Trending Assets

Top investors this month

Trending Assets

Top investors this month

Economic Update - Jobless Claims & PMI

Stocks are higher today and are working on posting a gain for the week. Despite closing slightly lower on Wednesday, all three major averages are up at least 2% on the week. Fed Chair Jerome Powell, who spoke before Congress again today, admitted yesterday that a recession is a possibility.

For economic data today, initial jobless claims were slightly lower at 229,000 last week, just above expectations of 225,000. Initial claims were at 231,000 the previous week. Continuing claims were slightly higher at 1.32 million.

Elsewhere, the flash June reading of the S&P Global U.S. Manufacturing PMI fell more expected to 52.4, a nearly 5 point drop and the lowest level in 2 years. The Service PMI also fell more than expected to 51.6, the lowest level in 5 months. A reading below 50 represents contraction for the sector.

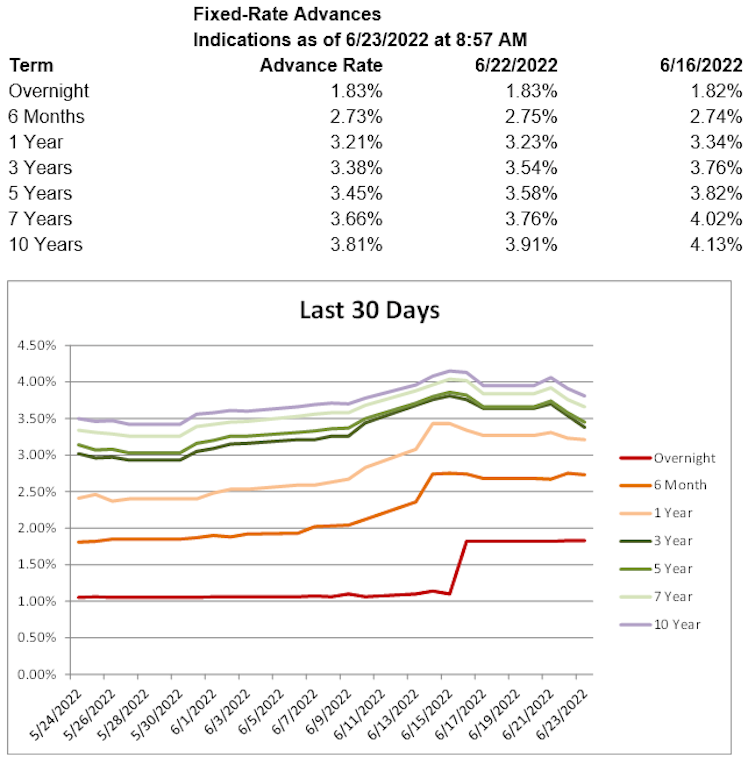

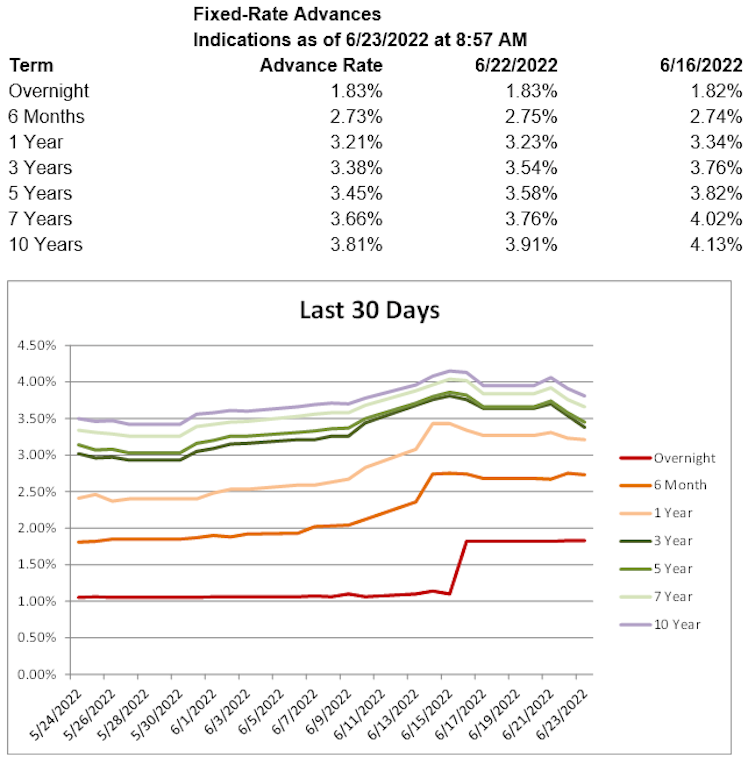

Treasury yields are lower this morning, with the 2-year T yield down 14.7 basis points to 2.91%, the 5-year T yield down 16.2 basis points to 3.07%, and the 10-year T yield down 13.0 basis points to 3.03%. Advance rates are lower throughout the curve today.

Already have an account?