Trending Assets

Top investors this month

Trending Assets

Top investors this month

Bank of America Q3 Earnings – Strong Consumers = Strong Bank

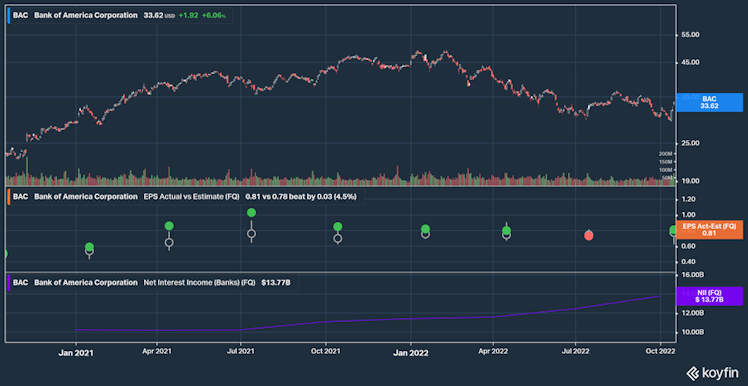

Bank of America $BAC released their Q3 earnings report pre-market this morning, October 17th. The report surprised (in more ways than one) and sent the stock up 5.62% at the most in pre-market and closed 7.07% after-hours this evening.

I read the earnings transcript and reviewed the earnings presentation and can tell you that a key set of highlights shows that there is great operating performance behind this move higher and hint to a couple tailwinds that make the bank and the economy look good despite looming inflation and recession concerns. Read the transcript and presentation for yourself here, all of the presented information comes from that.

Those key items include:

• Net Interest Income & Improved Outlook

• Excess of Leverage and LTAC Ratios

• Strong Consumer Spending & Growing Deposits

Net Interest Income

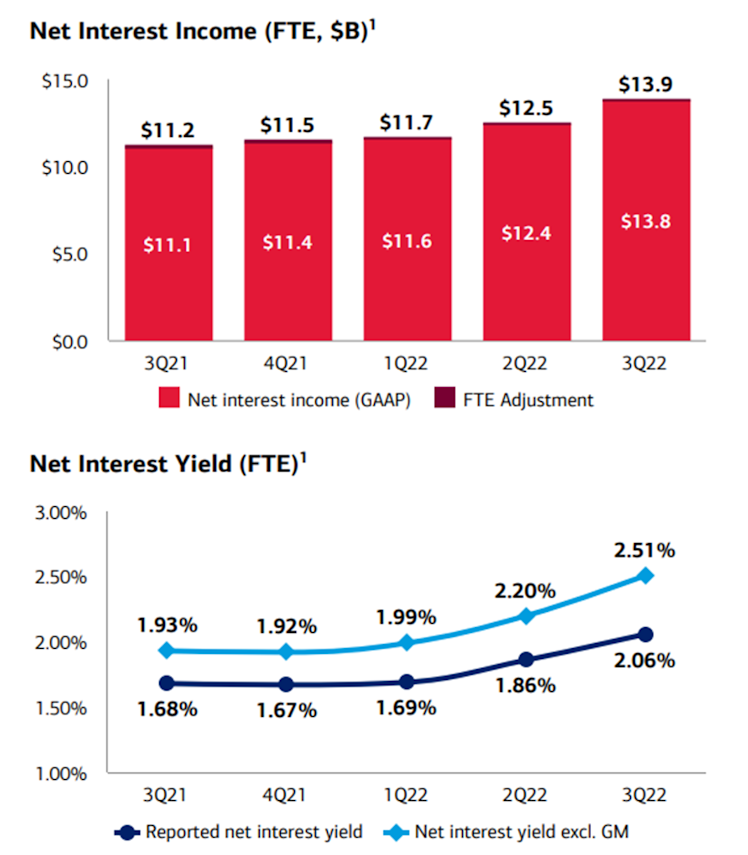

Net interest income (the primary measure for how profitable a bank is) increased $2.7 billion or 24% year-over-year. This is driven primarily by benefits from higher interest rates and loan growth. NII is up $1.3 billion over the last quarter. Thanks to rapid rate hikes by the Fed, short-term interest rates have risen over 200 basis points in the last year. This drives up the interest that $BAC earns on their assets with adjusting rates, when that is coupled with disciplined deposit pricing this drove nearly $1 billion in NII growth this quarter.

$BAC provided forward guidance on their NII as they did last quarter. Previously, investors were told to expect consecutive NII increases of $1 billion in both Q3 and Q4. Q3 just put up $1.3 billion. With this outperformance and the expectation that rates will continue to increase, loan volume will keep growing, and deposit prices are baked in, $BAC updated their Q4 expectation to $1.25 billion. That would put Q3 and Q4 total NII to $2.55 billion compared to the prior $2 billion.

