Trending Assets

Top investors this month

Trending Assets

Top investors this month

Why the global supply chain disruption is a tailwind for Zebra Technologies

TLDR:

- Pandemic-induced supply chain disruption as a tailwind to supply chain optimization -> $ZBRA transforms industries by increasing efficiency per employee

- Technology leader with a sticky ecosystem of hardware + software + data analytics

- Capable capital allocators (organic investment, inorganic investment, opportunistic buybacks, high ROIC)

- Reasonable valuation

Transforming Industries

The last years were turbulent and I believe Zebra will be a long-term beneficiary of these trends:

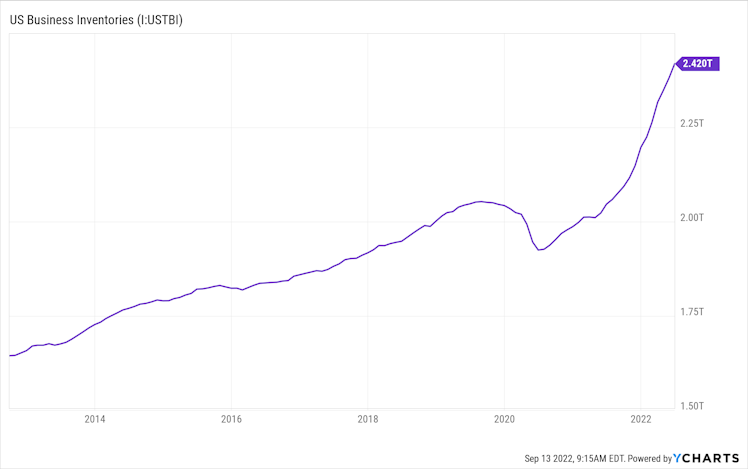

US inventories have gone through a sharp crash followed by rapid increase and overcapacity. Many companies got burned, especially retailers. Management teams are in disarray and change needs to happen!

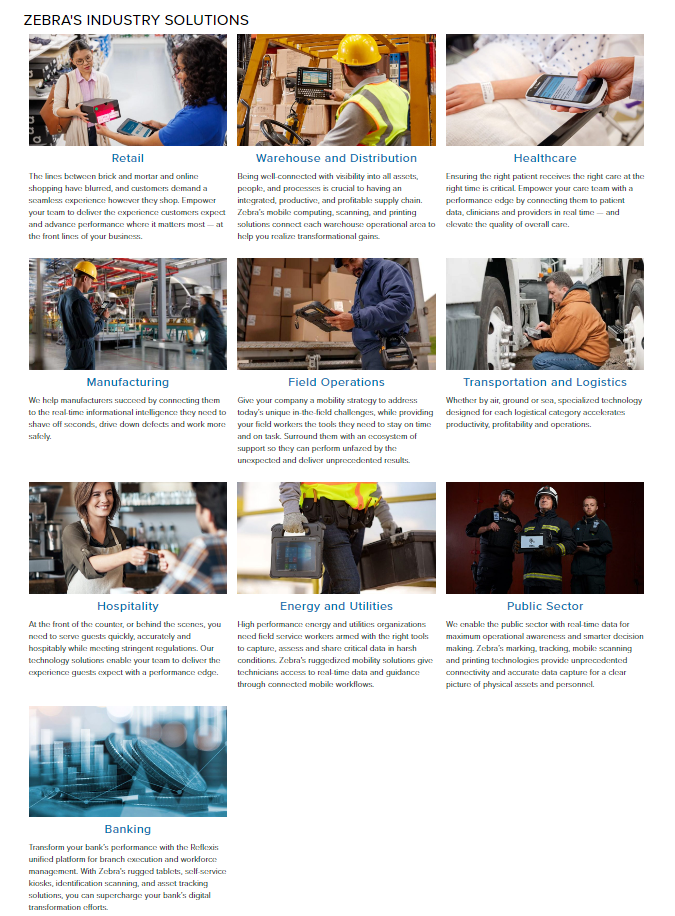

Warehouse and retail companies face high employee turnover and low average tenures. To combat this Zebra offers handheld solutions that increase employee efficiency, helping offset these downsides and streamlining operations. Zebra also operates in many other industries, as you can see below. Many industries are ripe for productivity investments.

