Trending Assets

Top investors this month

Trending Assets

Top investors this month

Datadog (DDOG) Q4 2022 Earnings Review

After enjoying several years of hypergrowth, Datadog’s revenue outlook for this year reflects a substantial slowdown. The challenge for investors is to discern whether annual growth in the mid-20% range is the new norm for Datadog or reflective of headwinds from the broader pullback in IT spend. Similar to the discussion around hyperscaler growth trajectories, enterprise IT teams are using this period of macro pressure to optimize their software infrastructure spend.

This optimization is a natural outcome of the rush to push through cloud migrations and feature releases during Covid with little oversight to spending levels. With IT budgets contracting, the opposite motion is taking hold, magnified by a concentrated effort to address accumulated optimization debt. After ignoring bloat for two years, enterprise IT teams are scrambling to lower costs. For the hyperscalers, this is a straightforward exercise. A plethora of options and flexibility make it very easy to reduce server instance sizing, commit to longer usage terms and even turn off services that are underutilized. The same advantages of cloud elasticity that drove rapid growth during boom times can apply a similarly acute impact on spend if reduction is the goal.

Opportunities to optimize spend on Datadog exist as well – not the same mechanics as with the hyperscalers, but familiar patterns. Customers can remove Datadog licenses from some hosts (APM, Infrastructure), shorten log retention periods (Log Management) or even limit the number of test runs (RUM, Synthetics, Continuous Testing). Further, as customers introduce new cloud workloads, they might forgo monitoring or apply limited observability coverage to their tiers. If customers delay a digital transformation project, that would impact Datadog spending growth as well.

As with the hyperscalers, these optimization efforts are creating a headwind to Datadog’s normal spend expansion. While customers are adopting multiple Datadog products at the same rate, they are ramping up utilization more slowly, or even optimizing down, on existing workloads. By not expanding spend as infrastructure tiers go through this one-time capacity adjustment, Datadog’s sequential revenue growth is being compressed.

This effect became noticeable in Q3 and looks to continue for at least another quarter or two. Similar to the hyperscalers’ experience, I think this optimization will be most concentrated in the first half of 2023 and front-loaded. Enterprise IT teams would rank order opportunities for optimization with highest savings impact first.

While painful in the near term, I think this situation provides a favorable set up for the second half of this year and into 2024. As optimization debt is addressed, application workloads will return to their normal expansion rates. That, combined with the positive contribution of new workloads, should allow Datadog sequential revenue growth to re-accelerate later in 2023 and early 2024.

Datadog Product Strategy

Considering Datadog’s projected slowdown in revenue growth for 2023, investors are left to speculate about different explanations beyond workload optimization and IT budget pressure. They wonder whether competitors have finally caught up to Datadog, the observability market has matured, products have been commoditized or DIY options are being embraced. I actually think none of these are significant factors.

Datadog is following the same playbook they have been applying successfully for many years. Nothing in the observability market has changed in the last 6 months to blunt the effectiveness of Datadog’s strategy, beyond a recognition that enterprise IT spend is being scrutinized. The same competitive advantages that Datadog enjoyed 1-2 years ago are still in place. As overall macro headwinds abate or at least stabilize, then Datadog’s ability to outperform the observability market in general will resume.

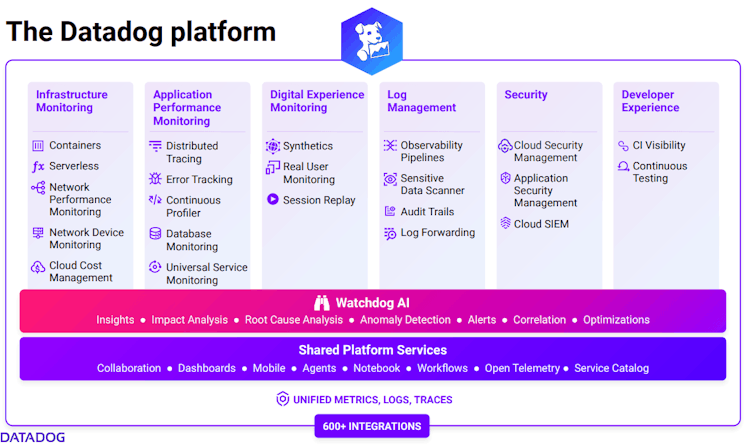

To appreciate why this will happen, we have to revisit Datadog’s product strategy and more importantly their competitive advantage. While they are currently focused on the observability market, the application of this has been historically targeted at the market for infrastructure monitoring, application performance and log analysis. These sit at the confluence of the developer and operations teams (DevOps) and provide Datadog with a fertile environment to deliver tools well suited for this audience.

