Trending Assets

Top investors this month

Trending Assets

Top investors this month

$OKTA Notes

Summary

- OKTA is a ~$40B market cap cloud identity management technology company

- Okta connects any person with any application on any device. It's an enterprise-grade, identity management service, built for the cloud, but compatible with many on-premises applications.

- Okta features include centralized provisioning (allocating privileges), Single Sign-On (SSO), Active Directory (AD), LDAP integrations, and flexible policies for organization security and control.

- The need for this type of solution was born of the unique challenges of how technology has grown and shifted in the growing diversity of devices, identity issues, security, employee mobility, vendor partnership, and the exponential growth of unique application options.

- OKTA is part of many clients' core tech stacks thanks to these solutions.

- I expect Okta to grow to ~$5 billion in revenue by the end of FY2026

Global Trends

It's worth repeating that the 4 megatrends that have been driving every cloud cyber security infrastructure business for the past several years,

- The adoption of cloud and hybrid IT

- Shift to dynamic work environments

- Implementation of Zero Trust Architectures // The identity security infrastructure is a requirement for Zero Trust.

- Continued ransomware attacks and IT security breaches are driving elevated spending levels, benefiting Okta and other security software companies.

OKTA Growth Advantage

- Low-cost implementation compared to traditional solutions such as $SAIL and $CYBR. Lower hours required to set-up → lower professional services hours were used up to perform integrations with new apps and other API integrations.

- Management (clarification: this refers to buyers of these services) of only cares if it solves the problem and the cost of implementation.

- Growing reputation outside of industry specialists - COOs and/or CSOs need social proof

- Mature product - it contains most of the solutions required by businesses (Missing Privileged Access Management but it's coming Q1 2022)

Why Now?

- Companies are going remote-first or remote enabled and need the security enhancements → Upgrade cycle is happening now.

- Cybersecurity threats - attackers frequently target the identity vector as it allows them to leverage user identities to gain access to high-value systems and data while concealing their activity and movements within an organization’s IT infrastructure.

- A new wave of regulations and compliance measures and may impose penalties for non-compliance by regulatory bodies.

Key Metrics to Follow

- Revenue growth needs to be ~40% for the next 5 years to justify current pricing

- Net Dollar Retention Rate > 120%

- Gross Margins > 70%

- Large company sales - Customers > $100,000 revenue = 44% growth annualized in the past 3 years. They need to keep this up as the majority of revenue will come from large organizations.

- Acquisitions will have to be part of this strategy. So far, Auth0 was a strategically sound investment but it will be hard to continue to invest and integrate in this environment.

Additional Info on their Solutions

OKTA provides solutions to these problems:

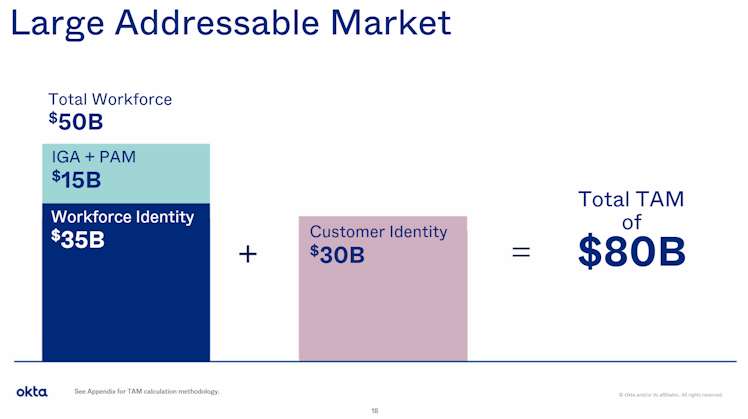

- Workforce Identity - Protect + enable employees, contractors + partners: Single Sign-on & MFA, Universal Directory for all users, groups, and devices

- Customer Identity - Create frictionless registration and login for apps. Offloads customer identity management to Okta

- Auth0 → Adds strength to customer identity. Developer first identity solution (API)

Some Cold Calling / Messaging.

What I did was go to Linkedin and I cold messaged a lot of folks who are implementing these products in large organizations (Mainly Deloitte, Booz Allen, etc.).

They had great things to say about:

They didn't speak well of CyberArk.

Already have an account?