Trending Assets

Top investors this month

Trending Assets

Top investors this month

SLT Core Portfolio: Vertex ($VRTX) a FCF machine running a monopoly in the cystic fibrosis market with an overlooked pipeline.

Vertex is in the 23rd place in our quantitative screener, and a company we have been following and investing in way before the creation of SLT Research. We are not biotechnology specialists, so more than ever, please give us your feedback in the comments section.

Thesis

- VRTX has a monopoly on the cystic fibrosis transmembrane conductance regulator (CFTR) market with minimal threat from gene therapy competitors. Its Trikafta/Kaftrio product is unique, and has greatly expanded the number of CF-related mutations eligible for CFTR modulator treatment across age groups. VRTX drug lengthens patients’ life expectancy which is priceless.

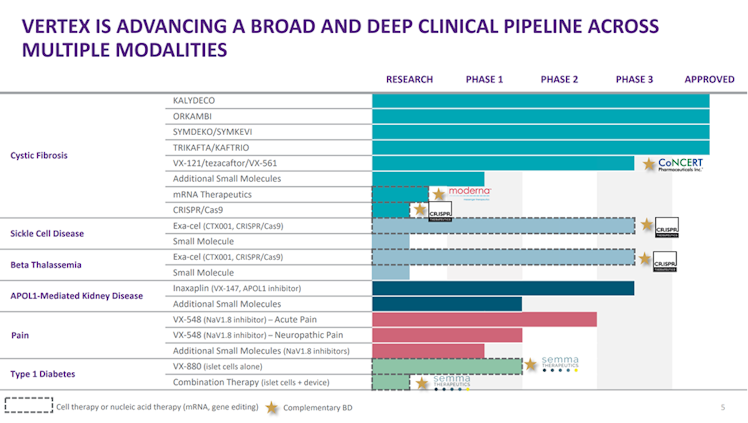

- VRTX developed over the years an attractive pipeline increasing potential global opportunity, especially in gene therapy for sickle disease, APOL-1 medicated kidney disease, and diabetes.

- Best-in-class margins, stable and predictable growth with strong financial situation.

- VRTX’s management is experienced in the biotechnology industry and showed capital allocation skills over the years. We like the direction in which the current CEO is steering the company, from both an operational and ESG point of view.

- VRTX is traded at a discount - we believe that the company has an embedded option given its pipeline showing life and potential and current price offers an opportunity to buy this option for free.

Company Description

VRTX invests in scientific innovation to create transformative medicines for people with serious diseases with a focus on specialty markets. It has four approved medicines to treat

cystic fibrosis (CF), a life-threatening genetic disease, and is focused on increasing the number of people with CF eligible and able to receive its medicines through label expansions, approval of new medicines and expanded reimbursement.

In addition to CF, the company is seeking to broaden its pipeline into additional disease areas such as sickle cell disease and beta thalassemia, APOL-1 medicated kidney disease, and type-1 diabetes for example.

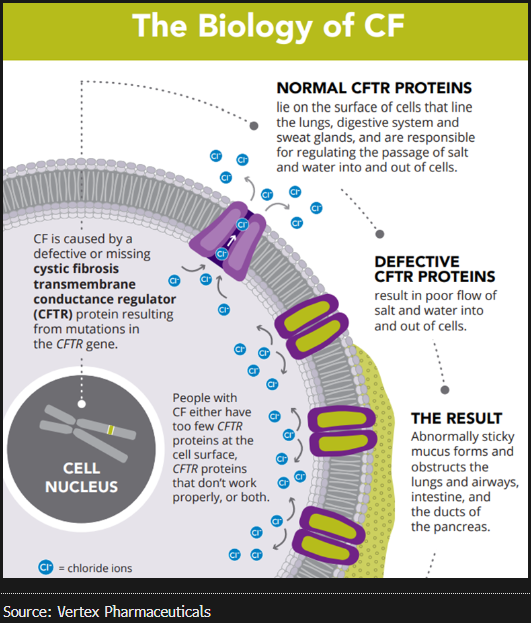

VRTX discovered, developed and produced the first medicines to target the underlying cause of CF after more than 20 years of research and development. CF is an inherited disorder that causes severe damage to the lungs, digestive system and other organs in the body. It is caused by the presence of mutations in both copies of the gene for the cystic fibrosis transmembrane conductance regulator (CFTR) protein.

