Trending Assets

Top investors this month

Trending Assets

Top investors this month

Q1 Portfolio 2022

As the third month of this project comes to an end, I will share my activity for March. As a reminder to readers, the first year of this project will be a build-out phase until I conduct the necessary research on single stocks I want to own and construct the desired weightings of the portfolio. Interested readers can find more details about this project in "Maiden Post of Reasonable Yield", and the previous two months of updates on my blog.

As a further reminder, this project was born in January 2022, with the goal of documenting the maxing out of the UK ISA annual limit (£20K) each year, with a DGI portfolio

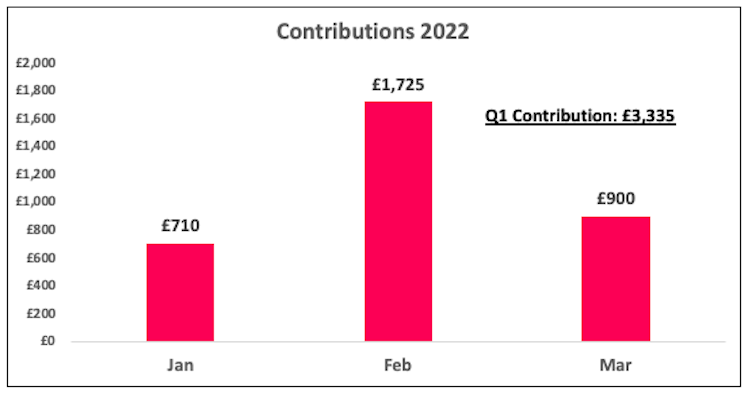

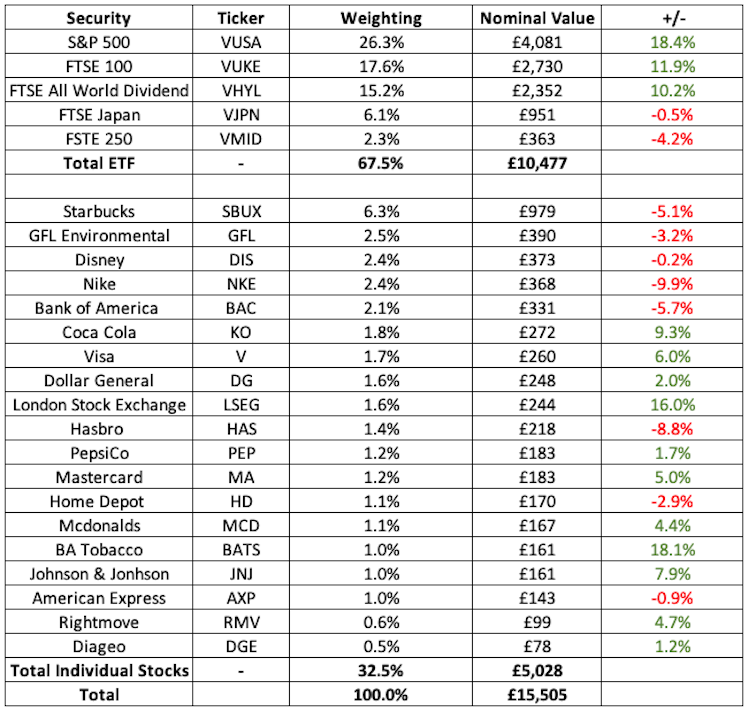

In March, £900 was deposited and invested, meaning a total of £3,335 has been invested this year, excluding the initial £10,000 or so that was allocated pre-2022 to pre-fund the account and kick start this project. Thus, bringing the total value of the DGI portfolio to approximately £15,500. As of April 5th, there is a newly refreshed £20K ISA limit for the tax year, and the goal will be to contribute ~£5K per quarter during the next year.

