Trending Assets

Top investors this month

Trending Assets

Top investors this month

The Red Devil is in The Detail - Manchester United F.C. $MANU

With the World Cup kicking off today, I am putting together an analysis of publicly traded football clubs and whether any I would consider adding to my own personal portfolio.

I'm writing these for a longer individual post on my Substack which I will release later in the week, however you lucky Commonstock-ers will get to see each individual club I will analyse before I publish to Substack.

Most football clubs are privately owned and the takeovers by millionaire owners are heavily publicised, such as the purchase of Chelsea FC in May this year by a consortium led by US investor Todd Boehly or the Saudi Arabian Public Investment Fund’s highly controversial buying of Newcastle United late last year.

Even the World Cup hosts Qatar are at it, with the Emir of Qatar and the Qatari sovereign wealth fund buying French club Paris St Germain in 2011.

However, some hugely popular and global football clubs are publicly traded which means anyone can buy shares in those clubs and become an owner of a football club. Now when your team disappoints you by losing a match, not only can you be an upset fan but also a disgruntled owner too.

First club I will be looking at is the infamous Manchester United! $MANU

---------------------------------------------------------------------------------------------

Manchester United needs no introduction. Probably the most successful club in English history, with 20 league titles, 12 FA Cups, 5 League Cups, 3 Champions League/European Cup titles and 1 Europa League title. The Forbes list of most value clubs puts Manchester United in 4th place.

The club was bought by the US-based Glazer family, who purchased their first stake in the club in 2003. By early 2005, they owned over 75% of the club, meaning the company had to be taken off the London Stock Exchange. Then by June of that same year, the Glazers had purchased the remaining stake until they owned the whole club.

In 2011, rumours began to circulate that the Glazers were looking to list shares in the club on a public exchange. The money raised by the listing would be used to pay down debt that the club had amassed under the Glazers’ ownership.

In August 2012, the club was listed on the New York Stock Exchange. Shares would be divided into two groups: A shares and B shares. The A shares would be listed whereas the B shares would remain with the Glazers. The B shares come with 10x more voting rights than the A shares, meaning the Glazers still remain in overall control of the football club.

Fig 1: Manchester United Share Price since NYSE Listing Source: Koyfin

The shares were listed on the New York Stock Exchange at a price of USD 14.05, they then rallied in late 2019 up to around USD 25 a share but have since fallen down closer to USD 13 a share. That price rally came after results for the financial year ending June 2018 were released, in that year Manchester United finished the year in 2nd place in the Premier League, the club’s best finish since they won the league in 2013.

The reason the financial performance of a top-level football club is so dependent on how they perform on the field is thanks to broadcasting revenues.

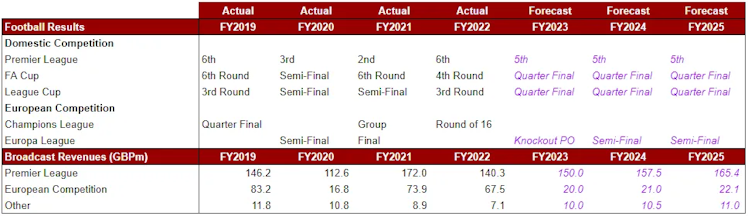

Fig 2: Manchester United Performance & Broadcasting Revenues Source: Manchester United & Porchester

Broadcasting revenues make up the bulk of these top-level football clubs’ revenues. You can see above, revenues from the Premier League correlate strongly to their performance for that given year.

Additionally, being in the Champions League is a huge revenue driver for football clubs. Manchester United’s appearance in the lower European competition (the Europa League) over the Champions League in 2020 saw the club receive much less in broadcasting revenues.

This is what has driven these big football clubs towards the controversial European Super League. The European Super League was a tournament proposed by a host of big clubs in which they would compete instead of the usual UEFA-run Champions League and Europa League system.

There was no qualification possible to enter the Super League, only the same group of clubs would take part every year. No qualification meant guaranteed broadcasting revenue from a European competition. From a financial perspective, the European Super League proposition makes sense for a club like Manchester United.

The Super League project fell apart on the back of a huge uproar from fans. The Super League would be anti-competitive with it being closed to new entrants and elitist by keeping the same large clubs in it and benefitting from it. The project is currently on ice, however there is no guarantee that the idea or a similar one doesn’t come back again in the future.

We will look to forecast revenues for the club for the next few years as part of our analysis, and those are the purple results in Fig 2. These are based on how the club is performing this season, however this is obviously impossible to accurately predict. As Leicester City showed in 2016, anything can happen!

