Trending Assets

Top investors this month

Trending Assets

Top investors this month

Valuation of Amazon.com – Thoughts, Narrative and Intrinsic Value

I believe that every good valuation starts with a narrative, a story that you see unfolding for your company in the future. In developing this narrative, I will try to make assessments for Amazon.com (its products, services, and management), the market, the competition, and the macro environment in which operates trying to:

- Keep it simple.

- Keep it focused.

To come up with a value, I will use a DCF model for Amazon Retail/Media, Amazon Web Services, and a valuation method for Amazon Prime

Breaking down the Business model

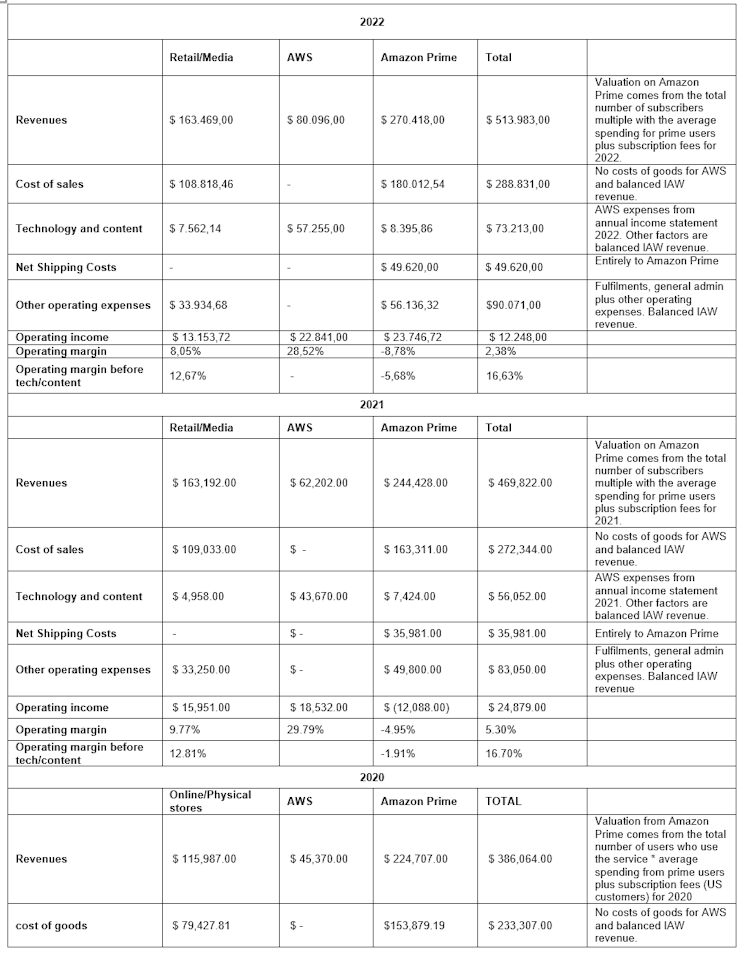

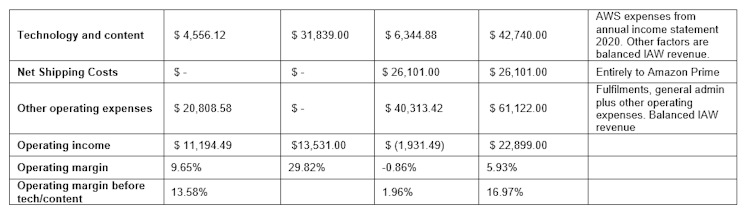

Sometimes in the valuation process, we should adjust the way the accountants break down the businesses. In this section, I will break the business model of Amazon into three main components, and I will use a DCF model

separately for retail/media, Amazon Web Services, and Amazon Prime. I will reallocate the revenues as follows:

- Revenues from Retail/Media.

- Revenues from AWS.

- Revenues from Amazon Prime Memberships.

Thereason, why I believe I should reallocate the revenues is because, from an accounting point of view, we cannot value the “buying power” of Amazon Prime Membership which is at the heart of the investment

philosophy (obsession with customers). Secondary reasons to reallocate revenues are as follows:

Third-party services

Are commissions/fees which come from third-party retailers who sell their products in stores and fulfill orders through Amazon. Consequently, we can suppose that these are revenues that can be attributed to Online/Physical stores, FBA, or from the «buying power» of Amazon Prime members.

Advertising services: Amazon provides advertising services to sellers, vendors, publishers, authors,

and others, through programs such as sponsored ads, display, and video advertising. Revenues that are recognized as ads are delivered based on the number of clicks or impressions. Consequently, we can suppose that our revenues while someone navigates the Online stores or/and from the Amazon Prime membership.