Datadog’s initial success was realized by bringing three facets of DevOps functions together into one common interface and combined dataset. These were the “three pillars of observability”, consisting of traces (APM), logs (log management) and metrics (infrastructure). Before Datadog, these three critical aspects of software application and infrastructure monitoring were addressed by different tools. Those tools were even provided by some of Datadog’s current competitors – logs by Splunk and Elastic, traces by Dynatrace and New Relic, metrics by open source solutions.

Datadog was the first to bring these three experiences into a common pane of glass with data thoughtfully linked into one cohesive view. Operators no longer had to swivel between apps to move from a slow trace to an error in a log file to the spiking CPU in a metric. Those were all combined into one view. That was the magic of Datadog. After spending years swiveling, I can tell you that consolidation was a ground-breaking improvement to productivity and mean time to repair.

As a result of this cohesion, Datadog experienced high demand and rapid growth. The sell was pretty easy – allow a DevOps team to address their three primary workflows in a single tool, versus toggling between disjointed experiences provided by separate vendors. Datadog’s platform disrupted incumbents who had become comfortable with their corners of the market.

Of course, the legacy tool providers caught onto Datadog’s game and began efforts to build the three pillars of observability into their tools as well. Some used acquisitions and others performed organic development, with varying degrees of integration. At this point, all of Datadog’s competitors have reached parity in the three pillars, at least offering logs, metrics and traces in a single interface.

A simplified view of Datadog’s recent slowdown would be that competitors have caught up to Datadog and that observability platforms are fungible. With a little tinkering, open source solutions might do the job. Datadog may have lost pricing power, as competitive offerings approximate feature parity and enterprises can achieve “good enough” observability with a less expensive solution.

However, I think this view is premature for a few reasons:

- Value of Single Experience. With the 3 Pillars of Observability, Datadog proved that DevOps teams value having all types of monitoring in one consolidated view. Not stopping with the 3 pillars, Datadog has rapidly expanded into many other important aspects of monitoring modern digital experiences, including RUM, Synthetics, Session Replay, Databases, Network, Serverless, continuous profiling, etc. These are all critical to maintain a high quality user experience and service continuity. It would not make sense to purchase APM, logs and traces, but forgo RUM, network, database monitoring, profiling, etc.

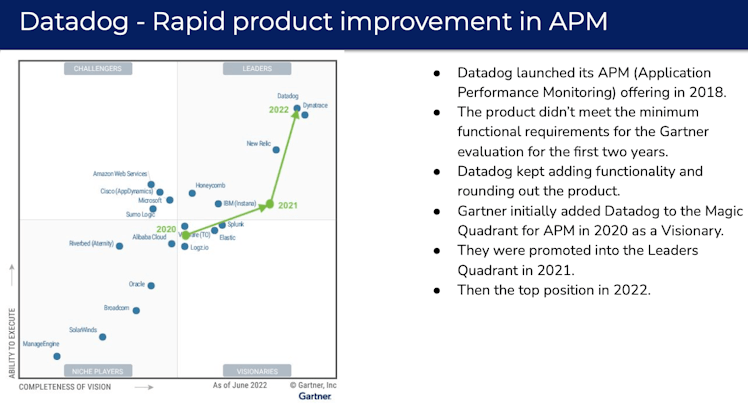

- Continue to Expand Capabilities in Each Segment. In addition to incorporating new modules into a unified experience, Datadog is continuing to improve each existing module. After introducing APM in 2017, Datadog progressed up the Gartner MQ over several years, moving from Challenger to Leader, passing legacy providers in the process. They are applying this to each segment they occupy. Discerning buyers appreciate the difference. When minutes of downtime can cost tens or hundreds of thousands of dollars, why would a DevOps team skimp on their monitoring tools? It’s like a brain surgeon choosing a “good enough” scalpel.

- Consolidation Argument. With pressure on IT budgets, enterprise teams can reduce cost by replacing several point solutions and DIY projects with a single platform. By addressing more aspects of a full observability solution than competitors, Datadog allows customers to consolidate more tools onto a single platform. Open source and DIY projects are rarely suitable replacements and usually result in a higher TCO.

Datadog’s competitive advantage lies in their rapid and highly efficient product development process. They build and release new product offerings faster than any of their competitors. Their speed of module development, roll-out and iterative improvement is only accelerating.