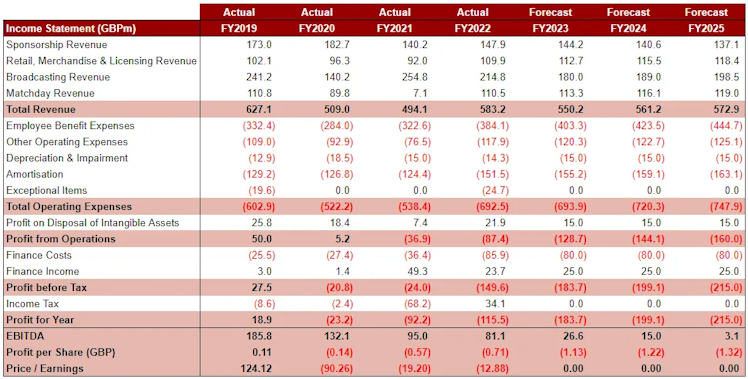

Fig 3: Manchester United Income Statement & My Forecast Source: Manchester United & Porchester

The other drivers of revenue apart from broadcasting are sponsorship, merchandising and revenues from matchdays such as ticket sales. The biggest cost is far and away the employee expenses, a huge portion of which is the players’ salaries.

My forecast uses my assumptions on performance from above and their impact on broadcasting revenues. The club currently is not profitable, and if the club doesn’t significantly turn things around on the pitch, things could get worse.

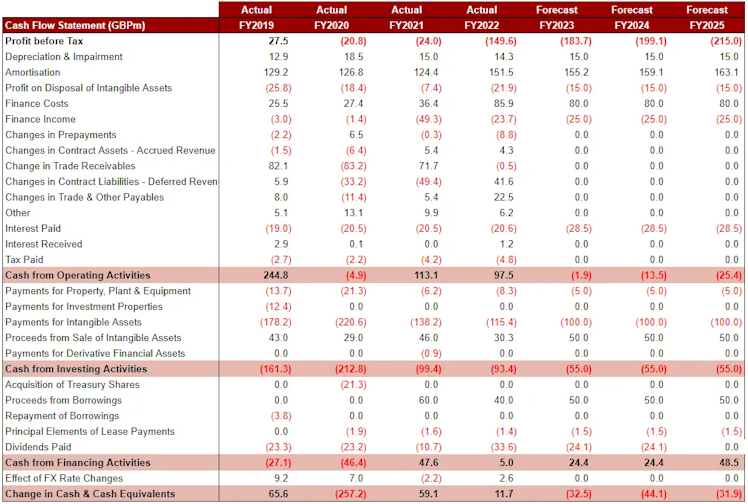

Fig 4: Manchester Unites Cash Flow Statement & My Forecast Source: Manchester United & Porchester

We can then feed this income statement into a cash flow forecast for the club. Here I have assumed player purchasing of around GBP 100m a year (you see this under “Payments for Intangible Assets”), an eventual suspension of the dividend and additional borrowing. This is the only way I see the club keeping some cash flow generation, since it is very unlikely to see cash generated from operations.

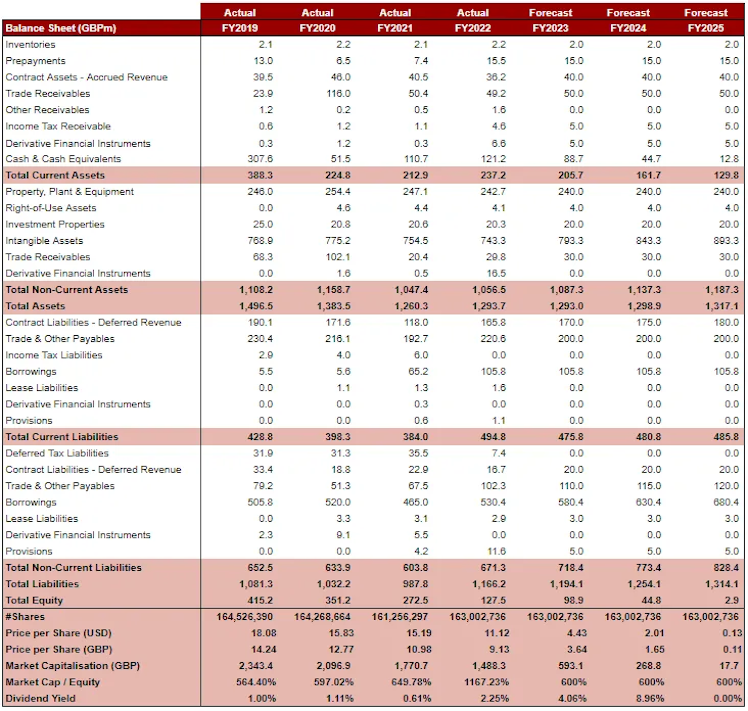

Fig 5: Manchester United Balance Sheet & My Forecast Source: Manchester United & Porchester

Now we will feed our cash flow forecast into the balance sheet and see the effect that will have on the equity price. Immediately you can see the issue. The negative profits and the necessary squad investment will need the club to borrow for funding. This pushes up the liabilities significantly, shrinking the equity value.

Historically the shares have traded around 6x higher than the value on the financial statements. If we assume that holds, I see the market capitalisation falling close to 0 over the next few years.

The outlook isn’t good for Manchester United from a financial point of view if performance levels on the pitch remain the same. Without Champions League football and no sign of the European Super League either, revenues won’t be sufficient to keep the equity value up.

Porchester

Already have an account?