Trending Assets

Top investors this month

Trending Assets

Top investors this month

Resurrection of the Dead Cow

"The potential for growth there is enormous"

Canada's two official languages are English & French; I didn't have the opportunity in my younger days to pick up Spanish. I've attempted to more recently but one Spanish phrase that has always stuck in my head is Vaca Muerta - meaning "Dead Cow".

Credit to my Twitter friends Yux and Beaven Rich for mentioning the world's second largest reserve of shale gas and the fourth largest for shale oil in my timeline several months ago. The name has always stuck with me, so my interest was piqued this morning when I saw this Reuters article:

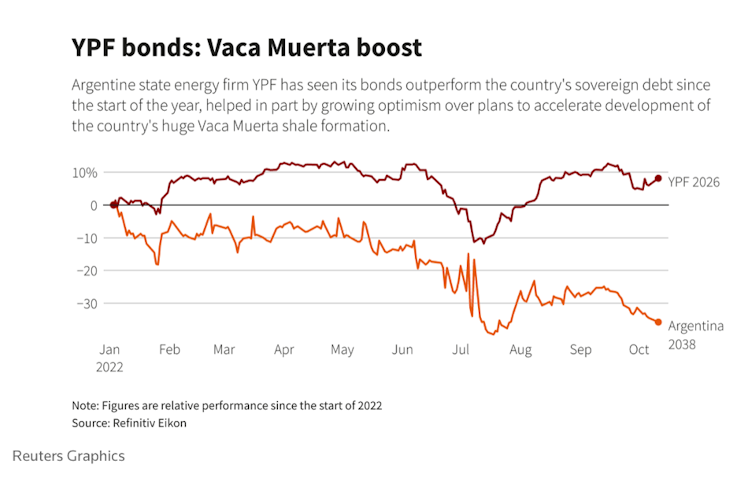

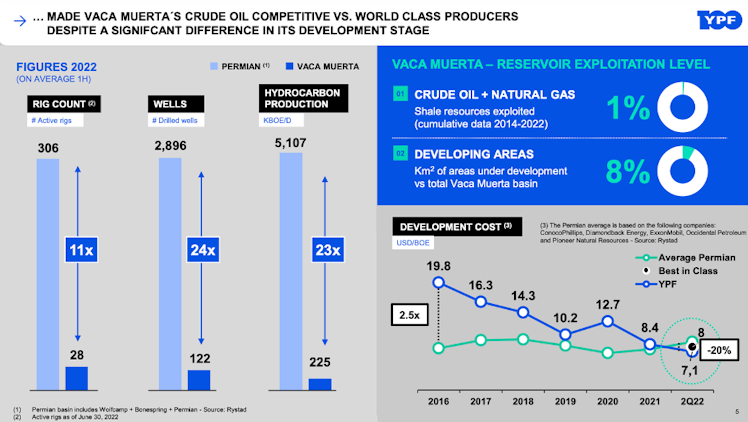

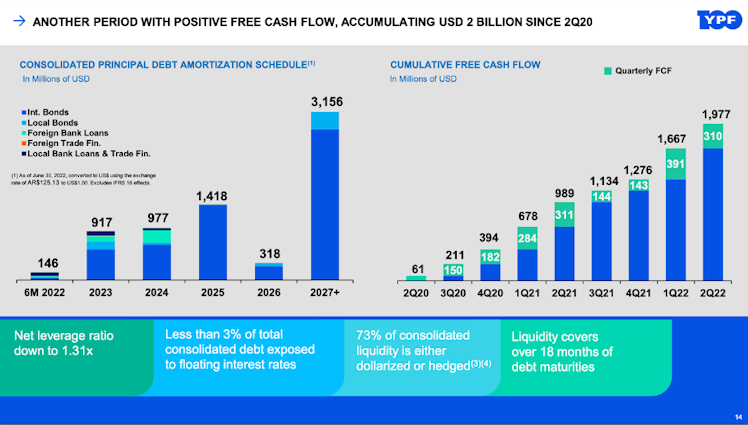

Argentine state-owned energy firm YPF (<YPFD.BA>) has seen its bonds and shares take off this year, despite a wider economic malaise, with hope of a shale boom in the South American nation's huge Vaca Muerta formation luring investors.

The state firm's bonds have risen between 5-11% this year, even as some sovereign debt has plummeted as much as 35% amid concerns about near-zero foreign reserves, inflation heading towards 100% and a weakening peso currency. YPF shares are also up some 80%.

