Trending Assets

Top investors this month

Trending Assets

Top investors this month

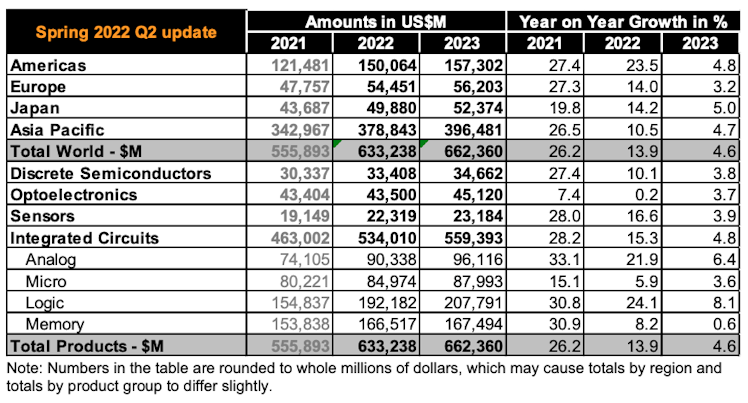

Forecast: Semiconductors with +13.9% growth in 2022, but +4.6% slowdown in 2023 📈

World Semiconductor Trade Statistics forecasts +13.9% growth for the worldwide semiconductor market in 2022, with growth slowing significantly to +4.6% in 2023. The slowdown comes on top of a very strong 2021 which saw +26.2% growth. It’s only natural that demand comes down after such a huge move for the whole industry. WSTS exists since 1986, so I’m inclined to trust their data and forecasts.

While the breakdown of semiconductor categories in 2021 looks great across the board, 2022 paints a different picture. Some categories like Optoelectronics and Integrated Circuits - Micro are clearly not growing that fast anymore. But the main culprit is the memory category which is expected to slow down to only +0.6% growth in 2023.

Among semiconductors, the memory category has always been highly cyclical. Memory chips are basically a commodity with intense competition, thus no producer can build a sustainable edge. This category will always struggle the most in economic downturns.

To get a good visual representation of cyclicality, take a look at the monthly chart of $MU and spot the wave patterns. I would never invest in such a company for the long term. On the other hand, if you are a value investor with semiconductor knowledge, this is probably a lot of fun for you.

As for the other categories, it seems like growth will continue a while longer. I wouldn’t go all-in the semiconductor category anymore, but rather pick the best companies from those that are still growing and have proven long-term track records. In the analog category, $TXN comes to mind, an extremely well-run company.

Already have an account?