Trending Assets

Top investors this month

Trending Assets

Top investors this month

$META – Can it go lower, or did we hit a bottom?

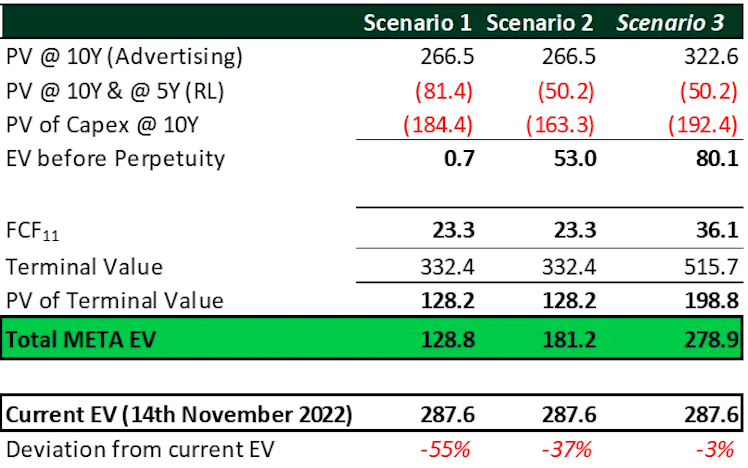

On the second part of our recent release for $META we run 3 stress scenarios to evaluate whether the value assigned to $META by the market is reasonable. These scenarios do not predict the future but rather stress (in our opinion) the downside.

FY’23 Inputs

The input for Revenue of FY’23 was $115.4B in line with FY’22 estimated revenue, provided Meta generates $31B in Q4’22 (guidance of $30B-$32.5B). This figure is well below the $123.4B FY’23 estimate of analysts provided by Koyfin.

Advertising /FoA revenue FY’23 of $113.5B with an operating margin of 37%, the lowest margin achieved in latest years and c. 100bps lower than our estimate for FY’22 (average margin for 2019-2021 stood at 46%).

Given that Reality Labs expenses will increase meaningfully in 2023 we applied a 30% mark-up on the projected loss of FY’22 (assumed at $13.1B), resulting to an operating loss of $17.0B.

Taxes were assumed at 21% of operating profits, in line with guidance provided.

We added back to those figures a non-cash depreciation & amortization of 9%. This is higher than the historic figures (2019-2021 -> 7.6% & 9M 2022 7.5%) but considering the increasing CAPEX as a percentage of revenue we consider this adjustment fair.

CAPEX for FY’23 was estimated at $35.5B (guidance mid-point).

It shall be noted that we did not add back Stock Based Compensation as one way or another, this has a cost to existing shareholders (dilution).

Scenario 1

We assumed that FY’23 figures will prevail for the next 10 years for both FoA and Reality Labs (“RL”), while in the process the Company’s CAPEX will decline gradually from 31.3% of revenue to 18.3% (average of 2012-2021).

It shall be noted that our stress model assumes that the investments in RL for the next 10 years, i.e., c. $189B in operating expenses and increased CAPEX requirements will not generate any meaningful benefit to META. An unlikely scenario as the company has a real option to abandon it earlier or downsize its investments in RL. Additionally, the stress model assumes that FoA margins will remain at current levels, implying that among others Reels and WhatsApp will remain under-monetized (again unlikely).

Using a ten-year period and a discount rate of 10% (the minimum required return that we aim to obtain from our investments under the current environment) we reach an Enterprise Value of almost 0.

For the terminal year we assume that RL will be abandoned and applied a terminal growth rate of 3% to FoA cash flows.

Based on these calculations, we reach an Enterprise Value (“EV”) of $128.8B or 55% lower than the current EV of $287.6B (14th November 2022).

Scenario 2

The differences compared to Scenario 1 are that RL is abandoned earlier (i.e., after year 5) and CAPEX is assumed to reach the 18.3% as a percentage of revenue by Year 6.

Based on these calculations, we reach an EV of $181.2B or 37% lower than the current EV of $287.6B.

Scenario 3

The difference compared to Scenario 2 is that Advertising/FoA Revenue is assumed to grow by 5% per annum (so CAPEX figures increase as well) whereas in the terminal year the growth remains at 3%. It shall be noted, that per Statista, digital advertising spend is expected to grow from $602.25B in 2022 to $876.1B in 2026 or 9.8% compound annual growth rate.

Based on these calculations, we reach an EV of $278.9B or 3% lower than the current EV of $287.6B.

Source: StockOpine analysis

In neither scenario we assumed that margins would expand, nor that RL would ever have a positive contribution to META and thus will be just abandoned.

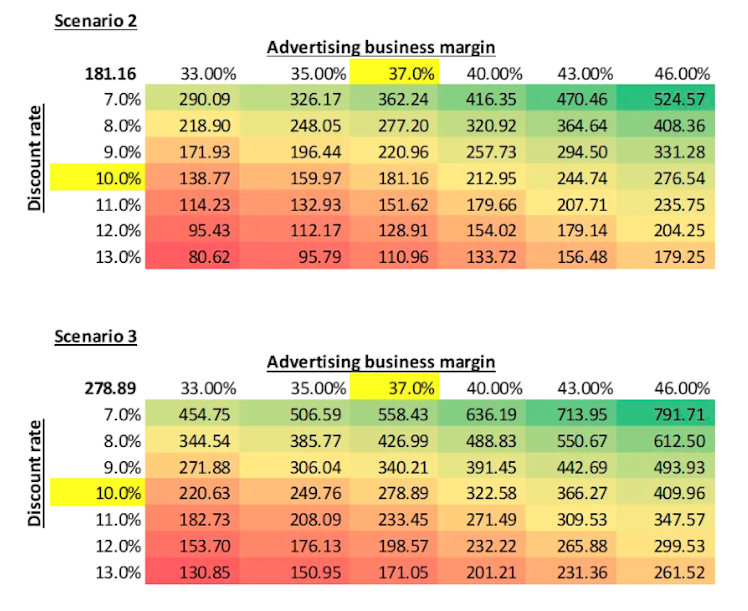

Sensitivity analysis

These scenarios are rather extreme and in no case represent our best estimate. Therefore, we run sensitivity on Scenario 2 and Scenario 3 by changing FoA operating margin and the Discount rate demonstrating where the value of META can go if margins improve but without any additional revenue growth than what is included in these scenarios.

Source: StockOpine analysis

If you enjoyed reading this memo, spread the word and ensure that you read the full memo here.

Disclaimer: The team does not guarantee the accuracy or completeness of the information provided in the newsletter. All statements express personal opinions based on own financial and business analysis. Any estimates or forward-looking statements made are inherently unreliable. No statement of opinion is an offer or solicitation to buy or sell the financial instruments mentioned.

The content of our newsletter is not a trading or investment advice and we do not provide any personal investment advice tailored to the needs of any recipient.

Neither the team nor any of its affiliates accept any liability whatsoever for any direct or indirect loss however arising, from any use of the information contained herein. Any unauthorized copy of this newsletter or its contents is illegal.

This post may contain affiliate links, which means that we might get a commission if you decide to sign-up using any of these links. No extra cost is charged to you.

Already have an account?