Competitive Moat

VRTX has a monopoly with its portfolio of four approved medicines to treat CF. We will mainly focus on the latest and game-changing Trikafta/Kaftrio medicine. Following its launch, the drug was reported to reduce the use of symptomatic drug classes such as antibiotics, mucolytics and anti-inflammatory drugs due to overall improvements to patient lung health. As a result, children with CF born today have a more optimistic prognosis than those born more than 30 years ago. The overall survival of CF patients has increased remarkably over the past few decades, and the majority of CF patients in the US and UK are now expected to live beyond their late 40s thanks to Trikafta/Kaftrio’s impacts on improving lung health.

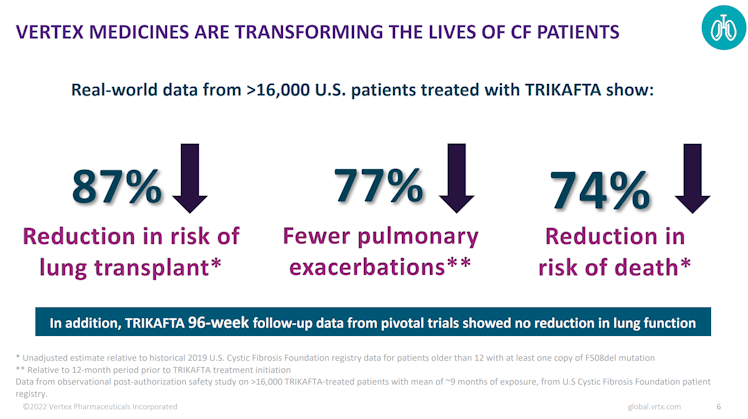

Real-world data from more than 16k US patients treated with Trikafta showed a 87% reduction in risk of lung transplant, 77% fewer pulmonary exacerbations, and an impressive 74% reduction in risk of death.

The introduction of CFTR modulators to the market yielded a shift in research and development (R&D) towards therapies that target the disease’s underlying cause. Currently VRTX has a monopoly however, CFTR gained interest during the last couple of years, especially regarding solutions around gene therapy.

Although CF is a prime candidate for a true cure via introduction of a normal CFTR gene or editing of mutations, accomplishing this in all affected organs is a major hurdle. Localized delivery to the lungs wouldn't address channel defects in the pancreas or gut, for example.

We are not specialists but experts say that these obstacles to CF gene therapy are unlikely to be overcome in the near or medium term, putting off a potential threat in the short-term to VRTX products and, even if its drugs are less elegant than gene therapy and must be taken every day, they have the advantage of reaching all organ systems. In addition, the company is also experimenting mRNA in collaboration with Moderna, and given the fact that VRTX, due to being the only provider, is the sole collector of real-world patient data, has an edge over its competitors even when it comes to developing new products.

Sustainable growth

VRTX Trikafta/Kaftrio is more efficient than predecessors and expands the number of CF patients eligible for the company's products by 35%, setting the stage for a ramp-up in global sales.

The drug, approved in 2019 in the US as Trikafta and the following year in Europe as Kaftrio, can be taken by about 15,000 patients previously ineligible for previous VRTX's products. Growth is currently fueled by this new cohort of patients gaining access to the drug, but also by patients eligible to previous drugs but shifting towards Trikafta given higher efficacy. It matters because the new drug is more aggressively priced and a sales mix with more share of the latest drug should boost VRTX's revenue.

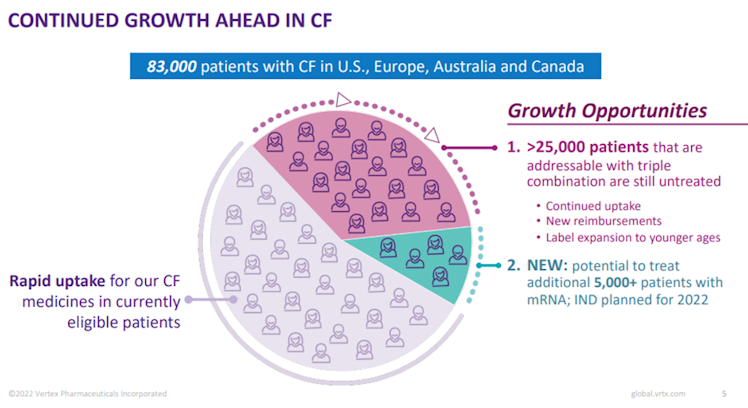

There is still more room to grow for VRTX in the CF segment as the company estimates that more than 25k patients are addressable. This should be done through a combination of continued younger cohort being approved and allowed to use the drug and new reimbursements in place. VRTX latest cystic fibrosis offering, for the reason listed above, may

