Trending Assets

Top investors this month

Trending Assets

Top investors this month

What I Learned from Trading: Asymmetric Payoff

The asymmetric payoff is one of the most foundational principles of our investing and trading strategy. Asymmetry was always implicit in our investing process, but learning to trade brought that principle to the front of our conscious minds. It’s now the focus of everything we do in our "investment operations". Any investment activity or rule that doesn’t contribute to an asymmetric payoff is deemed superfluous and unceremoniously dumped. We scrutinise everything we do because time is valuable and there’s no time to waste.

In geometry, symmetry refers to a shape that’s the same on both sides of a central dividing line, also known as the mirror line. The following shapes are symmetrical:

In investing, symmetry usually refers the 1:1 relationship between risk and reward. A symmetrical payoff is when you risk $1 for the chance to make $1. Risk and reward are inextricably linked when it comes to games of chance. You can’t earn monetary reward without risking capital. Symmetrical payoff is a low bar if you’re a long-term investor. Asymmetrical payoff is the aspiration.

The English Oxford dictionary defines asymmetry to be:

"lack of equality or equivalence between parts or aspects of something; lack of symmetry"

Symmetry and asymmetry can be pictorially represented as follows:

In investing, symmetry usually refers the 1:1 relationship between risk and reward. Symmetrical payoff is when you risk $1 for the chance to make $1. Risk and reward are inextricably linked when it comes to games of chance. You can’t earn monetary reward without risking capital. Symmetrical payoff is a low bar if you’re a long-term investor. An asymmetrical payoff should be the aspiration.

The English Oxford dictionary defines asymmetry to be:

"lack of equality or equivalence between parts or aspects of something; lack of symmetry"

Symmetry and asymmetry can be pictorially represented as follows:

Asymmetry is more than just a visual cue. It can appear whenever we compare inputs to outputs. Asymmetry works in both negative and positive ways. The Pareto Principle is a direct manifestation of asymmetry: 20% of your inputs are responsible for 80% of your outcome. The relationship between inputs and outputs isn’t always linear.

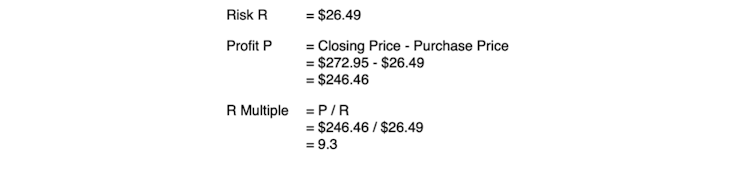

For example, you invested in McDonalds stock 20 years ago at the beginning of 2002, you would have purchased it at around $26.49 per share. By the beginning of November 2022, the stock price had risen to $272.95 per share, a multiple of more than 10. If we think of it in terms of a risk multiples, we put our entire purchase of $26.49 per share at risk to and earned the following long-term reward:

The R Multiple tells us that we made a profit that was 9 times the capital we risked (9R). This is the return asymmetry in action, and this doesn’t even include the dividends paid out to shareholders. Over the 20 year period, the total dividends amounted to $56.32 per share.

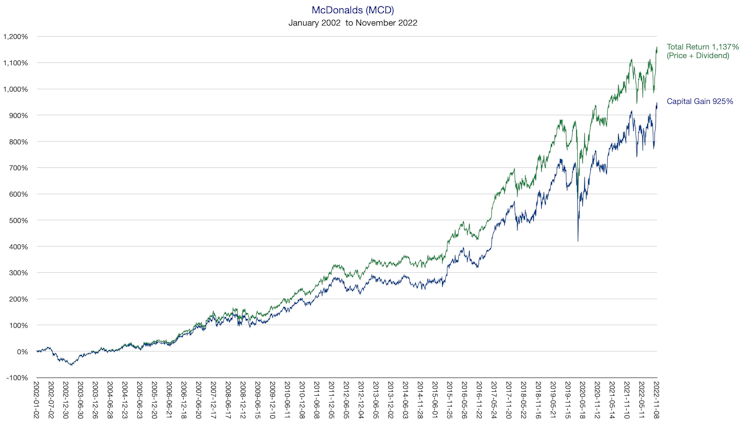

The following chart shows the meteoric growth of the McDonalds ($MCD) stock price in percentage terms. If we include dividends received as cash (but not reinvested), we can also plot total return.

