Trending Assets

Top investors this month

Trending Assets

Top investors this month

Global Slowdown Impacts Chinese Exports

Exports out of China in May fell by more than expected as the global economic slowdown begins to impact global trade.

The Chinese General Administration of Customs reported a -7.5% fall in exports as compared to the same time last year, which is considerably below analyst estimates of a -0.4% fall.

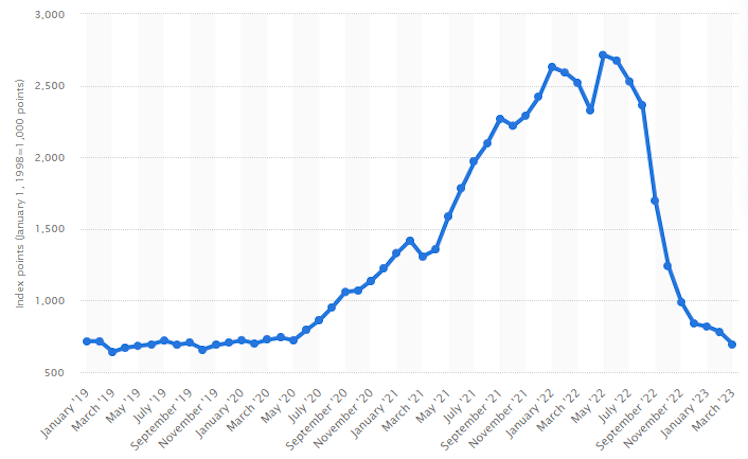

Although far from estimates, this is not altogether surprising. International shipping rates have collapsed in recent months, suggesting a significant shrinking in demand. Freight costs are now back to where they were before the COVID-19 pandemic after seeing a close to 4x increase at their peak from pre-pandemic levels.

Freightos Index China to US West Coast

Although exports from China have slowed significantly, there is some positive news when it comes to imports. Imports to China only fell -4.5% as compared to -8% expected by analysts. This suggests that the domestic economic rebound is continuing despite slowing global economics and it's impact on China's export economy.

Additionally, the Chinese government is considering a stimulus package to help with the Chinese real estate sector, which has been under significant distress over the past few years on housing oversupply and house developer bankruptcy issues.

This is additional data to support that the global economy is really beginning to feel the bite of high inflation and fiscal tightening, and will likely translate to more recession indicators turning red and slowing corporate earnings in the coming months.

However, a strengthening Chinese economy could bring significant support to certain areas of the economy, notably luxury stocks. These have held up very well since the start of this period of inflation thanks to high margins and strong brand loyalty leading to companies being able to protect these margins. Much of these companies revenues come from China, both from domestic sales and from Chinese tourists. These companies could continue to be a safe haven for those looking to protect their portfolios from continued inflation and global slowdown.

Already have an account?