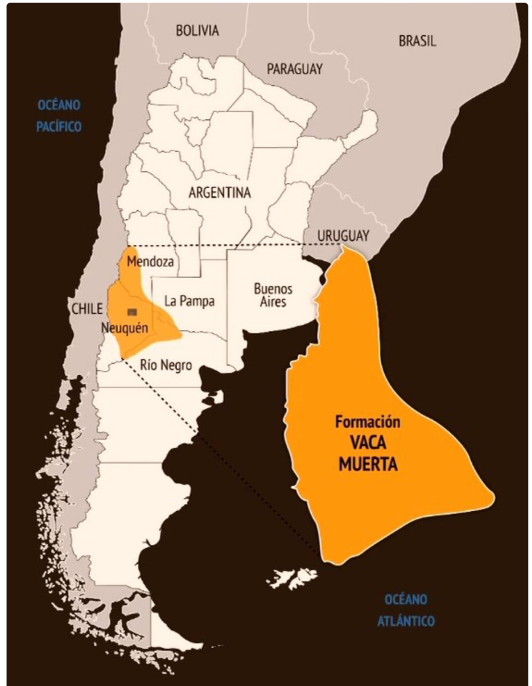

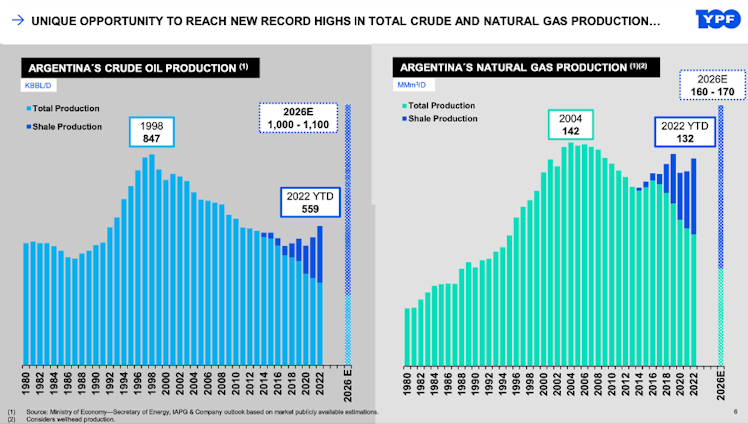

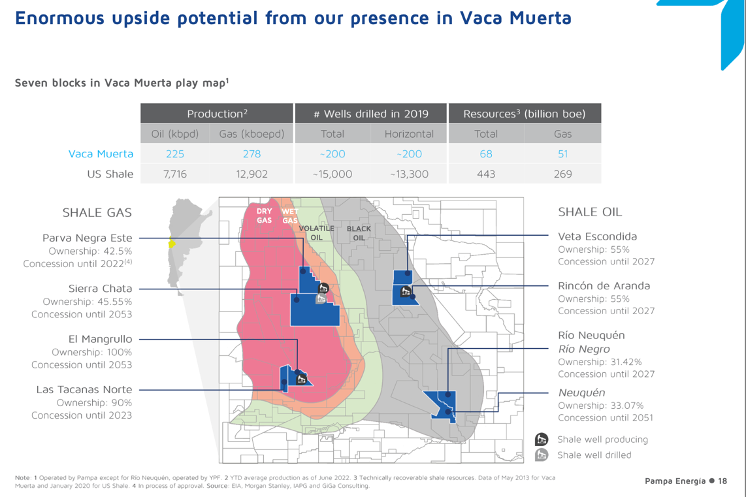

Behind the divergence is a major government push to increase production from Vaca Muerta, a shale formation in southern Patagonia the size of Belgium. It is the world's second largest reserve of shale gas and the fourth largest for shale oil.

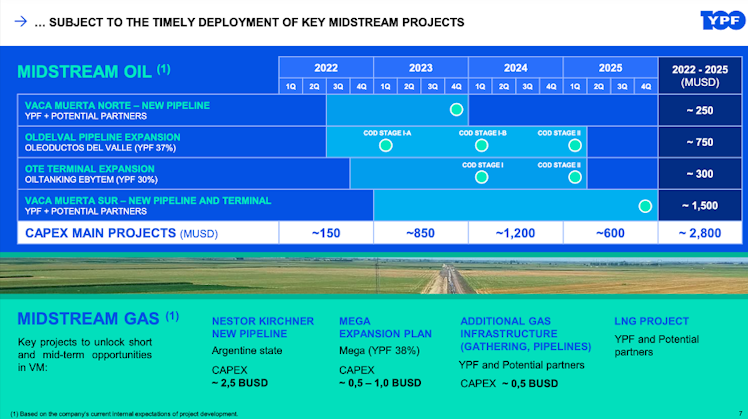

YPF leads development of the region, seen as key to overturning a deep fiscal deficit and making Argentina a net energy exporter to bring in much-needed dollars.

