Trending Assets

Top investors this month

Trending Assets

Top investors this month

BHP Sees Need for Nickel

BHP Group will increase its spending on nickel exploration over the next two years to meet growing demand for the raw material used in making electric vehicle batteries, the chief of its nickel operations said on Wednesday.

“This year will be the highest annual spend for exploration in Nickel West,” Farrell said.

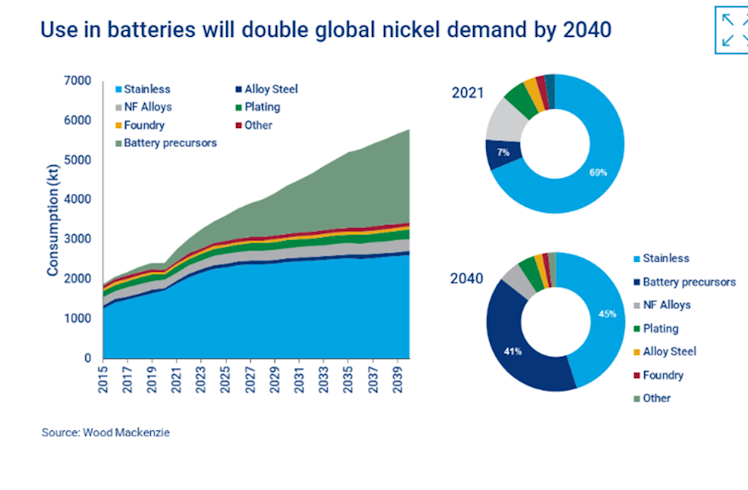

By 2030, around 60% of all car sales globally will be electric, increasing to 90% of all car sales by 2040, she said. “The dominant battery chemistry powering this global fleet is expected to rely on nickel,” Farrell said.

“This megatrend, combined with a firm demand base from the traditional stainless and class-1 applications means we anticipate demand for nickel in the next 30 years will be 200% to 300% of demand in the previous 30 years,” she said.

Recap of my June 1st post on the need for nickel:

BHP, the world’s largest mining company sees nickel as one of three “future-facing commodities”, along with copper & potash, and is currently scouring opportunities in the highly prospective Ring of Fire region of Ontario.

According to Rystad Energy’s October 2021 press release, global demand for high-grade nickel will outweigh supply by 2024 and will continue a steady year-on-year climb. Rising demand spurred in part by the energy transition will lead to a shortage in less than two years. Unlike other essential battery raw materials used for cathodes such as lithium, the battery market is not the dominant end-user for nickel in the short-term. The stainless-steel industry accounts for more than 70% of current global nickel demand, and the battery market made up less than 10% as of 2020.

Nickel demand from the stainless-steel industry is expected to grow at 5% a year, while the market for batteries is poised to explode. In an unconstrained supply scenario, battery demand for nickel could quadruple by 2030. The battery market currently only accounts for 9% of the current global supply, but that share could rise to 31% by 2026.

There may be enough nickel in the ground to support a major EV ramp up, but there are not enough planned mining projects or processing facilities to make the type of high-grade nickel that’s needed for EV batteries. The nickel content in battery cells is only increasing, as more nickel increases energy density. Not all nickel is high quality enough for EV batteries, it must be “class-one” nickel, with at least 99.8% purity.

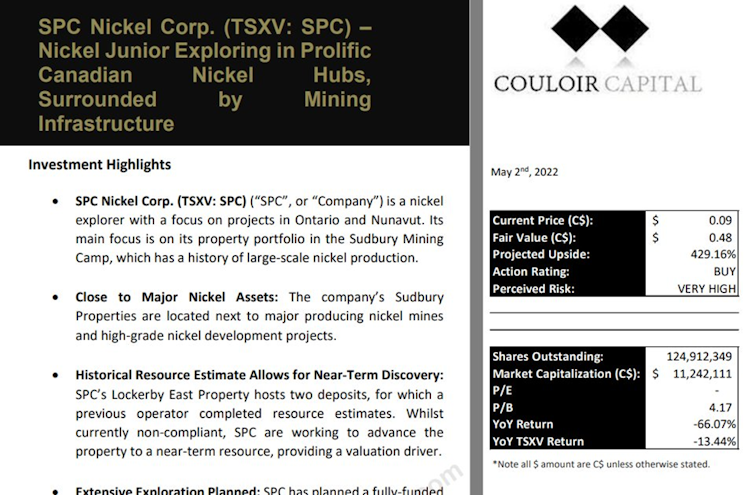

My current favorite speculative nickel play in the high-risk junior mining sector is $SPC.V.

Others for your watchlist:

$NAN.V

$CTM.AX

$CRI.V

$FPX.V

$HZM.TO

Please DYODD, I am happy to answer any questions that I can – and as always, please note that you should never invest more than you can afford to lose in such a high-risk sector. For me that’s normally a 1-2% allocation, never more than 5%.

Already have an account?