Trending Assets

Top investors this month

Trending Assets

Top investors this month

The 2022 Bear Market in Context

Today, the S&P 500 index closed at a new low for a bear market that started back in 3 January this year.

In my investing lifetime, I have now endured 5 bear markets (declines of > 20%) and 8 corrections (declines between 10% to 20%).

After the 2008 Global Financial Crisis, I vowed to track the progress of the S&P 500 index for every future bear market I would experience. It's not because I'm a masochist, far from it. It's because I find it helpful to put the falls I'm experiencing in context to what I've experienced in the past. This helps me mentally prepare for what could lie ahead. In other words, if I thought it's painful now, it could easily get a lot worse.

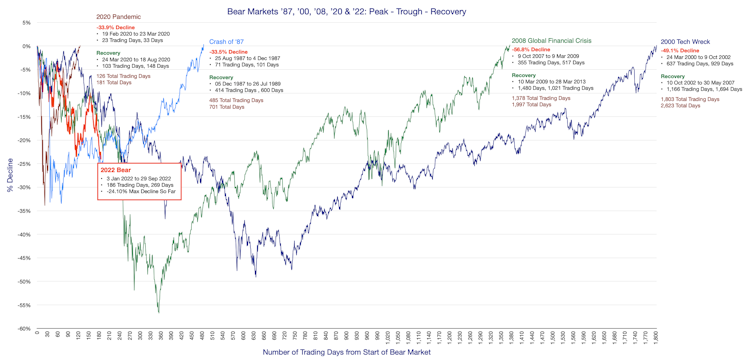

Here is a drawdown chart of the S&P 500 index for all bear markets (declines > 20%) since the 1987 crash:

It's a busy chart, but you can see the current bear market (red line) is still shallow and young of age compared to the 2000 Tech Wreck and 2008 GFC. The "aberration" has been the pandemic bear market of 2020 because it was over in a mere blink of an eye. I personally felt long-term investors weren't truly tested then because the decline and subsequent recovery so quick. Skittish investors may have fled, but long-term investor who bought the dip received an almost instantaneous payoff. From a stock investing perspective, it wasn't the generational wealth destroyer that the 2000 Tech Wreck and 2008 GFC were. What truly challenges you is when the "buy the dip" strategy doesn't seem to work and you watch your portfolio value continue an unrelenting march downward.

How long this bear market will continue and how deep it will go is unknowable. But if we compare today's bear market to previous ones, we need to be prepared for the possibility it could go much deeper and much longer. This is when having conviction in your investment process is most needed. How you behave in these times sets you up for your success later when the market eventually recovers and moves forward.

I'm always reminded of this great quote from Morgan Housel. I really wish he was around dishing out his insights when I first started investing back in '87.

All bear markets are painful. No one likes watching their portfolio decline as the months ebb by. If you're engaged in the market like I am, restricting yourself to looking at your portfolio once a year or once a month isn't really an option. We watch the market because we're always on the lookout for those big opportunities. Feeling pain is a natural part of the investing process. If you are fairly new to the stock market and hope you become inoculated to pain after you survive a few bear markets, prepared to be disappointed. I'm afraid it doesn't quite work like that. I STILL feel the pain of bear markets. You just get very adept at compartmentalising it so it doesn't affect the job at hand. You become much more confident sticking to your process because you know it has a long-term positive expectancy. The pain is still there, no matter how much you try to ignore or deny it. The longer you save and invest, the larger your portfolio gets. Those paper drawdowns start to get very, very large. On paper, I can easily lose an entire year's salary whenever we have a couple of bad days in the market like today. The recovery is almost always painfully slow which doesn't help. The "up the escalator and down the elevator" is a cliché for a reason.

Luckily, I've never lost sleep and it doesn't affect my mood because I know it's all part of the deal. I don't have a reliable system that gets me out of the market just before a large decline while avoiding the head fakes - i.e the dips that look precipitous, but recover in an instant to make higher highs. Those false positives can be very disruptive to growing your wealth. You can't afford to miss times when the market is lurching higher.

As a long-tenured investor, I don't really have any insightful words of wisdom that isn't already a cliché ... stay the course, this too shall pass, stick to your proven investment process, no reward without pain etc etc.

My only comment is to accept your emotions, they're there for a reason. We're not emotionless automatons. They'll tell you if you've taken on too much risk. Maybe you should lighten up on those speculative, non-profitable small cap stocks. Acknowledge your feelings but don't let them cause you to abandon your plans. Just remember to keep an even keel once the bull market returns because we tend to fall back into our bad habits and take on too much risk chasing returns. Your portfolio should align to your temperament. Be less preoccupied with maximising returns, and more focused on optimising your portfolio to suit your temperament. Your emotions is the temperature gauge for this. When you achieve that balance, you're less likely to succumb to bad investor behaviour.

I always love metaphors when it comes to long-term investing. One of my favourite is the ringside interview in Rocky 3 with Clubber Lang (Mr T). It perfectly encapsulates the journey of the long-term investor:

Ringside Interviewer: "what's your prediction for the fight?"

Clubber Lang: "Prediction?"

Interviewer: "Yes, prediction"

Clubber Lang: "Pain"

Already have an account?