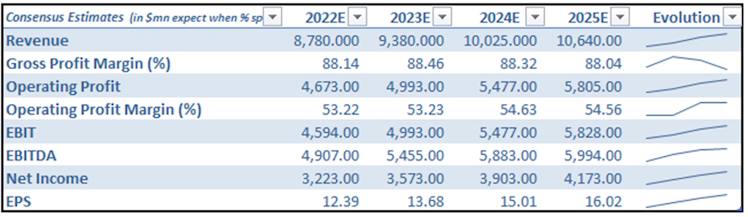

drive revenue past $10bn in 2024-2025, according to consensus estimates. A 7.2% CAGR

from 2021 revenue.

The company is also on track to file the investigational new drug application with the FDA regarding its mRNA product, likely to address the remaining 10% patients that cannot be currently treated by existing VRTX drugs.

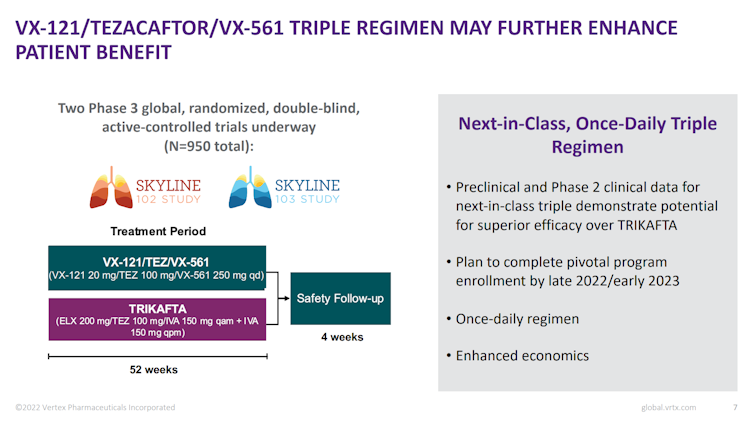

To conclude on the CF segment, the company has a next-generation triple-combination regimen, VX-121/Tezacaftor/VX-561, which entered in Phase III development and this program would likely have exclusivity well beyond 2037 (which is the patent expiration of Trikafta/Kaftrio) and delay threat of generics.

Beyond CF, VRTX has multiple paths to further growth given its promising pipeline. Again we are not specialists and will not comment on the feasibility or quality of the technology employed but we wanted to highlight two programs:

- CTX001: it has the potential to be the first approved gene therapy for sickle disease. As per VRTX information, the initial multibillion dollar opportunity is c.32k patients with severe disease, expandable to c.170k patients across the US and Europe.

- VX-147: first medicine targeting APOL1-medicated kidney disease (AMKD). The company recently initiated a pivotal phase 2/3 with impressive pilot data driving optimism. It represents a significant opportunity of c.100k patients. JPM estimates an unadjusted peak of c.$3.9bn worldwide opportunity for VRTX’s AMKD program in the 2030s.

Source: Vertex

Financials

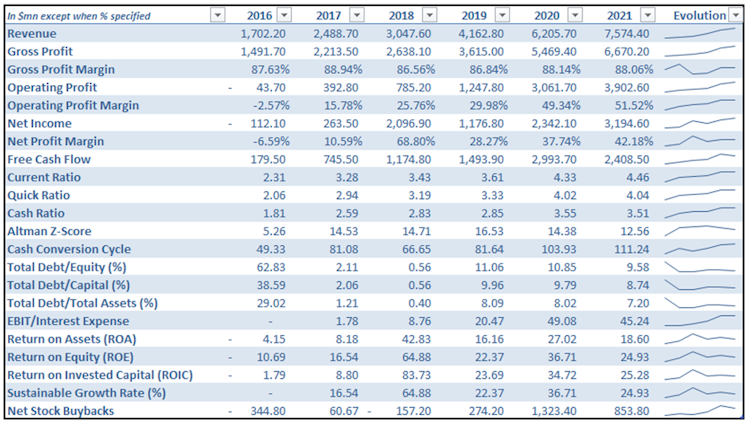

The company multiplied its revenue by almost 4.5x between 2016 and 2021. Sales have been boosted by constant innovation and successful launch of new drugs, especially Trikafta/Kaftrio in 2019, allowing the company to address new patients and obtain new reimbursement plans in further countries.

