Trending Assets

Top investors this month

Trending Assets

Top investors this month

What I Learned from Trading: Process Thinking

In my previous post, I outlined how learning to trade taught me to exploit any natural advantage (edge) I might have in the market. This led to the principle "know your edge, play to your edge".

This next trading principle has been responsible for my greatest strides as a long-term investor. When I first began to learn about rule-based trading systems, I realised my approach to long-term investing was informal and haphazard. My method was all in my head, and therefore fluid and subject to change on the whims of my emotions. I didn’t have a process and set of rules to guide me through my investment decisions. Without a repeatable process, how could I be confident of a long-term positive outcome?

"If you can't describe what you are doing as a process, you don't know what you're doing"

W Edwards Deming

The Deming System of Profound Knowledge

This post is going to be epic in length because it was a turning point for us. This is the point where we made the leap from "hobbyist" investors to "professional-grade" investors (for want of a better term, and I say this with great modesty). I thought about splitting this up into multiple posts, but decided against it because I feel it really needs to remain unified as a single essay.

A trading system is a set of repeatable concrete rules that govern when you can buy a stock, how much to buy and when to sell. A successful trading system is a repeatable process that will yield a positive expectancy over the long-term. There will be individual trades that result in small losses, but overall the sum total of all trades should be highly profitable. A successful trader will follow a positive expectancy trading system that fits their personality, objectives, psychology and beliefs.

Everything about the trading system must be congruent with the trader’s temperament. This is because every trading system will experience a string of trading losses. If the psychological demands of the trading system doesn’t fit the mindset of the trader, cognitive dissonance steps in to sabotage the trader’s results. The trader might try to altar the rules in a perpetual quest to chase profits or even worse, abandon the system just before it becomes highly profitable. Trading is all about mindset and psychology.

At the minimum, a trader’s system must address the following:

- The buy criteria that dictates when to open a new position.

- A stop-loss rule that limits the loss when the trade doesn’t work out.

- The rules for profit-taking, usually linked to the stop-loss rule.

- A position sizing strategy that determines the allowable risk per trade and avoids the risk of ruin (running out of trading capital).

- System adaptations for different market conditions.

Almost all aspects of a trading system apply to long-term investing. Our investment process should be a repeatable system with a long-term positive expectancy of success. Not every investment is going to be a winner, but similar to a trading system, the sum total of all investments over the long term should be highly profitable. The psychological demands of your investment process should match your personality, otherwise you won’t stick to your process and end up sabotaging your results.

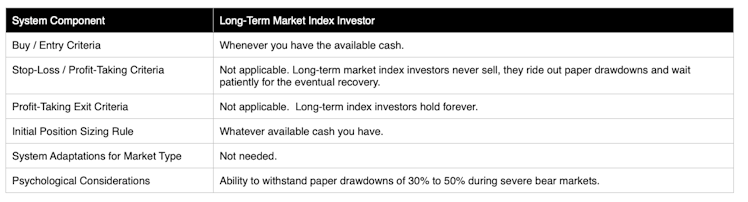

A long-term investment process will address the same elements as a trading system, but use different criteria:

The simplest way to build long-term wealth in the stock market has been described succinctly by the most successful stock market investor of all time, Warren Buffet:

"A low-cost index fund is the most sensible equity investment for the great majority of investors. By periodically investing in an index fund, the know-nothing investor can actually out-perform most investment professionals"

If this quote is all you knew about stock market investing and you stuck doggedly to this plan without fail, you’ll become very wealthy over the long term. In a two sentences, Buffett lays out a full investment process for retail investors. An investor with a portfolio consisting of a single market index fund enjoys the simplest of processes:

Market index investors achieve reward-to-risk asymmetry by capturing the long-term returns of the aggregate stock market. They hop on the big macro growth trend, ride out the volatility and hold on for multiple decades.