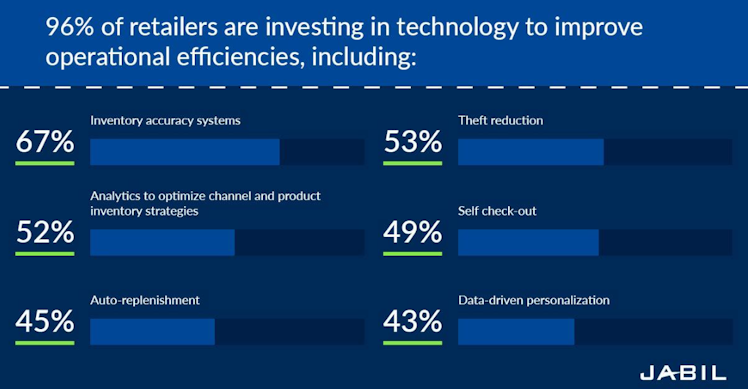

According to a study, 96% of retailers are investing in technology to improve operations(picture below). Another study suggests that the Supply Chain Management Market is expected to grow at a 9.4% CAGR to $45 billion in 2027. Zebra Technologies enjoys large tailwinds from this structural shift in global operations in most industries.

Technological innovation

Zebra is a leader in most of these areas and keeps innovating.

Zebra innovates in two ways:

- 10% of sales are reinvested into R&D to offer a larger variety of solutions to customers

- Zebra acquires companies in adjacent industries to add solutions to its portfolio that will help its customers, upselling existing customers to further improve their innovations. The company is a disciplined capital allocator and has successfully added these bolt-on acquisitions. They also are an angel investor to build relationships with companies to potentially acquire at a later date, drastically reducing execution risk, because they know the company well at the time of acquisition.

I personally experienced this increase in productivity this year at Wacken Open Air, where Cashless payments were introduced via an RFID chip in the festival wristband. This eliminated drunk people counting coins to pay for their 10th beer of the night, instead just holding their wristband against a scanner, massively increasing sales speeds. RFID is a particularly interesting market, projected to grow 12% CAGR to $35 billion in 2030. It's still a small segment for Zebra, but growing "well in the double digits" according to the last call.

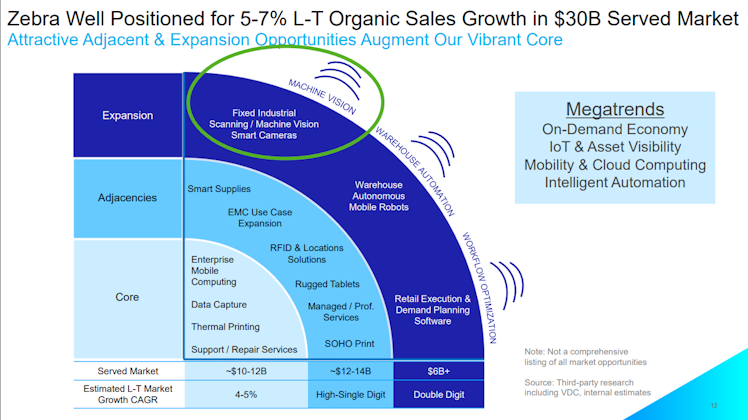

Below is a look at the vast portfolio of services and solutions Zebra offers in one interconnected ecosystem. I believe that the company's 5-7% organic sales growth figure is conservative. I rather see management underpromising and overdelivering than the other way around.

