Trending Assets

Top investors this month

Trending Assets

Top investors this month

Yesterday, I read Bradesco's report on $NU. Before giving my opinion, let me tell you how I read sell-side reports. I don't care much about the writing, as they usually copy it from the prospectus. Instead, I focus on looking for mistakes in their estimates, which is typical.

So, no hard feeling on any sell-side analyst reading the thread. It's normal to make mistakes. Now, about $NU. As pretty much nobody knows enough about the company, they (sell-side analysts) usually talk to each other to match the big numbers.

Bradesco wasn't different. Big numbers look very much like GS, BTG, and so on. What usually differs the output is i) analyst background (bias) and ii) technical competence. If you ask an analyst who covers $ITUB and $BBD an opinion about $NU, he'll tell it's rubbish.

He will say that because he's used to short-duration stocks growth, consolidated markets, and high economic correlation stocks. This is a bias. And it's okay. Everyone has preferences analyzing stocks, as do I.

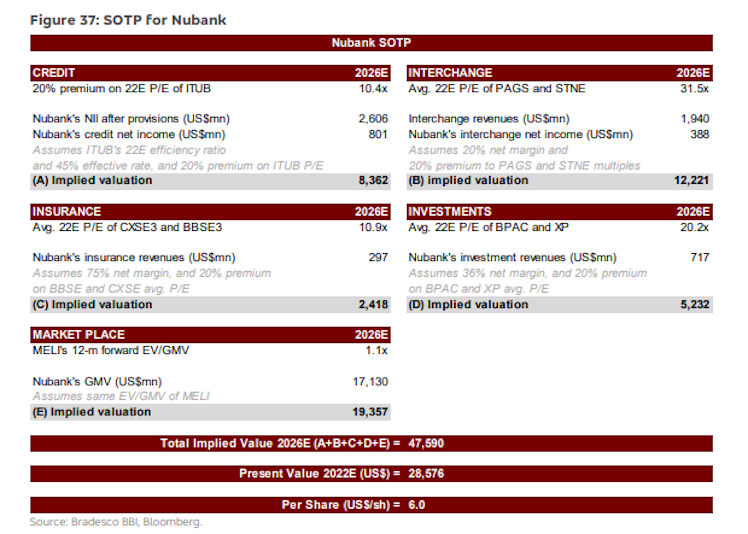

The problem I found in Bradesco's report can be summarized in the table below. There are two problems: i) four years CAGR for a company such as $NU, with a cash flow duration above 20yr, isn't enough.

An investor that holds a $40b Fintech in LatAm should expect that $NU growths above its peers for more than four years. Assuming that $NU would grow above its peers after 2026, you're slashing its upside for nothing.

But it's okay. Let's say the analyst is being conservative here. Problem (ii) is the multiples. He used TRADING multiple to estimate the value for each business. I'll repeat it: TRADING multiples.

For instance, using trading multiples implies that if $ITUB goes up 50% over the next week, $NU's intrinsic value should rise as well... C'mon... This isn't intrinsic value.

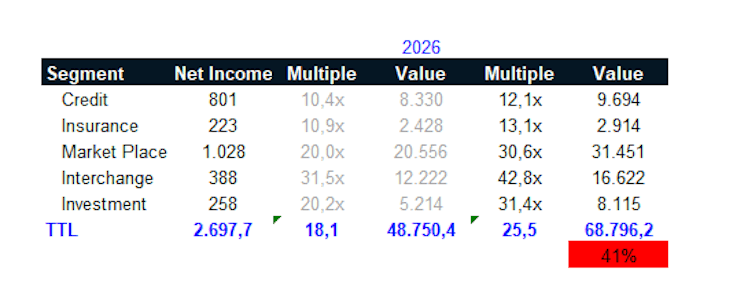

I did the math again, using NTM multiples at fair value for each business (interchange only used $PAGS). The difference in the value for $NU would be 50% using multiples on fair value instead of trading multiples.

Does it mean that $NU is cheap? Honestly, I don't know. So far, I have barely spent 20 hours studying the company. That would require a more profound analysis. But, if you're curious about the difference in the price target if BBD had used the correct multiples, I'll tell u.

Using trading multiples, $NU would be trading a 4yr IRR of 2%, while using Target Multiples would give u a 12% IRR for the period. Roughly speaking, that would be a $9/sh target instead of $5/shs.

Also, if you extend the IRR to 6/8 years, the IRR increases since the model expect the $NU will generate positive EVA (return over its cost of capital) for more than four years. I'll be more than happy to share my numbers once I'm comfortable with them.

Already have an account?