"The company maintains a very good operating and financial performance ... with very healthy credit metrics, among the best in the region," said Maria Moyano, corporate debt analyst at financial group Adcap.

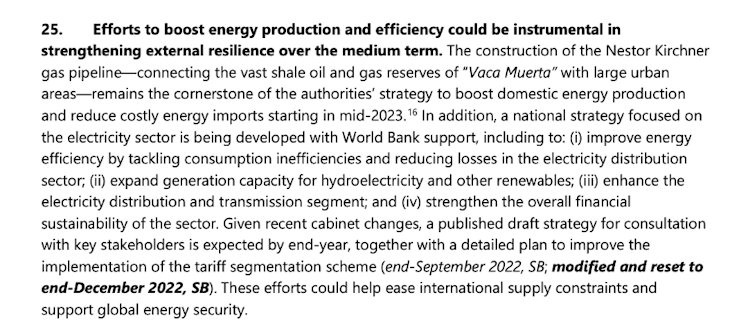

Given my experience investing in Argentina's copper & lithium resources, I am aware of their government's eagerness to work with the IMF and repay their debt. It appears as though development of their energy sector will be a key part of that.

“Strong and stable regulatory frameworks can help boost Argentina’s export potential in key sectors, including energy.”

WASHINGTON, Sept. 14, 2022 /PRNewswire/ -- Argentina's Minister of the Economy, Sergio Massa, announced that following a week of meetings with U.S. officials and executives, he has made significant strides toward bolstering his country's economy, currently undergoing historically high inflation and other pressures.

Throughout the week, Minister Massa secured investments from a number of leading U.S. corporations and global financial institutions. The investments will go toward supporting key economic development initiatives, helping drive efforts to foster long-term economic development in Argentina. Announcements included:

Energy Sector: Companies including BP, Chevron, Exxon, and Total Energy engage in further support of Argentina's role in the energy sector, including exploration and production at Vaca Muerta as well as additional sites

Argentine stocks and bonds on Wall Street also continue to show an marked upward trend, led by state energy company YPF with a 100% increase in American Depository Receipts (ADR) in the last 45 days and other energy companies and banks demonstrating a 40% ADR increase on average in the same period. Additionally, Argentine bonds have stabilized at values 20% higher than last July.

Argentina possesses the second-largest volume of shale gas in the world, much of which is deposited in the Patagonian Vaca Muerta formation. While the extraction of this asset has infused billions of dollars into Argentina’s economy, it has also drawn the vociferous opposition of environmentalists and indigenous activists, groups who are particularly opposed to the controversial fracking process required for utilizing shale.

One of the most critical hurdles between Argentina and economic stability is the successful reduction of energy subsidies, as per the loan agreement conditions negotiated with the IMF. In 2021 alone, the government spent nearly US$11 billion to shelter citizens from market energy rates.

Knowing government is on board with development in the energy sector these days is paramount. Given the massive resource, Argentina's dire need for affordable energy, and agreement with the IMF, it's worth looking for opportunities to invest in this not-so-dead-cow.

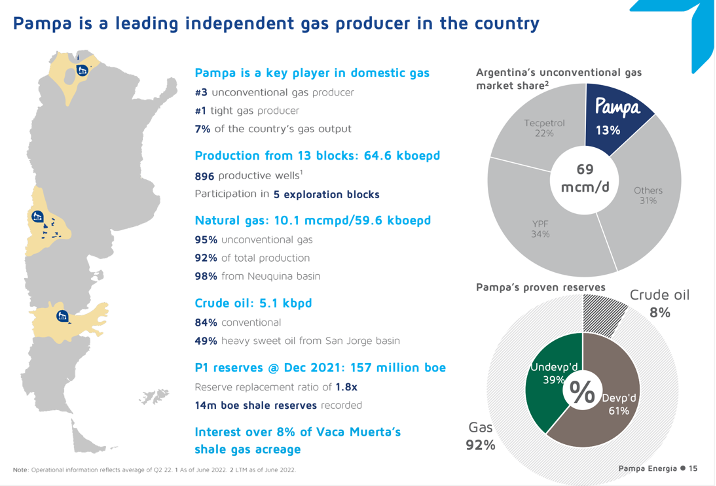

I have NOT bought yet as I am still performing my due diligence but two companies for your watchlist are $YPF and $PAM

Como Estado, I'm very interested in a stake of this dead cow and I think you might be too...

Buenos Aires Times

Argentina 'must maximise resources to defend human rights,' says UN expert

Visiting United Nations envoy Attiya Waris calls on authorities to ensure financial pressures do not affect the defence of human rights.

Already have an account?