I deliberately chose McDonalds because buying this stock didn’t require any special predictive foresight or stock picking superpower back in 2002. McDonalds was a mature stalwart of the consumer discretionary sector and one of the 30 constituents of the Dow Jones Industrial Average index (DJIA). It wasn’t viewed by the market to be the next big growth stock like Apple, Google or Netflix. It was just a well-run, well-branded burger-flipping operation (and stealth retail estate business) that was instantly recognisable to everybody.

The McDonalds example proves that asymmetric reward doesn’t require perfect market timing or getting into the next big growth stock at the ground level. However, it does require hopping on board a long-term success story and staying the course. You have to let your profits run to capture an asymmetric payoff. There’s an old trader saying "be right big, be wrong small". If you sell to crystallise your gains because you’ve reached some profit target, you’ll always truncate your gains and might never achieve life-changing, multi-bagger returns. Asymmetry requires you to "let your winners run".

Picking winning stocks isn’t the only strategy to generate lucrative reward asymmetry. All long-tenured investors know how difficult it is to consistently pick winners in the stock market. We can achieve return asymmetry by dollar cost averaging into a broad market index fund and holding for multiple decades. It’s a simple turtle-paced strategy that works if you give it enough time. You have to be consistent, patient and stedfast in a systematic dollar cost averaging process for a very long time.

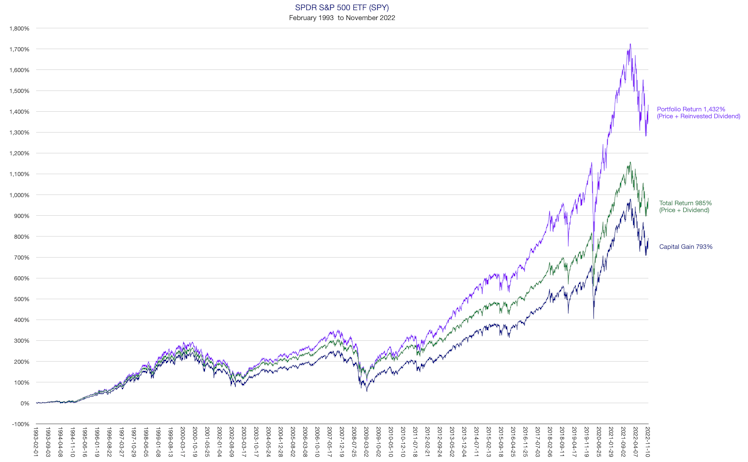

Consider the growth of one of the oldest and most popular ETFs tracking the S&P 500 index: SPDR S&P 500 ETF (Ticker: SPY). If you had bought shares in SPY at the inception of the fund, you would have paid about $44.25 per share. By the beginning of November 2022, that share price had grown to $384.52, more than 8 times your initial investment. This is a 7R asymmetric return on price alone. During that holding period, you would’ve had to endure the following bear market drawdowns:

- 49% drawdown during the Tech Wreck of 2000

- 56% drawdown during the Global Financial Crisis of 2007 to 2009

- 34% drawdown during the 2020 Covid-19 pandemic

- 25% drawdown during this current 2022 bear market

We know that dividends are an important component of total return. Compounding really kicks in when those dividends are reinvested. Total dividends paid over the period amounted to $85.02 per share. If those dividends were reinvested, your portfolio would have grown to over 14 times your initial investment.

It’s not enough to recognise when an asymmetric opportunity presents itself, it’s equally important to identify the key drivers and mechanics that produce that asymmetry. In other words, we need to know how that investment is going to become a multi-bagger, including your own conduct from a behavioural standpoint. If you know how the expected reward will be earned, you’ll more likely to stick to the plan long enough to see it happen. This can be as little as being patient enough to give the investment the necessary breathing space to do its job. There’s also a good chance you’ll need a holding period of years, or even decades to capture the full asymmetric reward on offer.

