Trending Assets

Top investors this month

Trending Assets

Top investors this month

September Idea Comp - Wix.com (WIX)

I’ll discuss the business quickly for anyone whose unfamiliar, but the bulk of this write-up will focus on the current situation and, in my opinion, stock mispricing.

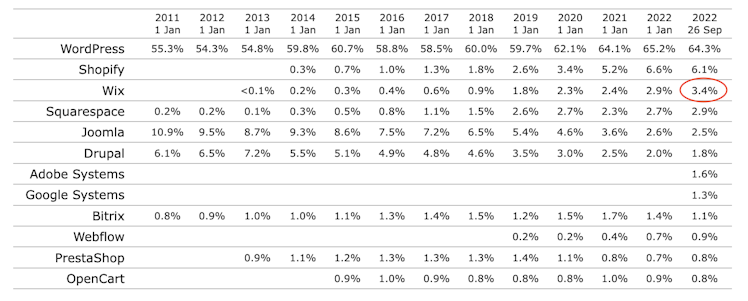

Wix provides a no-code (or in some cases low-code) website building platform for both individuals (Editor) as well as businesses (EditorX). That means virtually anyone can easily design and assemble the website they want, then to take it public with their preferred URL and Wix’s hosting and security capabilities, they have to select from a range of terms and prices. Between the platform’s ease of use and versatile applicability, Wix has been eating share among CMS providers over the last decade.

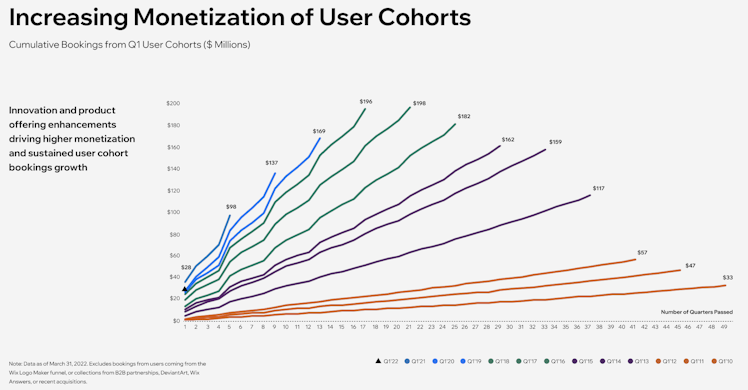

But it isn’t just pay once then goodbye. Wix’s cohort analysis points to high retention among its user base. Once you’ve spent time creating and iterating on your website for a year or more, it’s unlikely that you’ll want to completely rebuild and reacclimate yourself (or your team) to a new system. Instead, more often than not, users would rather just renew the hosting subscription, even if it’s at a higher price.

The Last 2 Years

Wix has made several capital allocation decisions as of late that have hurt profitability and, in turn, discouraged investors. Here are the 3 biggest ones:

- Development of EditorX - Historically, Wix has struggled to get agencies to join their platform. This has limited their growth primarily to the DIY category. However, during the last couple of years, Wix developed and launched a custom-built platform for agencies that seems to have been met with a positive reception. In Q2 of this year, Wix generated $85 million in partner revenue, up 143% from the same period two years ago.

- Investments in Business Solutions - Over the last two years, Wix has acquired a number of companies in an attempt to build out its business solutions offering (any additional products or services beyond a premium subscription). These have included SpeedETab, Modalyst, and RiseAI to name a few. The goal here appears to be to help merchants drive real transactions through their Wix website instead of just using it as a landing page. So far, the results have looked ok as business solutions now comprise almost a quarter of bookings, but I still question whether the spend was warranted.

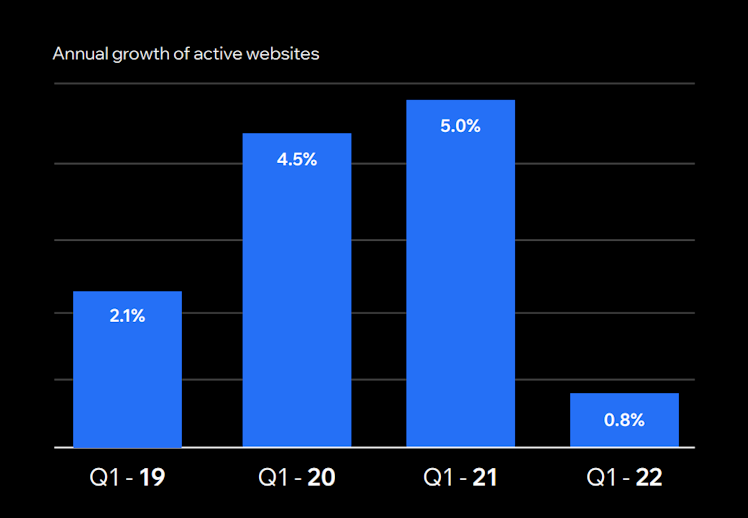

- Increasing customer support staff - During COVID, demand for website building surged. In order to service the increased demand, Wix increased their customer support staff. Shortly after, the trend sharply reversed and growth in active websites shrank (see the chart below). According to management, they’re now in the process of reining in these costs.

Due to these increased investments, Wix’s last 12-month OCF margin has compressed from its high of ~18% in Q3 of 2020 to less than 1% in its most recent quarter.

What now?

During the company’s May investor day, Wix laid out its financial plan for the next three years. In short, the company believes they’ll be able to reach 20% free cash flow margins by 2025 and there are a few things that I think need to happen to make that possible.

- Moderating Costs: Yes, obvious, I know. But management has already stated that this is in the cards. In the company’s guidance, they expect operating expenses as a percentage of revenue to shrink by ~1,000 basis points and the capex associated with their HQ buildout in Tel-Aviv to subside over the next 3 years.

- 7%+ subscriptions growth: Though it might not happen immediately, I expect active websites will return to their historical growth rate at some point in the next three years. This + the continued momentum in EditorX should put Wix’s subscriptions growth back on track. By my estimates, premium subs have compounded at 17%+ annually over the last 5 years so this feels attainable.

- 3%+ pricing growth: Since 2018, the cost per subscription has grown by 4% per year. Though there may be some discounting in the coming year that offsets pricing, I suspect the long-term trend here will continue.

In addition, Wix recently received Israeli-court approval for a $500 million buyback program. This should cover any SBC that comes over the next 3 years. At Wix’s current price of $73.80, its EV stands at ~$3.5 billion. Assuming Wix meets the estimates above, it should be able to generate $400 million in free cash flow by 2025. Applying a mid-teens cash flow multiple, there is clear upside for the stock over the next 3 years.

Already have an account?