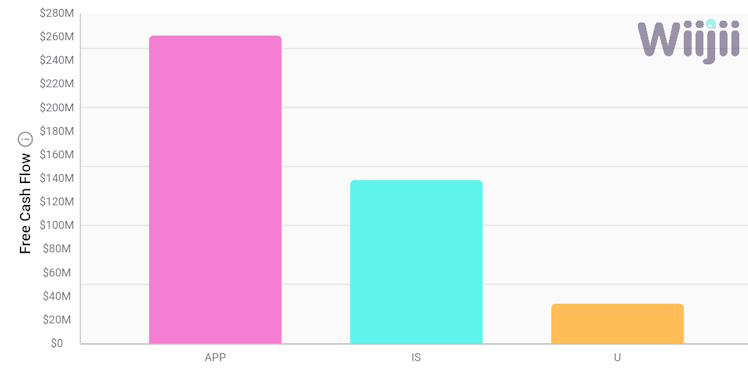

Growth aside, AppLovin $APP has generated the greatest cash flow over the past 12 months.

You can view these companies' FCF details here.

If you want to see the complete analysis of these deals, you can read it in our newsletter 👇.

mailchi.mp

🤝 Deal or No Deal? 🤝

Already have an account?