Trending Assets

Top investors this month

Trending Assets

Top investors this month

Our Notes on the FOMC Meeting

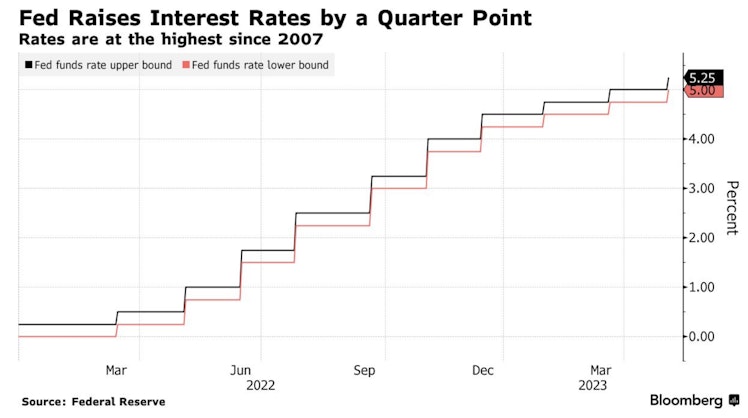

To start off, their statement release had a very different tone from the last meeting. They removed “anticipation” of further rate hikes

Instead, they stated that they will consider various factors “in determining the extent to which additional policy forming may be appropriate”

The FOMC balanced the hint toward a June pause with a clear message that it retains a hawkish bias

Inflation is still the key factor for the Fed, as we mentioned in our most recent article. The Chair made it clear that if inflation stays high, they will not be cutting rates

Maybe inflation wasn’t that transitory after all

In regards to a recession, Powell said, “It’s possible that we’ll have what would be a mild recession”

It’s more likely than not that a recession will be avoided, but Fed Chair Powell did not rule it out completely

The after-effects of the meeting led to more regional bank pressure. PacWest and Western Alliance both took big hits overnight under the continued stress of challenging banking conditions

Over the next few weeks, we will be paying close attention to the bank situation and how it could weigh in, but for now, we expect the next few meetings to stay at the current rate

Already have an account?