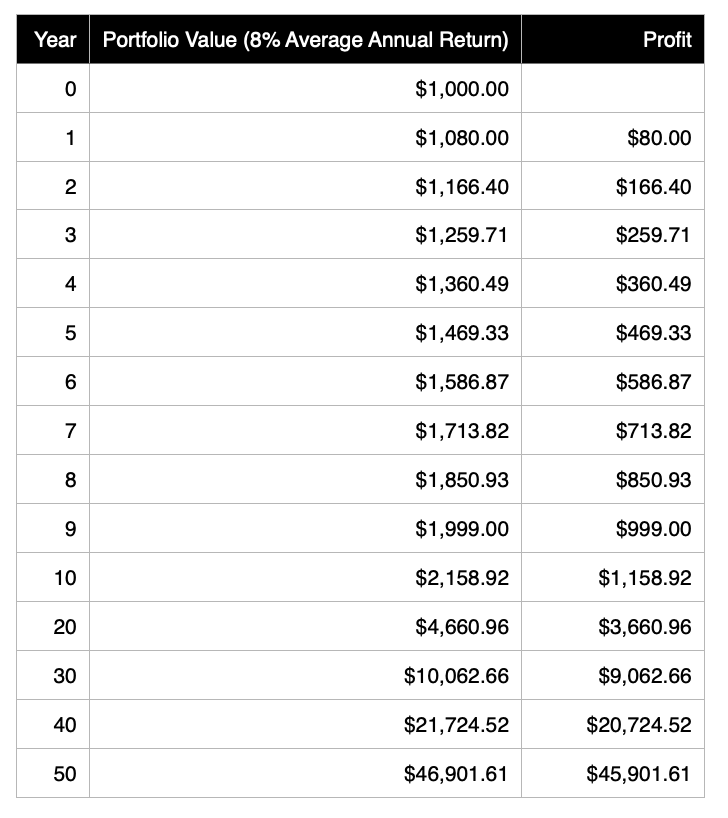

An investor who sinks $1,000 into a market index fund can expect to earn a conservative 8% return on average every year. With no additional investment, a $1,000 portfolio held over a multi-decade holding period will grow as follows:

After year 10, the index investor doubles the value of their portfolio. It seems slow going, but after 20 years the investor more than quadruples the value of their portfolio. From this point on, the real magic of compounding kicks in. After 30 years the portfolio is ten times larger. After 50 years, it’s almost 47 times larger. This is without any additional investment during the entire journey.

Unfortunately, the journey won’t be as linear as this example. Stock markets are volatile and there will be long periods of low returns, followed by a period of spectacular gains in a boom and bust cycle. The expected reward is still the same after 30+ years, as long as the investor doesn’t sell out. Asymmetric reward magnifies the longer you hold the investment.

Long-term investors deciding to buy individual stocks enjoy fractional ownership of the underlying businesses for multiple decades if they pick well. Each position is an open-ended trade. If the stock investment is successful, you won’t want to limit your profit by selling out too early. Master investors AND traders let their winners run. To the moon is the ideal !

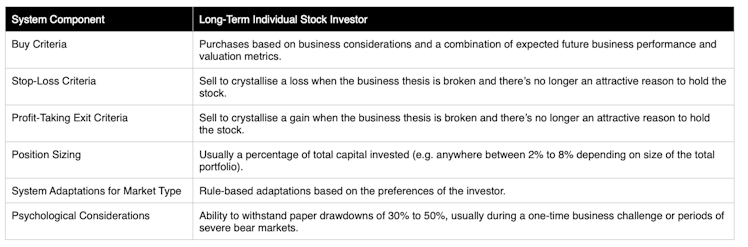

Investing in individual stocks requires significantly more homework than buying a market index fund. The same elements that govern a short-term trade must also be addressed when buying a company stock to hold long-term:

Short-term traders think in terms of positive expectancy systems and asymmetric reward-to-risk. Long-term investors should do similar, but in terms of a long-term process that hops on the big business trends and rides it all the way to its conclusion. The deal is we have to endure any turbulence along the way.

