Trending Assets

Top investors this month

Trending Assets

Top investors this month

$META Q2’22 Earnings preview

FINANCIAL HIGHLIGHTS

- Revenue $28.82B, ⬇️ 1% compared to Q2’21

- GAAP EPS $2.46, ⬇️ 32% compared to Q2’21

- Operating income $8.36B, ⬇️ 32% compared to Q2’21

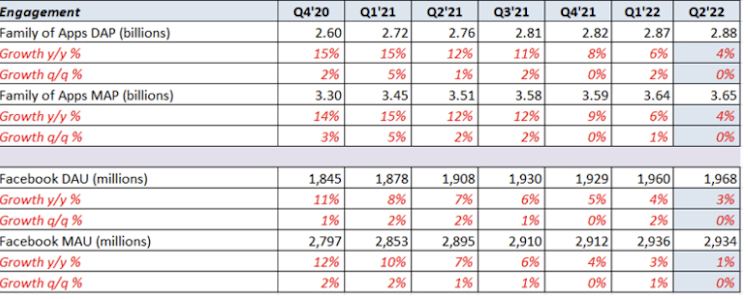

USER ENGAGEMENT

$META managed to retain engagement despite competition from TikTok and other apps striving for people’s time.

User engagement in both Family of Apps and Facebook has grown y/y but was flat q/q.

Facebook engagement was better than expected. Mark Zuckerberg, “Engagement trends on Facebook have generally been stronger than we anticipated, and strong real growth is continuing to drive engagement across Facebook and Instagram.”

REVENUE HEADWINDS

- Foreign exchange (revenue growth on a constant currency basis was 3% y/y).

- Reduced advertiser spending due to economic uncertainty.

- Shift in ad impressions towards lower-monetizing surfaces (from feed and stories towards reels).

REELS

Reels is growing quickly (30% increase in time spent q/q) gaining engagement across both Instagram and Facebook.

Reels reached $1B revenue run rate. According to Zuckerberg, Reels reached $1B run rate at a faster rate than when Stories were initially launched.

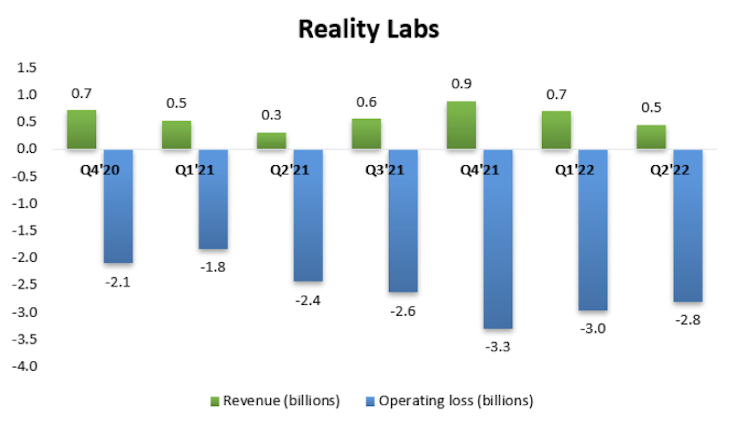

REALITY LABS

Operating losses for the segment were $2.8B compared to $2.4B last year. As operating losses continue to grow, they put downward pressure on $META ’s operating margin.

OPERATING INCOME

Operating margin for Q2’22 was 29% Vs 43% last year.

Total expenses were $20.5B, up 22% Vs last year driven to a large extent by headcount which rose by 32%.

Going forward management plans to push back on some of its investments and reduce headcount growth.

CASH FLOW

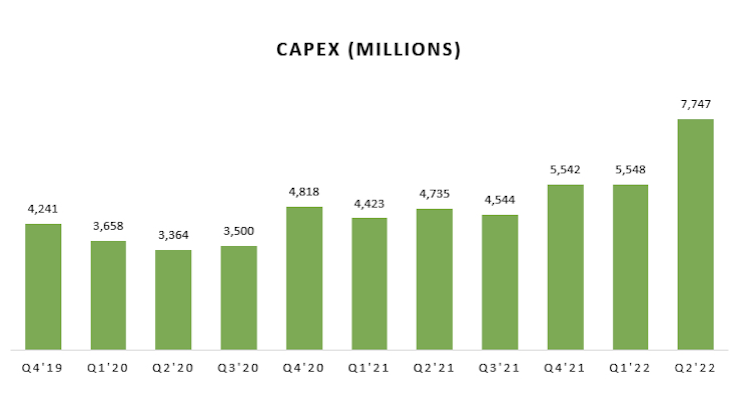

Free cash flow was $4.5B (15.6% of revenue) Vs $8.5B last year (29.2% of revenue).

Substantial increase in CAPEX to $7.7B, up by 64% y/y and 40% q/q. The substantial increase in CAPEX relates to server spend, including Meta’s AI Infrastructure.

SHARE BUYBACKS

$META repurchased $5.1B worth of shares, a significant deceleration compared to previous quarters.

Buying less at lower prices does not demonstrate the best capital allocation policy.

OUTLOOK

-Q3 revenue of $26-28.5B, implying y/y decrease of 6%. FX headwind on revenue growth expected to be 6% implying flat revenue on a constant currency basis.

-Total expenses for 2022 expected in the range of $85-88B, lower than the prior outlook of $87-92B.

You can read the full earnings preview in our substack. Subscribe for free to receive similar write-ups. We will be covering $PYPL and $ABNB in the following days.

stockopine.substack.com

StockOpine’s Newsletter | Substack

We focus on quality companies, providing high-quality fundamental research and stock ideas. Click to read StockOpine’s Newsletter, a Substack publication with thousands of subscribers.

Already have an account?