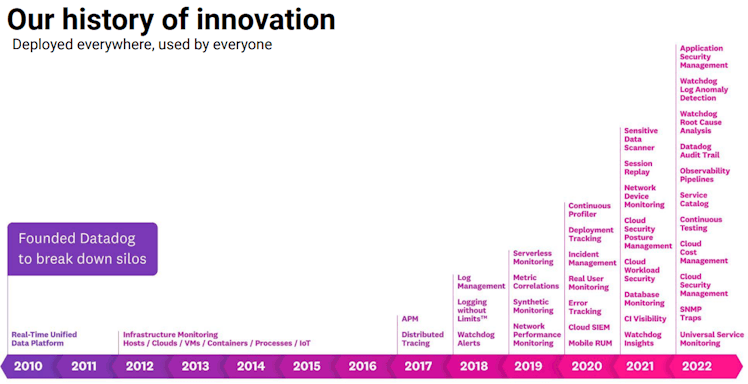

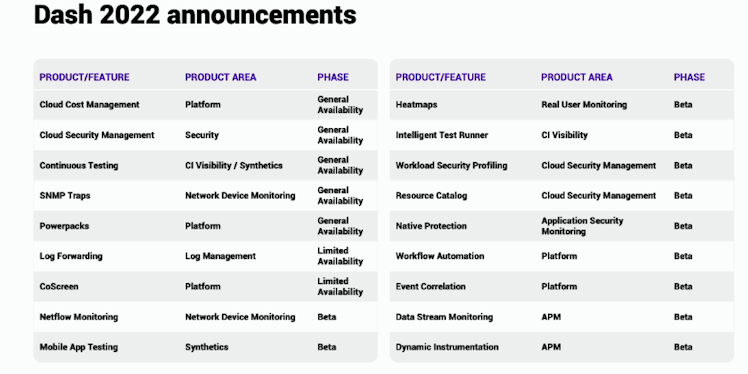

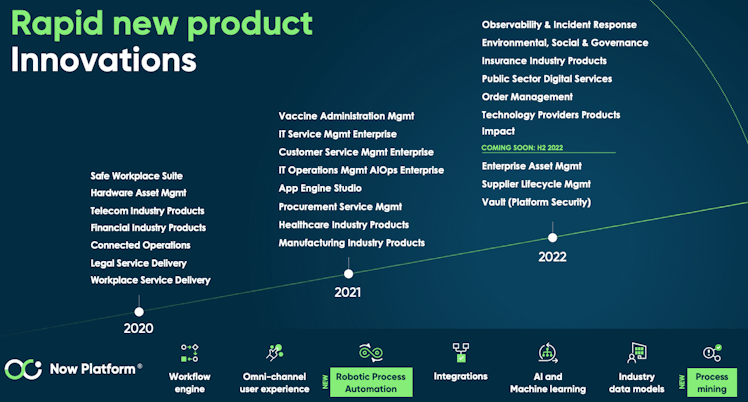

Looking forward, they have a large number of new products on deck. At their annual user conference Dash in October, they highlighted 18 individual product releases during their Investor Meeting coinciding with the event. This compares to 10 product releases listed in a similar chart at the Investor Meeting during Dash 2021, representing an 80% increase.

Of the 18 announcements at Dash, five are products in GA status. The rest are in limited availability or beta mode, with an expectation that they would progress to GA status over time. Products in GA, of course, are tied to revenue.

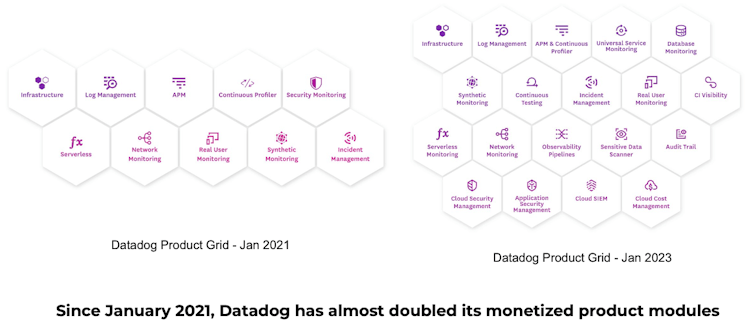

Over the past two years, Datadog has almost doubled the number of monetized product modules, as evidenced by listings on their Pricing Page. Some modules, like RUM have additional monetized features tucked under them, further expanding reach (in that case, it is Session Replays).

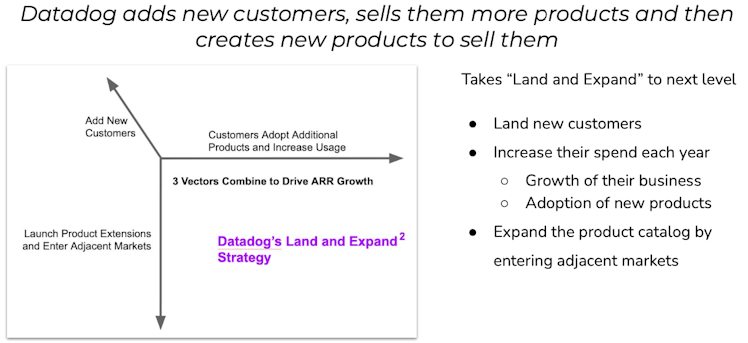

What is truly unique about Datadog is the efficiency of their sales motion. For the full year of 2022, approximately 75% of incremental revenue over the prior year was attributable to growth from existing customers. This is a consequence of Datadog’s robust land and expand model. Not only do customers increase their utilization of product module subscriptions as their businesses grow, they add new modules at a fairly linear rate. And, Datadog is continuously creating new relevant product modules for them to consider in the future. I like to call this flywheel for Datadog “land and expand… and expand.”