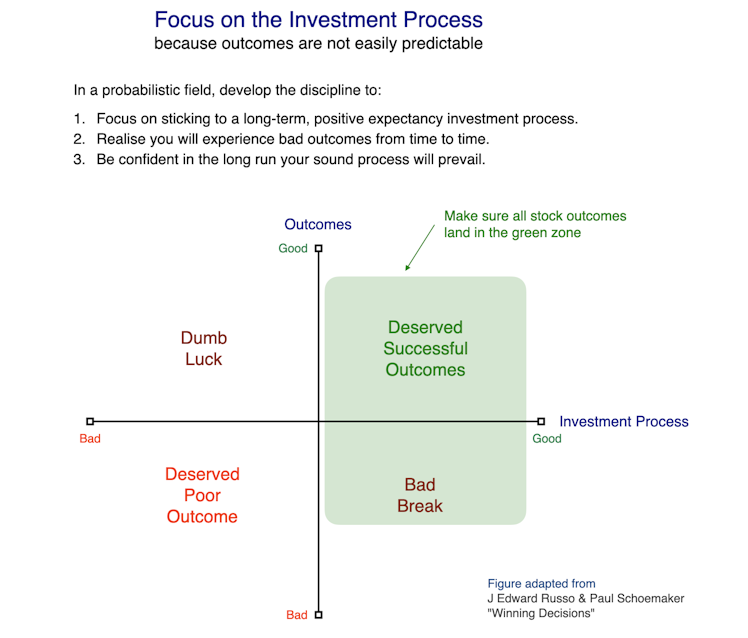

When we extend our time horizon, the efficacy of our investment process becomes the prime determinant of our success. There is an element of luck whenever you invest, especially in the short term. For example, you could buy a stock that becomes a surprise target of a corporate takeover a week later. You can also buy a stock right before the company issues a surprise earnings warning which tanks the price. Short term outcomes can be decided by luck, but over the longer term, the quality of your investment process counts more. The sum total of your outcomes statistically verifies your skill as an investor. Michael Mauboussin says the decision making process is more important than any short term outcome:

"If you compete in a field where luck plays a role, you should focus more on the process of how you make decisions and rely less on the short-term outcomes. The reason is that luck breaks the direct link between skill and results - you can be skilful and have a poor outcome and unskillful and have a good outcome.

Think of playing blackjack at a casino. Basic strategy says that you should stand - not ask for a hit - if you are dealt a 17. That’s the proper process, and ensures that you’ll do the best over the long haul. But if you ask for a hit and the dealer flips a 4, you’ll have won the hand despite a poor process. T he point is that the outcome didn’t reveal the skill of the player, only the process did. So focus on process"

Michael Maubousin goes on to say:

"So here’s the distinction between activities in which luck plays a small role and activities in which luck plays a large role: when luck has little influence, a good process will always have a good outcome. When a measure of luck is involved, a good process will have a good outcome but only over time"

If you’re not sure whether the outcome of any activity involves a degree of skill or is simply down to luck, Mauboussin provides the following test:

"There's a quick and easy way to test whether an activity involves skill: ask whether you can lose on purpose"