Subscription services: Subscription sales include fees associated with Amazon Prime memberships and access

to content including digital video, audiobooks, digital music, e-books, and other non-AWS subscription services. Consequently, I can assume that revenue comes entirely from the membership of Amazon Prime. (I have

upload two pictures that are showing how i breakdown the business model)

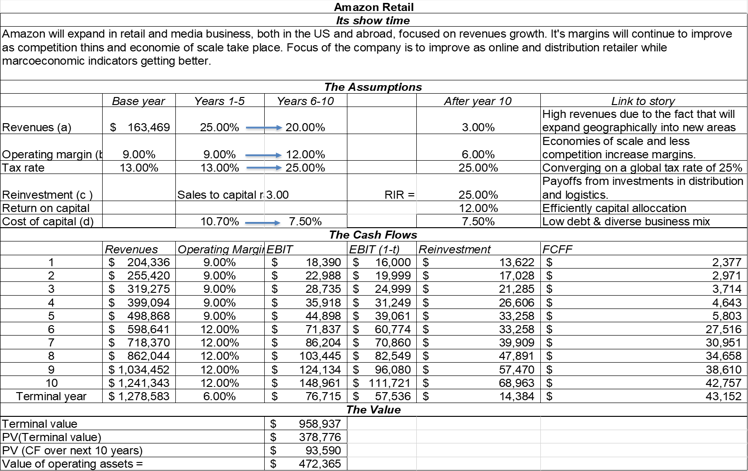

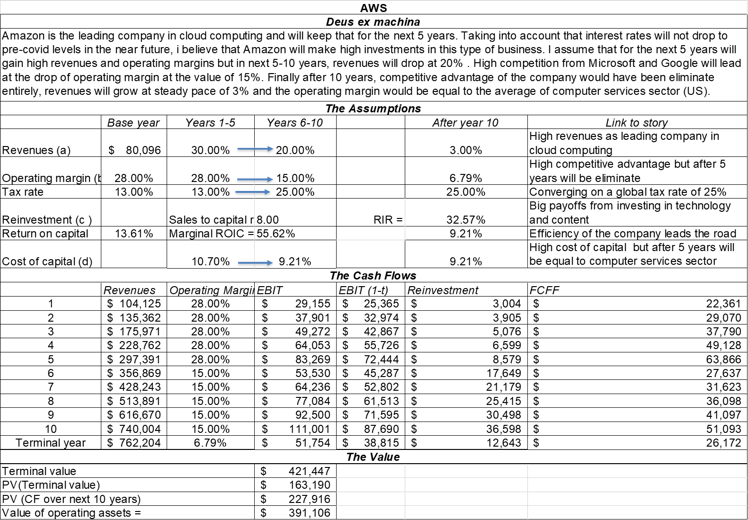

Main narrative for Amazon.com (2023)

Amazon.com is the leading company in global e-commerce and cloud computing services with an “army” of Amazon Primers, looking to consume every available product. On the other hand, high competition in cloud

computing and high costs from retail businesses make it very difficult to sustain as a leader in the field. I will assume that the company will remain prominent in global e-commerce but every competitive advantage

of AWS against Microsoft and Google would be eliminated (i have upload two pictures that show my valuation for Retail/Media business and AWS business plan).