Excess of Leverage and LTAC Ratios

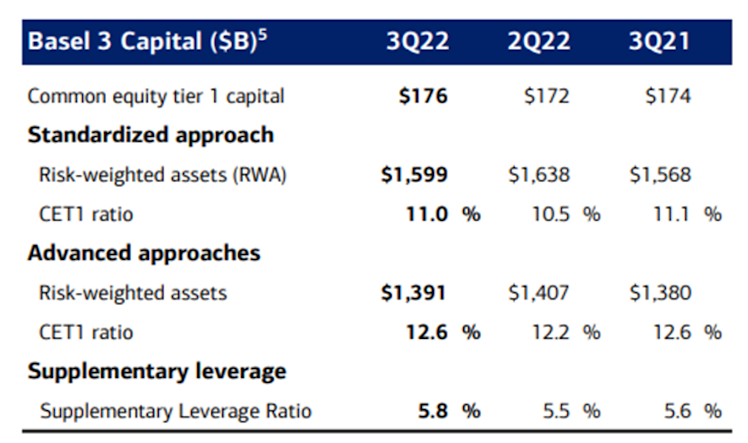

Regulatory capital can sometimes be a negative throttle on the growth of banks and is something I like to keep an eye. I’d like to highlight $BAC’s supplemental leverage ratio (SLR). Introduced in 2010 as part of the Basel III requirements, a SLR applies to banks with $250 billion or more in total consolidated assets. It requires that they hold a minimum ratio of 3%. Enhanced supplementary leverage ratios apply larger and more systemic financial institutions and require a larger ratio. This ratio calculates how much capital a bank must hold relative to their total leverage exposure

In regard to $BAC’s regulatory capital, their supplemental leverage ratio increased to 5.8% versus the minimum requirement of 5%. This leaves some very positive room for balance sheet growth. The bank’s TLAC ratio (total loss absorbing capacity a standard to minimize the risk of a bailout) is well above the requirement which can support balance sheet growth as well.

Strong Consumer Spending & Growing Deposits

This last section is the most important! $BAC’s earnings show some great stats about the overall health of their consumer base.

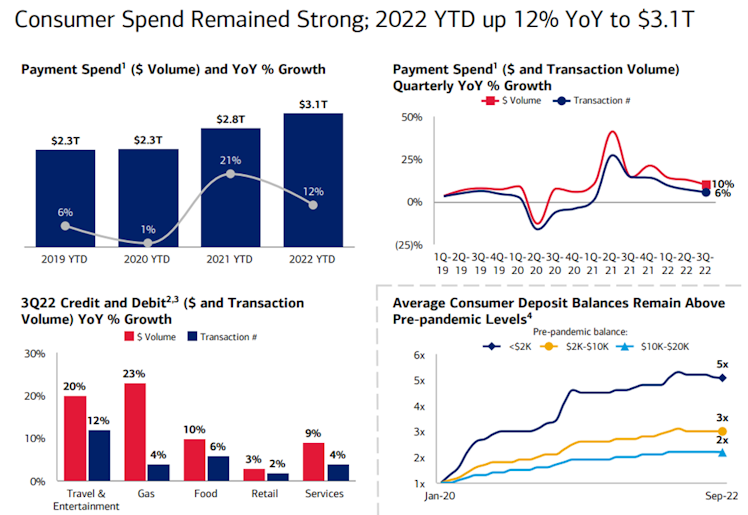

First, consumer spending is strongly up 12% year-to-date. One could say this is on account of inflation. To counter, I would direct your attention to the top right graph below, not only is payment dollars up 10%, but the number of transactions is up 6% as well. That increase in sales volume is a positive sign that inflation is not slowing purchasing.

Second, consumer deposit levels (bottom right graph) are multiples above pre-pandemic levels. These levels are higher compared to a year ago as well. These deposit levels suggest continued spending capacity, even with inflation. $BAC opened 400,000 new consumer checking accounts for the 15th consecutive quarter of growth which is helping push deposit levels consistently higher.

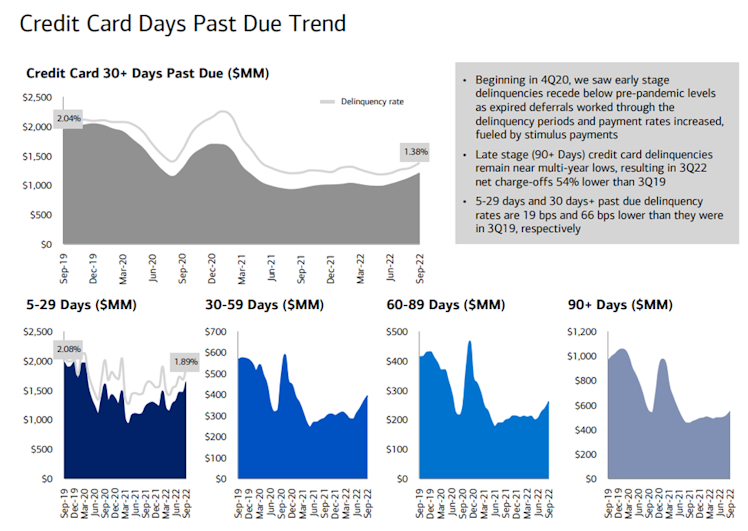

Third, total credit and debit and usage are 12% above pre-pandemic levels. The payments on those credit cards are 1,000 basis points higher than pre-pandemic. More purchasing activity in a higher rate environment is the perfect position for a bank to be in. Add to that the fact that credit days past dues are significantly trending downward and we get a picture of a very strong consumer at the moment.

Summary

In sum, consumer activity is stellar. I didn’t review the wealth and investment leg of the bank in this post, but those branches showed great activity as well. NII has improved quickly and appears to be able to continue that trend. The average consumer is healthy and strong. $BAC’s balance sheet has room for growth and responsible income statement management looks to show that margins will continue to grow as well.

In addition to all of that, $BAC increased their dividend last month by 4.8%. They also bought back $450 million in share repurchases that covered employee issuances so as to not dilute.

Disclaimer: I am long $BAC with a position of 16.6 shares that I fully intend to grow!

Bank of America Corporation

Quarterly Earnings

Already have an account?