Trending Assets

Top investors this month

Trending Assets

Top investors this month

An Appeal to Retail Investors: A solid, simple strategy will get you there

I recently caught up with a fellow retail investor who I mentored many years ago. After a cursory catch up on each other’s lives, the conversation inevitably drifted to investing, a passion for both of us. My friend has always been the more "adventurous" investor (he's say "entrepreneurial"). Dollar cost averaging into a market index fund was never going to cut it for him. His investing journey involved futures and derivatives trading, contract for difference trading (CFD), forex trading, crypto trading and various other complex strategies that just make my head spin. He didn't do this all at once, he just transitioned from one strategy and trading instrument to another. I used to jokingly say to him: "if it moves, you'll trade it". I might be a little unkind for saying this, but he threw everything at the wall to see what would stick. That’s what goes through my mind whenever I speak to him. I was happy when he told me he's now restricting himself to just buying stocks on the US exchange and trading CFDs on the Australian exchange. We had a very entertaining time talking about his long circuitous journey before eventually landing back on a simpler path to building wealth.

For every investor starting out their investing journey, there’ll usually be a period of experimentation. You won’t know what you’re good at unless you try. There’s nothing wrong with this approach provided you manage your risk appropriately. I felt it’s important to remind my fellow retail investors: simple is usually best when it comes to investing. And this is not always intuitive. We harbour a complexity bias which has us believing that complex strategies can result in better investment performance. But among retail investors, that’s more the exception rather than the rule. An important principle is to know your limitations. Ego isn’t important, making profits is.

It’s easy to become enticed to add more and more input variables and steps into your investing process on the assumption that it will lead to better results. You read about institutional investors using proprietary indicators, beta neutral long-short strategies, arbitraging and a whole host of other buzzwords that sound impressive. But you have to remember that institutional investors are being paid to run complex quaint strategies. Their selling point is packaging up this complexity and selling it to the retail investor as a product solution. They know these strategies are largely beyond our resources and understanding. But just because an investment strategy is complex, it doesn’t mean you'll get a better long-term outcome. You only have to glance at the S&P SPIVA Scorecard for proof of this. While some quaint managers can perform very well over the long-term, we just don’t know in advance which ones will. Top performing funds shift positions quite substantially from year to year because reversion to mean comes into play.

A well-known example of our complexity bias has been highlighted by a study on how a baseball outfielder catches a fly ball. Scientists and mathematicians use complex formulas to explain the trajectory of a ball that’s been thrown or hit high in the air. In his book The Selfish Gene, scientist Richard Dawkins describes how we "supposedly" catch a ball:

"When a man throws a ball high in the air and catches it again, he behaves as if he had solved a set of differential equations in predicting the trajectory of the ball ... At some subconscious level, something functionally equivalent to the mathematical calculations is going on"

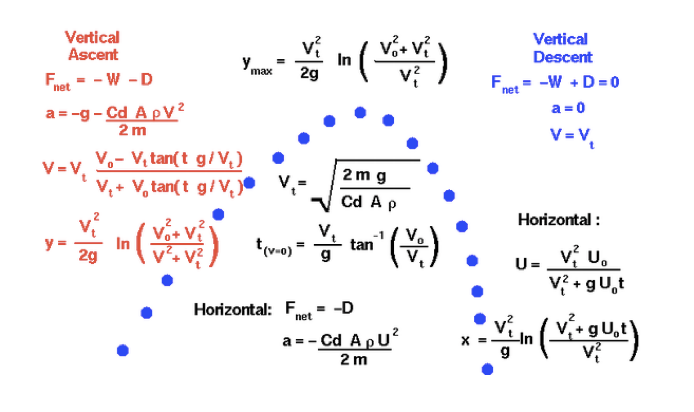

Here is the mathematical formula that our brain might be solving at the subconscious level.

Got it? Good.

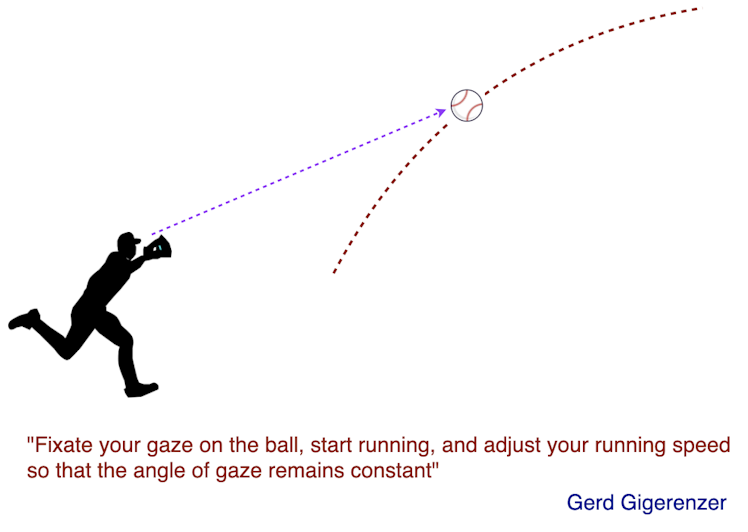

If that’s what our brain is doing, fantastic ! But that doesn’t explain why I’ve never been good at solving differential equations at any point in my life, but I was very adept at catching fly balls when I was young. It turns out that our subconscious brain is not solving differential equations, it’s doing something much simpler. Gerd Gigerenzer, a director at the Max Planck Institute for Human Development, describes what our brain really does:

Glorious !