What really struck us is VRTX's high margins profile and its ability to hold a level of gross margin around 90% over time, even as new products are launched and reach international patients. The new drug is now available and reimbursed in more than 25 countries, but it hasn't impacted margins. Operating margin has been constantly and swiftly improving over the last years to reach an impressive 51.52% in 2021.

We decided to delve a little bit deeper into the operating expenses to understand what made this improvement possible:

- SG&A: this expenses item went from representing 25.4% of sales in 2016 to just above 10% in 2021. The main reason, in our opinion, is mainly because VRTX products, apart from being the only solution available on the market, sell themselves given their efficacy. It enables the company to limit the S part of SG&A and focus on R&D.

- R&D: given its high margins and low SG&A expenses, VRTX is able to allocate the majority of its operating expenses to R&D. Despite having being interestingly multiplied by 3x, R&D as a percentage of revenue went from 61.6% in 2016 down to 40.3% in 2021. We appreciate that R&D represents 70% of VRTX operating expenses, it should allow VRTX to further deepen its leading position in CF and keep innovating and developing its huge potential opportunity products pipeline.

As a result, and using a normalized adjusted ROE (excluding one-time charges), VRTX's profitability significantly improved over the last three years. Adjusted ROE increased from 20.51% to 32.73% between 2019 and 2021. Given constant asset turnover and low (downward sloping) leverage, VRTX’s ROE is mainly pushed higher thanks to margins improvement.

It is important to note that the company is profitable since 2017 and is a strong FCF generator, which is rare in the biotech universe. We're according a special attention to stock based compensation, which can often be relatively high in the industry. Over the last 12M, SBC accounted for 11.6% of the cash from operating activities which is reasonable. In addition to allocate cash to innovation, VRTX has been buying back shares intensively in the last couple of years, keeping reinvesting in itself.

VRTX's balance sheet is very solid. From a liquidity point of view, current assets almost represent 4.5x current liabilities. As of 6/30/2022, the company was sitting on $9.25bn of cash, cash equivalents and short-term investments (STI) vs. total debt of only $847.3m.

We noticed an extension of the cash conversion cycle pushed by increasing level of inventories. In 2021, only c.24.5% of these inventories were classified as finished goods, implying that inventories are not mainly composed of unsold goods but rather increasing work-in-progress products to meet ramping demand.

From a solvability perspective, VRTX level of debt is very low. Total debt represents less

than 8% and 10% of respectively total assets and total equity. 2021 EBIT was at a level able to cover more than 45x the company’s interest expenses. The Altman’s Z-Score constantly above 10 since the company turned profitable in 2017 implies a probability of bankruptcy of virtually 0.

Outlook:

Looking forward and based on consensus estimates, revenue is expected to reach the $10bn milestone by 2024. We would adopt a more conservative stance and we believe this level of revenue will be reached a year later, in 2025. Gross profit margin is set to remain stable around 88% and operating profit to slightly improve to c.55% by 2025. We might observe better than anticipated EPS if in addition to increased revenue and improved margins, VRTX continues to reduce share count over time.

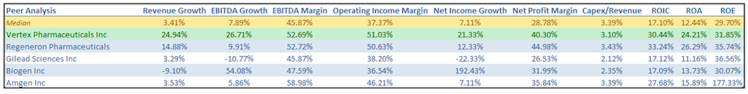

Comparison to biotechnology peers:

VRTX experienced a higher than peer group growth recently. We can clearly observe VRTX's higher margins profile resulting in a better profitability, with a significant lower use of debt and leaner balance sheet (median total debt / total assets of 32.22% vs. only 7.20% for VRTX).