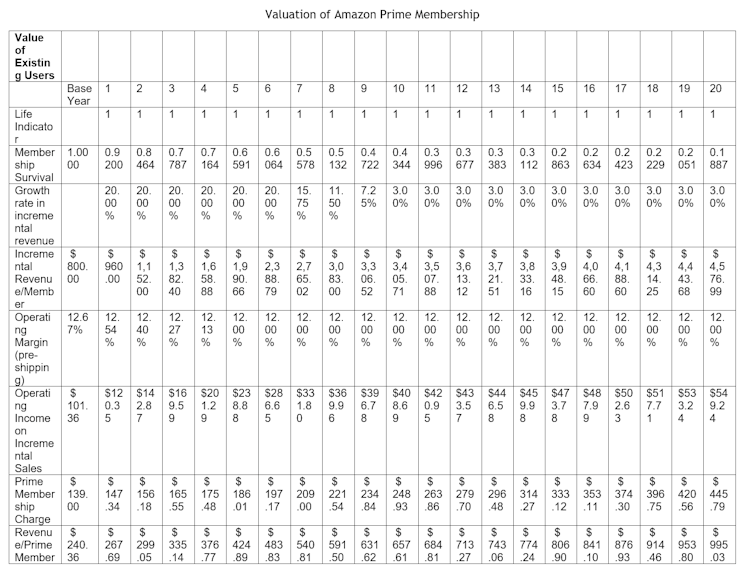

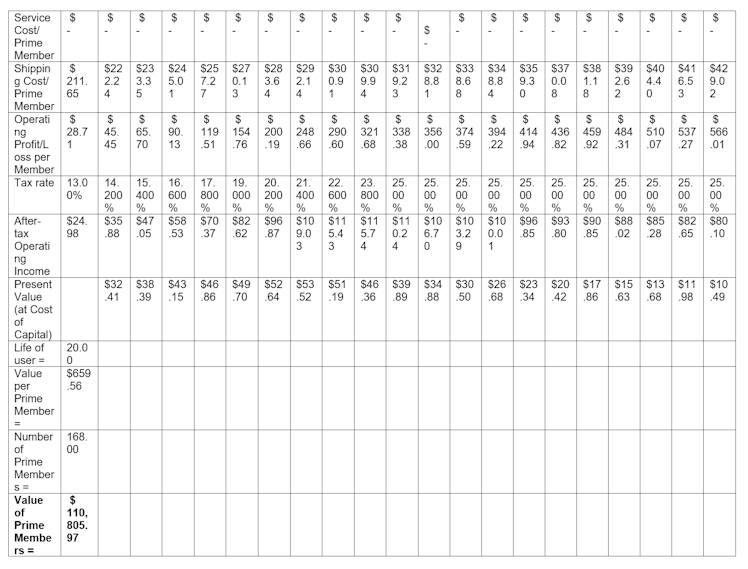

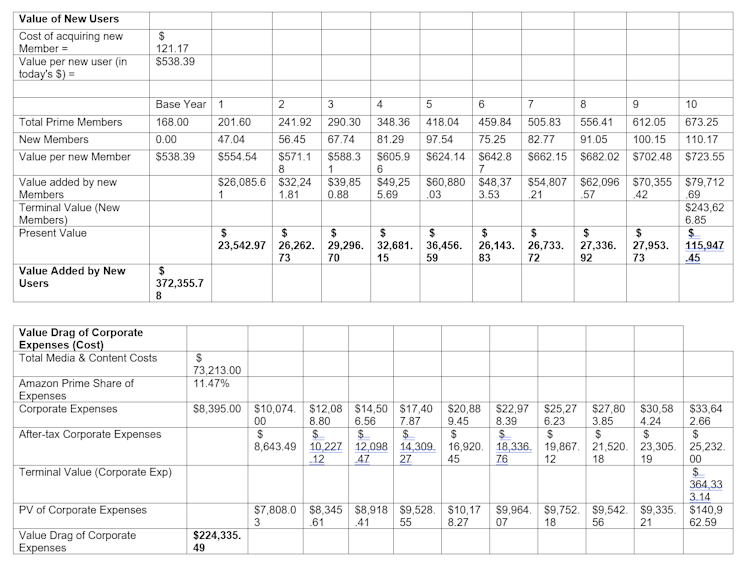

Valuation of Amazon Prime: I have evaluate this service in accordance with the following paper:https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3175652

##### Conclusion

--------------------------------------------------------------------------

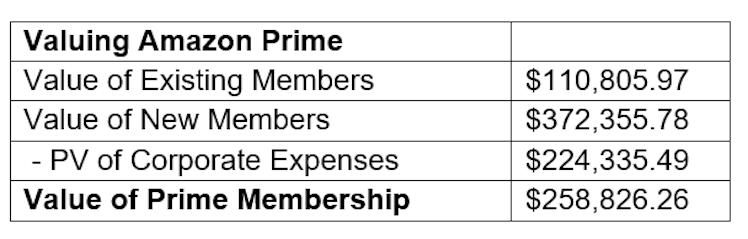

Value as of Feb 14, 2023

Amazon Retail/Media : $ 472,365.23

AWS: $ 391,105.71

Amazon Prime: $ 258,826.26

Value of Operating Assets: $ 1,122,296.94

Plus Cash: $ 53,888.00

Minus Debt: $ 135,000.00

Plus Value of Equity: $ 146,043.00

/ Number of shares: 10,189.00

Value per share: $ 116.52

Market share: $ 98.29

Undervalue: 18.55%

--------------------------------------------------------------------------

A good valuation stands between the numbers and narratives. I tried to

make estimations in fundamental factors, looking at the history of the

company and then I adjusted them to reflect the high competition and the

macroeconomic effects. I believe that the main advantage of Amazon.com

in near future would be cloud computing, which is estimated at 34% of

the global cloud services, but in long term, the competitive advantage

will be eliminated but will remain the global leader in e-commerce.

I hope all of you having good investments.

If you like my work please don't forget to share. Thank you

Original article: https://www.bluehorizon-invest.com/valuation-of-amazon-com/

Risk analysis of Amazon.com:https://bluehorizon-invest.com/risk-management-2/

Corporate Governance and Profitability Metrics for Amazon.com:https://bluehorizon-invest.com/valuation/

If you want to support my work you can check my Gumroad Profile here: https://eanagnostou90.gumroad.com/

Do you believe that I am optimistic in my valuation?

28%Yes.

42%No

28%I dont know

7 VotesPoll ended on: 3/5/2023

Already have an account?