Our brain employs a simple, but elegant shortcut to solve a complex mathematical problem. This shortcut is called the Gaze Heuristic. Gerd Gigerenzer is an advocate of simplicity and describes the general principle as follows:

Simplicity: Complex problems do not require complex solutions

Less Is More: More information, time and computation is not always better

We can apply this type of thinking in investing. At its core, investing is a very simple process. There are simple techniques to invest in the stock market that will make you very wealthy over the long-term. You don’t need complex formulas backed up by a bevy of micro and macro-economic theorems. Investment legend Warren Buffett recommends the following simple strategy for most retail investors:

- "Both large and small investors should stick with low-cost index funds"

- "The temptation when you see bad headlines in newspapers is to say, well, maybe I should skip a year or something. Just keep buying"

In only 3 sentences, Warren Buffett outlines one of the most effective long-term investment strategies that is both simple and historically proven. It’s certainly not a get rich quick (GRQ) scheme. It's a sensible long-term strategy that everyone can follow. You can add more sophistication to this baseline strategy by adding your own individual stock picks or even allocating a smaller amount of capital to trade. Some investors prefer to construct a portfolio of individual stocks. This is perfectly fine as long as there’s sufficient diversification. You just have to realise as you add more and more complexity, you can quickly hit the ceiling of diminishing marginal returns.

Ben Carlson’s seminal book "A Wealth of Common Sense" dispels the myth of complexity:

"There is an assumption that complex systems such as financial markets must require complex investment strategies and organisations to succeed. This is a false premise that far too many both inside and outside of the industry have come to believe"

He goes on to say:

"I’ve spent my entire career working in portfolio management. This experience has taught me less is always more when making investment decisions. Simplicity trumps complexity. Conventional gives you much better odds than exotic"

The remainder of his book goes on to explain why a basket of low-fee index funds is the way to go.

The myth of complexity has probably been perpetuated by the outdated investment management industry of old. Obfuscation (deliberately making things hard to understand) has been used to justify fees and keep clients locked into their services. Technology has since ushered in a wide range of simpler, cost-effective investment products that serve the mainstream investor extremely well.

I have a rule of thumb that rings true more often than not: The longer it takes a product salesperson to explain the fund's investment approach, the worse off the investor is likely to be. Complex products tend to come with higher fees, benefiting only the institution selling the product. Beware of people peddling needless complexity to an unsuspecting investor.

Here’s the paradox of the situation: the more complex the investment approach, the more enticing it will sound to the unsuspecting investor. In the final outcome, that investor will most likely be worse off.

Why Choose Simplicity?

A simple and understandable investing strategy leads to better outcomes because:

- it encourages you to own the decisions you make

- it usually involves lower account churn

- it usually incurs lower cost than more complex strategies

- it’s straightforward, making it easier to build the conviction to stick with the strategy, even during difficult periods.

Successful investors have figured out that keeping things simple is the best path to success. They understand the nuts and bolts of how the markets work and find a way to break down the process of investing into simple, easy-to-follow rules.

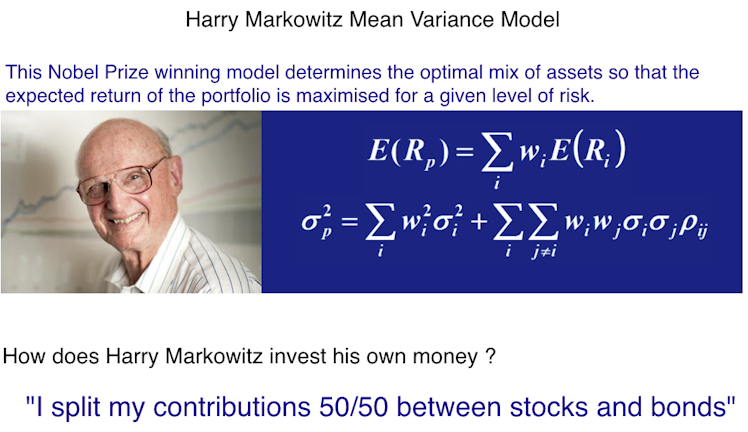

Harry Markowitz has always been the source of my favourite anecdote about simplicity. Harry pioneered the concept of diversification, winning the Nobel Prize for Economic Sciences. His mathematical models can be used to determine the optimal mix of stocks, bonds and cash to maximise return for a given level of risk. Harry mathematically proved that you could improve your returns while reducing your risk (volatility) by spreading your investments across different asset classes. This works because different asset classes often move in different cycles (but not all the time as we’ve experienced first hand recently).

When asked in the 1950s how Harry invests his money, his answer was a little surprising:

Here the full quote for better context:

"I should have computed the historical covariances of the asset classes and drawn an efficient frontier. Instead, I visualised my grief if the stock market went way up and I wasn't in it, or if it went way down and I was completely in it. My intention was to minimise my future regret, so I split my contributions 50/50 between bonds & equities"

Harry doesn’t just provide a commentary on complexity, he’s also highlights the gap between academic theory and practice. Harry is taking into account the human aspect of investing: regret. He also touches on behavioural economics here, and realises the best investment strategy is not going to be the one that mathematically optimises return, it’s going to be the one that best fits your personality type.

Takeways:

- If you’re new to investing, a simple strategy is all you need. There comes a plateau point where more complexity hits rapid diminishing marginal return.

- If you’re an experienced investor (or trader), regularly review your process to make sure you’ve not adding unnecessary complexity. Simplify your process as much as possible without losing the integrity of your strategy. Keep the Pareto principle in mind.

Thank you for reading. I really had to get this one off my chest.

PS: There is of course another option to simplify your process if you like buying individual stocks:

You could outsource your stock research to friends of the platform @stockopine and let them do all the heavy lifting.

I seriously get no kickbacks from this (wouldn't have it any other way) and I don't know them personally, I'm just a fan of their work.

Already have an account?