Management and ESG considerations

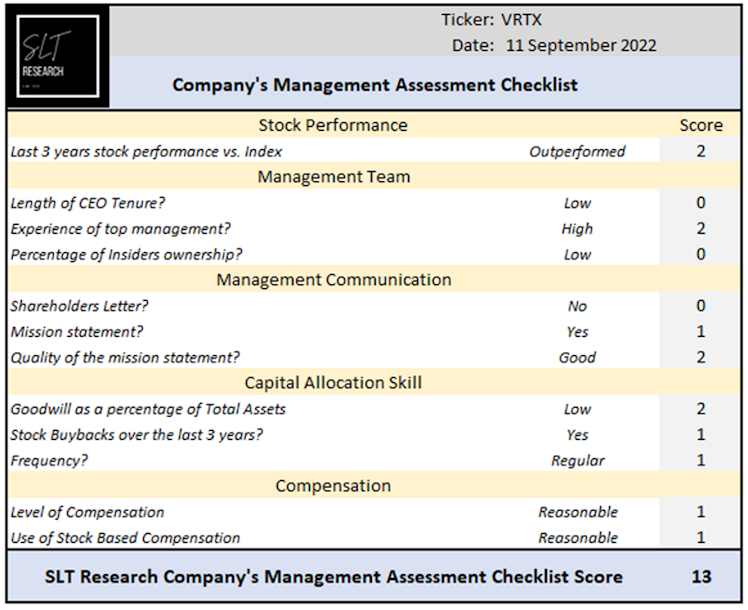

VRTX’s CEO Dr Reshma Kewalramani occupies President and CEO position for 2.4 years which explains the low score based on the length of the CEO tenure. However, she has been with the company for more than 5 years now. She joined as a senior VP for clinical development before becoming the Chief Medical Officer. Previous to VRTX, Dr Kewalramani worked as a VP at Amgen Inc. She has a strong experience in the biotechnology industry.

VRTX’s mission is to “invest in scientific innovation to create transformative medicines for people with serious diseases with a focus on specialty markets”. Its goal is to strike at the core of serious diseases to change people’s lives.

At the core of our strategy, we favor management team with important capital allocation skills. We believe it is the case at VRTX. Management has been allocating the majority of its cash in R&D or in VRTX itself opportunistically in the recent years. We already mentioned that given VRTX profitability and cash generation ability, investing heavily in R&D will help the company to maintain its competitive edge with superior products. Regarding buybacks programs, the below graph shows management smart and opportunistic allocation of cash to repurchase

shares with negative correlation between buyback yield nd the stock price.

Source: Koyfin

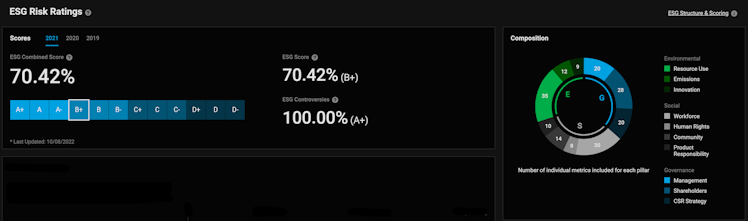

The company is a reference compared to peers from an ESG perspective. VRTX scores above peers median regarding social matters. The company is the peer group leader regarding Environmental and Governance matters. (Bloomberg ESG Scores). The DeGiro ESG risk score of B+ indicates good relative ESG performance and above average degree of transparency in reporting ESG data publicly.

Source: DeGiro

This is translated in reality with multiple program including The Vertex Foundation, seeking to improve the lives of people with serious diseases and contribute to the communities where Vertex is located through education, innovation and health. VRTX is also very active on the

sustainability front, with goals to reduce emissions and waste, and the aim to improve operating efficiency.

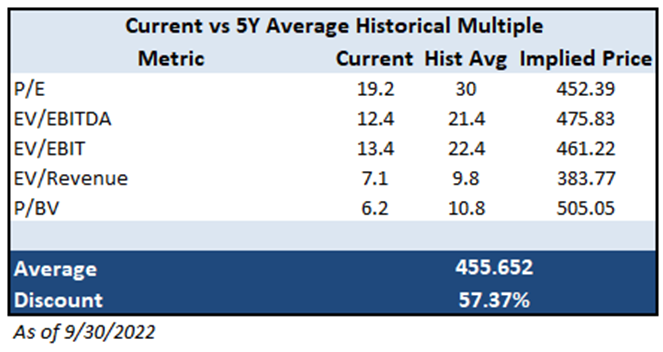

Valuation

The company is currently trading around -1 standard deviation from all historical multiple average presented above. All current multiples exhibited in the above table are pretty far from 5Y average. However, we also need to account that VRTX had a greater growth potential a few

years ago when they launched their new Trikafta product, justifying perhaps lower ratios currently.