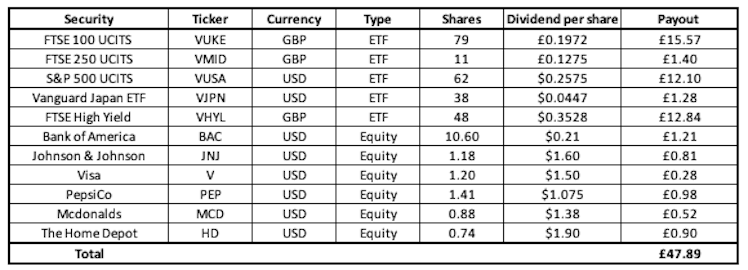

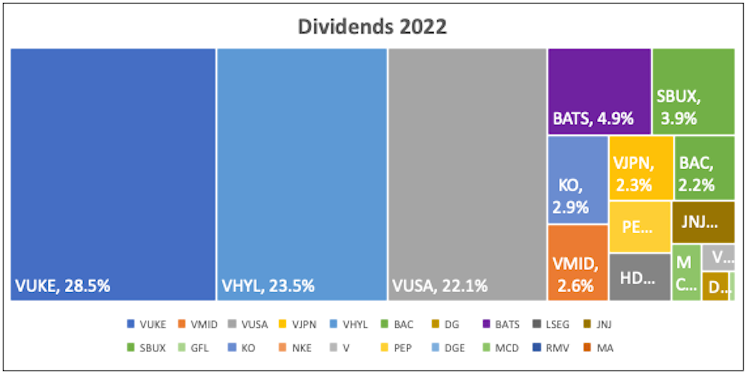

As the portfolio is currently concentrated in ETFs, the bulk of dividends are weighted towards the end of each quarter. This month, dividends were collected in the sum of £47.89, from the following sources.

At the conclusion of the first quarter of this project, the total dividend income stands at £53.04, and that is now our benchmark from which to compound quarterly, yearly, bi-annually, and so forth. As a reminder, the dividend goal for 2022 is ~£350.

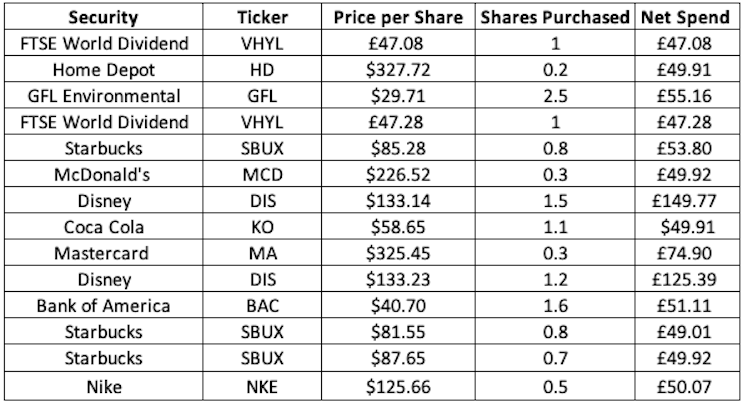

Activity in March

Buying activity in March has been confined to existing positions with a focus on individual stocks. The share of ETFs as a % of the basket is now 67.5%, down from 71.8% in February, and 77.7% in March. Buying in April thus far has included additional shares of Dollar General, Hasbro, Starbucks, and the FTSE 100 Index.

An updated table of the holdings and their relative weightings, value, and returns can be found below.

There are a number of companies on my watchlist (below), and so Q2 will be focused on expanding my watchlist, and locating any potential new entrants to the DGI portfolio. $AAPL $COST $WMT $CINF $MGP $ALLY $O $HSY $JPM. I am also looking to add some broad tech exposure maybe through QQQ ETF. I am not a tech investor, so don't wish to optimise to stock picking in that category.

Company Commentary

Below is some brief commentary on a select few of the names in the DGI portfolio.