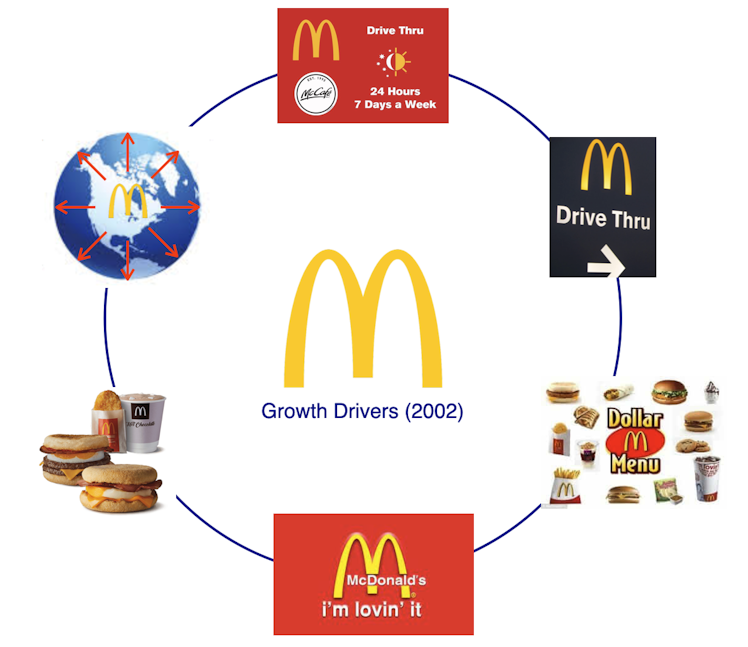

In the case of McDonalds, the business thesis back in 2002 was predicated on several factors: international expansion, continued strong brand awareness, introduction of all day menu offerings, expansion of drive-thru, extended hours and resiliency during economic downturns through value offerings like the dollar menu. This business doesn't sell some new, disruptive product that revolutionises the way we live, so asymmetry of return was always going to be achieved through steady growth over a long period of time.

Most long-term retail investors use their temporal edge (time horizon advantage) to achieve 5R, 10R, 20R, 50R, 100R returns. Investors can hold a market index fund or winning stocks or for a very long time to let compounding work its magic.

In trading, I was taught to abandon profit targets and let the market take you out of a winning trade (trailing stop loss). In other words, successful traders also let their profits run. It's a common theme shared by successful traders and investors. Traders open a stock position on price action, give the position some breathing room to ride out the routine day-to-day noise using volatility-based stops and close out the position when the price action turns conclusively adverse. The entry and exit criteria are congruent because it’s based on the same factor.

Long-term investors who buy a stock predicated on a business thesis should base their exit criteria on that thesis being broken. The original thesis can evolve as the business evolves over time, but the exit should be down to business impairment reasons rather than on any short term price weakness. Price weakness can trigger a review of your business thesis, but it shouldn’t be the prime consideration to sell out. The same factor that got you into the stock should be the factor that gets you out. This ensures congruence in your process and we believe this idea to be very important. If you buy a stock on business considerations but decide to sell because you’ve reached some arbitrary profit target, your entry and exit criteria isn’t congruent. You could leave a lot of profit on the table if the business continues to prosper.

Successful long-term investors apply the "slight edge" philosophy and let a quality business successfully executing their mission the necessary breathing space to time to hopefully earn a multi-bagger return (capital gain + dividends). Asymmetric payoff is what gets you to financial freedom. For us, if the investment opportunity has no expectation of an asymmetric payoff, then the opportunity is a hard pass. We don’t day trade, apply for an IPO to stag profits or trade option spreads.

Asymmetry is a theme that will run through a lot of what we talk about in our future posts.

Already have an account?