Trending Assets

Top investors this month

Trending Assets

Top investors this month

Chart of the Day - tightening standards

Well, as I mentioned in my Substack, the Fed reaction function is to try and best avoid contagion from the Silicon Valley/Signature/Silvergate fiasco to other banks.

Other banks have surely done a better job of hedging interest rate exposure (we can see that from the disclosures required by the Fed); however, right now, investors are seeking safety first.

While the Fed has stepped in to help, we know this help comes at a price. For one thing, the Fed bailouts will ease financial conditions. This means that the risk of a reacceleration of inflation is now higher.

This means that the high quality liquid assets may be under more pressure too. Those are the assets on bank balance sheets. This will serve to stress bank capital more and investors are reacting by selling shares in all bank stocks

The bank sector was down 12% in the last 5 days and now down 8% YTD coming into today and shares are lower today.

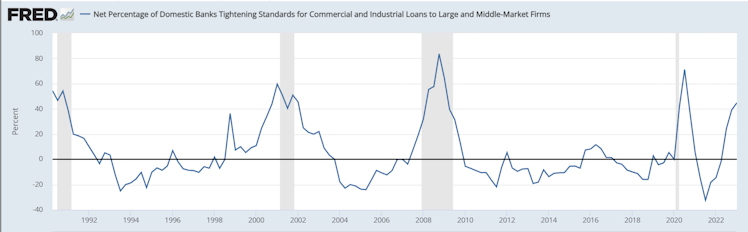

With bank capital stressed, you can imagine that bank mgmts will be less willing to commit new capital to loan portfolios. The chart today is the net percentage of banks tightening standards for commercial and industrial loans.

This was as of January this year and the percentage was already 50% were tightening. We can see that when we get to 60% or higher, we have a recession. If it was 50% in January, and bank capital is being stressed more now, what do you think are the odds this is going to be above 60% if you asked the question today?

I would guess there are pretty good odds it is higher today and a recession is becoming more likely. One can argue this will be pushed off a bit by the looser fincl conditions but I still think it is more likely to happen this year.

I still contend this is not a systemic financial crisis like time, however, it will be challenging going forward, particularly for companies in need of capital to support their business.

Time to ...

Stay Vigilant

LinkedIn

LinkedIn Login, Sign in | LinkedIn

Login to LinkedIn to keep in touch with people you know, share ideas, and build your career.

Already have an account?