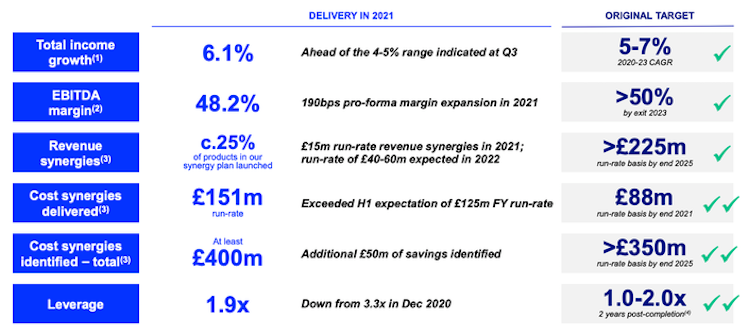

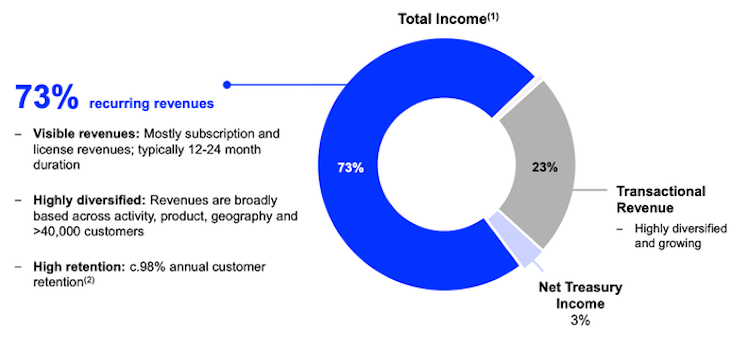

London Stock Exchange ($LSEG): The London Stock Exchange (LSEG) had fantastic full-year results back in early March. Revenues expanded to £6.8B (+6.1%), and adjusted EBITA of £3.3B (+8.3%) for a margin of 48.2%. Great cost synergies are being realised, net debt is trickling down ahead of schedule, and a healthy dividend hike of 27%. Free cash flow of £1.4B is expected to increase as the near-term CapEx requirements fade in the coming years.

LSEG's revenue composition has grown in quality after its acquisition of Refinitiv, with 73% of total revenue now being recurring. Still some work to do in terms of tying the two businesses together, however.

LSEG is a company I intend to add weight to at the right moment. I am following the Refinitiv integration closely.

Disney ($DIS): Disney is not a dividend-paying company, and I am aware it may continue to lack yield for the foreseeable future. I agree with management's decision to axe their dividend; partly to free up liquidity during the covid crisis, but also to lean aggressively into streaming, a capital-hungry endeavour. When there is an opportunity to attain attractive ROI on your money and venture into a business-model-shifting tangent, I am all for finding additional firepower at the expense of dividends. The caveat is that I assume Disney pays a dividend at some point in the next 5-years.

The DTC business has been doing well. From 27M Disney+ subscribers in Q1 FY20 to 130M as of Q1 FY22, the remaining subscriber counts (from ESPN+ and Hulu) have grown from 37M to 66M over the same time period. Equally impressive is the geographic dispersion of Disney+ which, beginning with 25M domestic subscribers in Q1 FY20 and 2M internationals, now boasts 43M domestic, 41M international, and 46M Disney+ Hotstar subscribers. Back in Q3 of FY21, Netflix would suggest Disney+ has a 1% market share of US TV time (compared to 6% in YouTube, and 6% in Netflix). While I think it's ignorant to suggest Disney ever competes with Netflix's extensive library, there is a great deal of runway for Disney to run yet.

The resurgance of the Parks & Resorts business (posting record revenues and EBIT in Q1) is another tailwind in itself but catalysed by the fact that the per capita spending of guests has been advancing (above pre-covid norms) despite operating at reduced capacity. Parks & Resorts EBIT margins in the first quarter stood at 32%, compared to 25% across 2018 and 2019. Leaving me to believe it will emerge from the pandemic stronger than it has ever been. As such, I have 3x'd my position in Disney.

Hasbro ($HAS): After submitting a well-articulated proposal to the Hasbro board, Alta Fox was ultimately dismissed by the Hasbro Board. For anyone who follows Hasbro, it would appear the board is not bowled over with their proposals, laid out in their well-researched piece "Hasbro, Let Wizards Go". Alta Fox, who owns a 2.5% stake in Hasbro, was shocked.