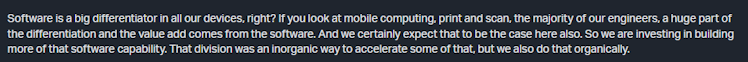

I see a large margin and growth opportunity in software and data analytics, where the company is investing heavily. Currently, 80% of sales are hardware, with software making the hardware more sticky. Below is a quote from the CEO in Q2 21:

Capital Allocation and Valuation

Capital Allocation should be a vital part of any investment thesis, Zebra has three main ways to allocate cash (in order of importance):

- Invest into organic growth (R&D/sales = 10%)

- Invest into inorganic growth (acquisition strategy mentioned above)

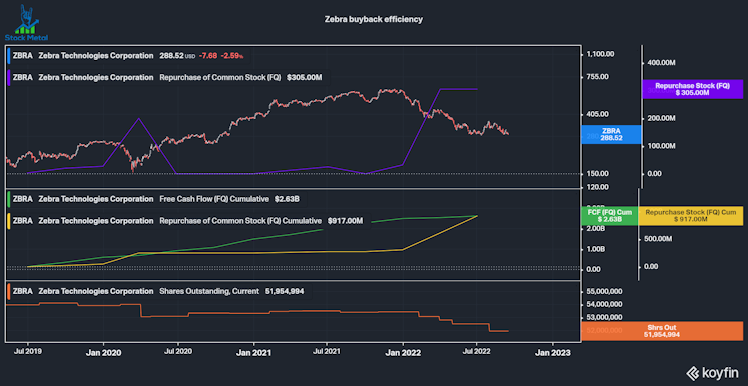

- Buyback shares at opportunistic prices, if there is no better use of cash. In the past 4 years, Zebra used ~1/3 of cumulative FreeCashFlow to buy back shares in opportunistic times: During the covid crash and after the valuation declined from the historical overvaluation of 35x forward PE back to good levels of 15 PE and 5% FCF yield

- This resulted in high average ROIC of 12.5% in the last decade, rising

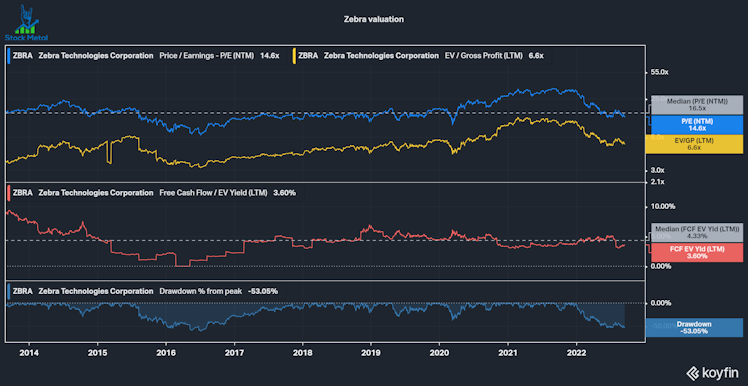

Valuation: Like I just mentioned, Zebra was highly overvalued in the 2020/2021 tech craze. Forward PE expanded to 35+ but finally came down back down under the historical median after a 53% drawdown. The FCF yield should be higher if we subtract settlement payments to Honeywell for a lawsuit that has been settled with a $360 million payment from Zebra. These 8 quarterly payments will impact FCF, but they are irrelevant long-term. Zebra also currently is impacted by high supply chain costs due to shipping prices, estimating a $200 million FY22 impact. If we adjust the $150m settlement plus $200 million supply chain impacts we get a 5.8% EV/FCF yield, significantly above the median 4.3% yield.

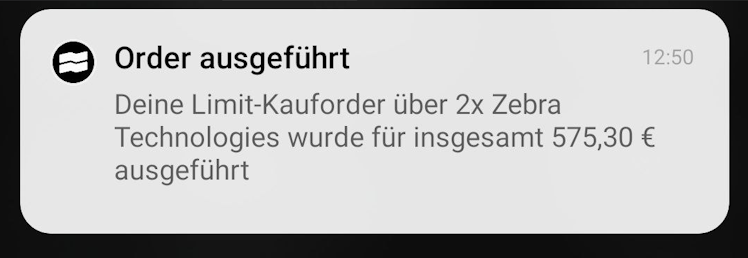

$ZBRA is a 5% position and I added $500 for this challenge

Questions? Share them in the comments and leave a like

Seeking Alpha

Zebra Technologies to pay $360M to Honeywell in patent settlement (NASDAQ:ZBRA)

Zebra Technologies (ZBRA) disclosed Thursday it agreed to pay $360M to Honeywell (HON) for past damages as part of a license and settlement agreement to resolve all...

Already have an account?