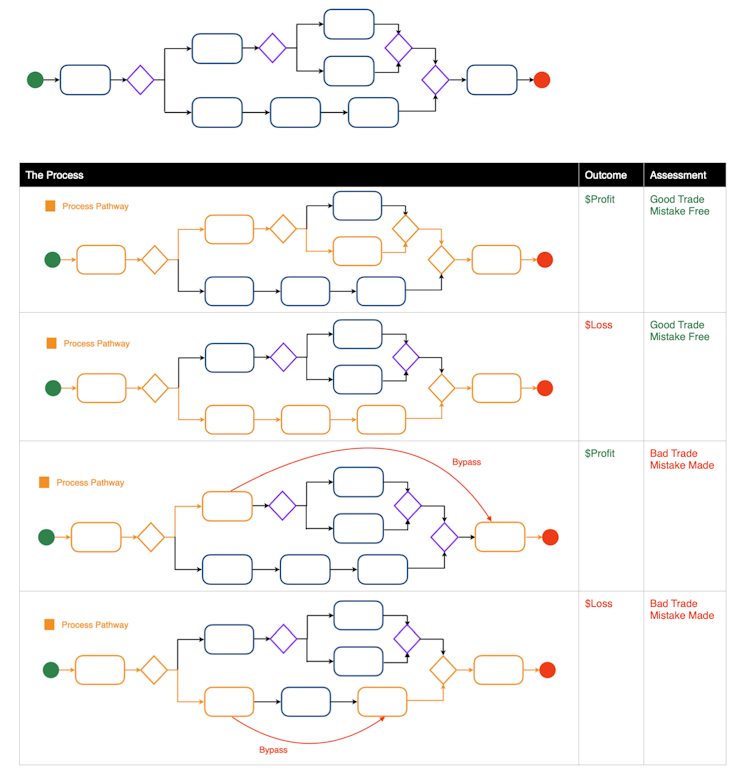

For an investor and trader, the importance of following a sound process can be visualised in the following chart:

"There are only two things that determine how your life turns out: luck and the quality of your decisions"

Annie Duke

Poker Champion & Decision Scientist

A good process is the surest path to success in the long run. The following diagram maps out our high-level process we follow when we invest in an individual stock.

Every step of our process is meticulously documented in a playbook. Every task and every branch has been scrutinised, adapted and refined over time. All strategic choices we’ve made about our evidence-based process has been explained in our playbook and backed-up by citations from published research. Our document as a living document, updated for any refinements made to our process and the latest updates to relevant research.

Any consequential change to our process results in a new version of the document. By versioning our document, we have a full audit trail of how our process has evolved. The earliest versions are quite cringeworthy to be honest.

Despite being very time consuming, good documentation is very important to your development as an investor. It helps clarify your thoughts and also alerts you to any gaps in your process. The benefits of a fully documented process are immeasurable. When you’re following a documented process, you know exactly what you’re doing and why you’re doing it. Those knee-jerk reactions that were once triggered by emotions (excitement, anger) are eliminated once you have formal rules to regulate your behaviour. When you discover a promising new stock opportunity, there’s a temptation to become too excited and impatient. You might slash or bypass your due diligence to expedite a stock purchase. This is easy to do when your process only lives in your head. When you’re forced to follow a concrete process and fill out template documents, you introduce friction which helps you avoid buying or selling stocks on a whim. You’ll also get that much needed cooling down period. These guardrails can reduce investment failure and more importantly, eliminate your risk of ruin.

Once your due diligence process operates long enough to build up a track record and the necessary corrections and refinements are completed, you’ll gain confidence your successful outcomes aren’t just a fluke. You have a concrete, positive expectancy process that can be repeated over and over again. Not all outcomes will be successful, but you’ll have the confidence you’ll achieve a good return over the long term.

This is an apt time to circle back to W Edwards Deming’s quote:

"If you can’t describe what you are doing as a process, you don’t know what you’re doing"

Be under no illusion, documenting an investment process is cumbersome, awkward and time consuming. There will be gaps in your process and some steps that are subjective will be difficult to explain in words. But over time and a few iterations later, you’ll have a good baseline. In 10 years time, you’ll thank us for convincing you to make the effort.

Accept that every good trading and investment process generates losses from time to time. A few bad outcomes are a feature of the process, they’re not mistakes. Trading coach Van Tharp defines a mistake as follows:

"One of the most useful beliefs of a successful trading is that when you don't follow your written rules, then you've made a mistake. In addition, if you don't have such written rules, then everything you do is a mistake"

It’s worth reading the above quote again because it critically reframes how we usually think about mistakes. We tend to consider a trading loss to be a mistake. But when the outcomes are probabilistic, there’s no avoiding trading losses no matter how good the system. Losing money on a few individual trades is all part of the process.

The following table shows a series of different outcomes and how they should be assessed for a hypothetical process represented by this flow diagram:

Process thinking is all about following a positive expectancy system, acknowledging the inevitability of a few bad outcomes, but having the confidence that your system will produce a successful result over the long-term. Good investor behaviour is all about following your process. If you don't follow your process, or you have no process, you're making a mistake. Make sure your process has been written down. Do the work, reap the benefit.

Thank you for reading this epic. I sincerely hope you gained value from it because this trading concept revolutionised my mindset once I took "process thinking" seriously.

Already have an account?