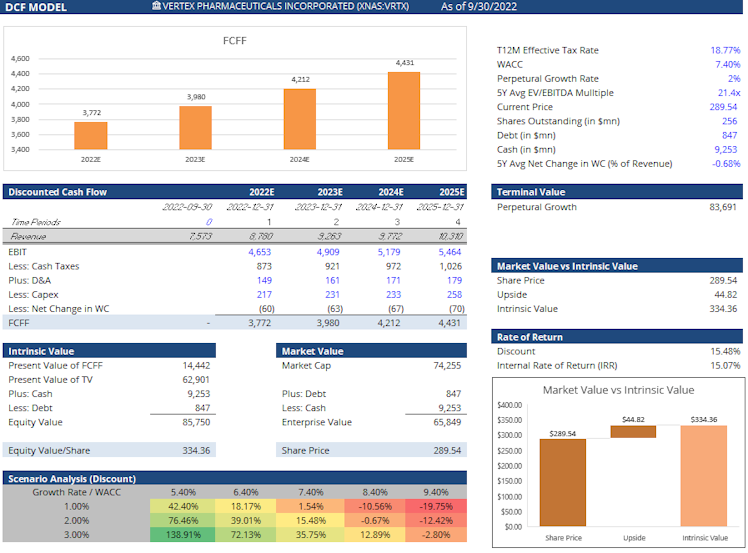

Given lower but more predictable growth (CF only), we decided to assess VRTX intrinsic value using a DCF model, using a more conservative assumption regarding revenue growth with 5.5% p.a. until 2025 (vs. consensus of 7.3% CAGR) and 2% afterward. We used a constant

EBIT margin of 52%.

Our FCF model assesses an intrinsic value of c.$334 per share for VRTX, representing a reasonable c.15% discount to current price.

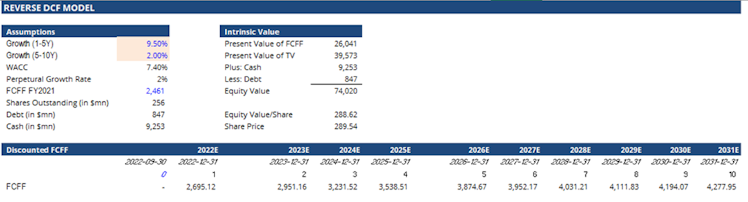

To conclude, and because a classic DCF model includes a lot of assumptions, we wanted to verify and understand what FCFF growth market participants are pricing in VRTX, so we ran a reverse DCF model. We would like to thank @invesquotes for the brief discussion around this valuation methodology and his help to implement and mainly understand it.

Interestingly, our reverse DCF model calculation is implying that market participants are actually pricing the company at a 9.5% FCFF growth rate for the next 5 years, and 2% thereafter. Compared to the consensus estimating free cash flow to grow at a 17.7% CAGR over the next 5 years, it confirms our views using other methodologies that VRTX's current price represents a discount to VRTX intrinsic value.

For us the current price offers a great opportunity to buy a monopoly with stable high margins at a discount, but mainly its embedded real option with the pipeline opportunity as the underlying for free. The DCF model takes into account only revenue from CF. Any incremental revenue from VRTX pipeline (especially CTX001 and VX-147 as discussed earlier) would drive valuation higher, and in our opinion, this option is not reflected in VRTX current price.

Risks

Key risks (but limited) for us include:

- Slower than expected international uptake of CF products (Trikafta) due to regulatory/reimbursement setbacks for CF programs, unforeseen toxicities arising from the triple combo regimens, and surprising competitive developments.

- Increased competition: multiple companies are pursuing development of gene therapy drugs for cystic fibrosis. However, as previously explained, we see low threat from these competitors, especially given the fact that VRTX is also working on this type of drug.

We hope you have enjoyed this write-up and as always, please let us know what you think!

Disclaimer: The information provided in this post is for information only and solely on the basis that you will make your own investment decisions after having performed appropriate due diligence.

Already have an account?