When founder Connor Haley caught up with Yahoo Finance he would say: "We've got a world-class slate of advisors. And they are all collectively stunned at the level of entrenchment of the current Hasbro board. I think we went well out of our way to offer a beyond reasonable settlement."But it's not just Alta Fox that is taken aback by Hasbro's refusal to listen to new ideas.

Adirondack Retirement Specialists, a Meaningful Shareholder of Hasbro, had the following statement:

"We were dismayed to see media reports indicating that the current Board of Directors rejected what appears to be a step forward toward adding value for Hasbro shareholders via a very reasonable settlement proposal from Alta Fox. If true, it is troubling to us that the current directors would reject a well-researched 2.5% shareholder’s input and candidates who have records of adding value at a time when Hasbro seems to have lost the market’s confidence. The Company’s shares are at a new 52-week low point, and it has a strategy that has led the business to lag the overall market and its major competitor over the past five years. For shareholders, we insist on a strategy that prioritizes the highest and best long-term allocation of capital and resources. In our view, Alta Fox’s proposal takes shareholders toward that goal. We intend to support the entire dissident slate as we believe that would be in the best long-term interests of shareholders if a contested vote is held at the 2022 Annual Meeting of Shareholders."

I suspect that the momentum for Alta Fox's proposals has impressed current shareholders, will continue to grow, and will eventually pressure Hasbro's board into action. Part of the proposal by Alta Fox was putting forward board members. The 5 proposed members include;

- A founder and CEO of a publicly-traded tech/software business

- A CFO who has experienced 5 spin-offs

- A professional Magic the Gathering player, and seasoned investor

- An expert in corporate strategy and;

- An operationally minded former CEO

I think the board can only hold off Alta for so long and am interested to see how this plays out through 2022.

Starbucks ($SBUX): Howard's first act as CEO was to axe the share repurchase component of Starbucks' $20B capital program. Share repurchases were expected to be ~2/3 of the total allocation, and with $3.5B already used, one wonders what the extra $9.5B is going to be used for. He remarked that it would be used to "invest more into our people and our stores" but with CapEx for store count growth already accounted for, I suspect he is actually signalling that the cost of labour is going to increase at Starbucks. No doubt, because of this unionisation battle they face.

Nevertheless, these are short-term (and by short term I mean 2-3 years) headwinds for Starbucks. It may no longer be a vessel for beating the market, but it's still an income-investors delight. With an expected dividend increase coming next quarter, I plan to continue adding whilst the turbulence thunders on.

Dollar General ($DG): A recent dividend hike of 31% was pleasing. Dollar General now pays 55 cents per share in dividends each quarter, up from 42 cents. At 18.1K units (up from 12.5K units in 2015, and 9.4K in 2010), I believe there is still ample room for growth across the United States. Having shown consistent mid-single-digit YoY growth in store count over the last decade, as well as firm revenue per store growth, I can see a future where there are as many as 28K locations across the States before we begin to ponder saturation. In 2010, the average Dollar General store was expected to earn ~$1.4M in sales each year. T

Today, that has advanced to $1.9M, up 36% despite a 93% increase in total units. That tells me this business box model is highly efficient and will continue to be scalable. Whatsmore, DG have shaved ~32% of their outstanding share count over that period and continued to pay dividends. The potential of DG's retail concept stores, Popshelf, which management opined could reach 1K stores by 2025 (currently projected to hit ~200 by end of the year) is exciting. Is a recession coming? I have no idea. Can DG survive a recession and continue to pay dividends? I am confident they can.

Other News

In other news, I expect to be adding ~£5K per quarter for the remainder of the year, meaning the value of this portfolio should reach between £30K and £35K at the year's close. The following year, a further £20K will be invested, and the year following that, and the one following... you get my point. This project will take a number of years before it starts to kick out some meaty dividends, it will also take a number of years before it grows to any reputable size. Such is the nature of Dividend Growth investing. I have other, more active, investments, to keep me busy while I grow this portfolio.

I thank you for following me on this journey. That will be all for this month.

Thank you,

R.Y

Already have an account?