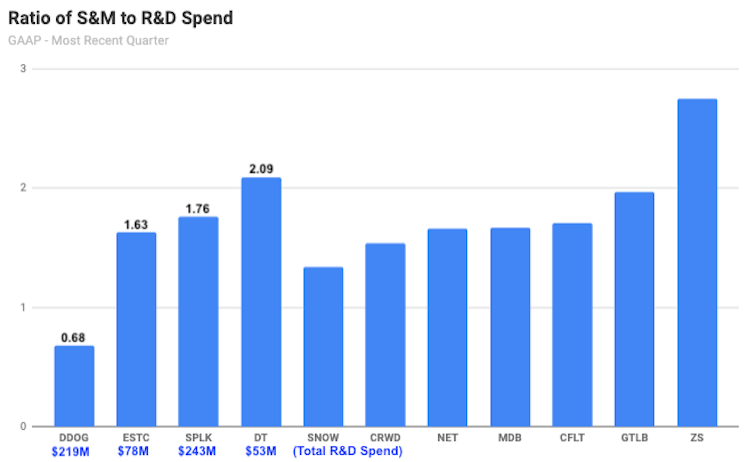

One of the most insightful competitive metrics that I track for Datadog is to compare their Sales & Marketing expense to that of Research & Development. For most fast growing software infrastructure companies, S&M exceeds R&D, often by a ratio of 1.5 or more (spend $1.50 in S&M for every $1.00 allocated to R&D). I tend to measure this on a GAAP basis, as it captures the value of SBC allocated as well. Non-GAAP data shows similar results.

Datadog is the only company in my coverage universe which can spend significantly more on R&D than on S&M. You read that correctly. Datadog allocates more dollars to product development than sales, and still maintains relatively high revenue growth rates. Every other company has to spend more on sales than product development.

In Q4, Datadog allocated $219M to R&D and $149M to S&M (GAAP numbers) for a ratio of S&M / R&D of 0.68. For all other companies listed using their most recent quarterly results, that ratio ranges from 1.34 (SNOW) to 2.75 (ZS). This includes security vendors with broad product platforms that are considered best of breed (and potential competitors).

As compared to other providers in the observability space, Datadog’s ratio is significantly lower. Splunk is at 1.76 and Elastic at 1.63. Dynatrace allocates more than 2x GAAP dollars to S&M than R&D, with a ratio of 2.09. I also listed the total R&D spend in the most recent quarter for each observability provider. As you can see, Datadog spent almost 3x more than Elastic and 4x more than Dynatrace on R&D. Datadog is almost allocating as much budget to R&D as Splunk, even though Splunk currently generates more than 2x as much revenue as Datadog.

I think this data is useful as we think about the competitive dynamic around Datadog. In the simplest terms, it reflects the efficiency of their sales motion. While their revenue growth rates have been higher than these competitors historically, they have been able to do so with less relative S&M spend. That means their products essentially sell themselves. The result is more gross profit that can be plowed back into R&D to further expand existing product feature sets and enter adjacent product categories.

This efficient flywheel shows no signs of letting up. As Datadog keeps growing revenue, the total amount of spend available for R&D to create more and better products keeps increasing, allowing them to out-develop competitors. Dynatrace is often held up as a strong competitor to Datadog, yet Dynatrace spent $53M on R&D versus Datadog’s $219M in Q4. There is no way Dynatrace’s product set will catch up. Additionally, Datadog has a founder/CEO with an engineering background, so their spend will be very efficient.

Not only is Datadog’s large allocation to R&D driving new product development, they are rapidly improving capabilities in existing products. Third-party industry analysts provide neutral reviews of vendor solutions in particular product categories. Two of the most respected are Gartner’s Magic Quadrant and the Forrester Wave.

Gartner publishes a report annually for APM and Observability, ranking all major observability providers in completeness of product set and ability to execute. Datadog introduced its APM offering in 2017, entering an already established field of entrenched competitors. For the first three years, Gartner didn’t include Datadog’s APM solution in their Magic Quadrant, as the feature set didn’t meet their minimum requirements for completeness.

The Datadog product team kept iterating on APM features until Gartner added them as a Visionary in 2020. They were promoted to the Leaders Quadrant in 2021. In the most recent report in June 2022, Datadog’s solution was moved towards the upper right corner, at an equal standing to long-time leader Dynatrace. Their trajectory implies that the 2023 report will push them further ahead of competitors.

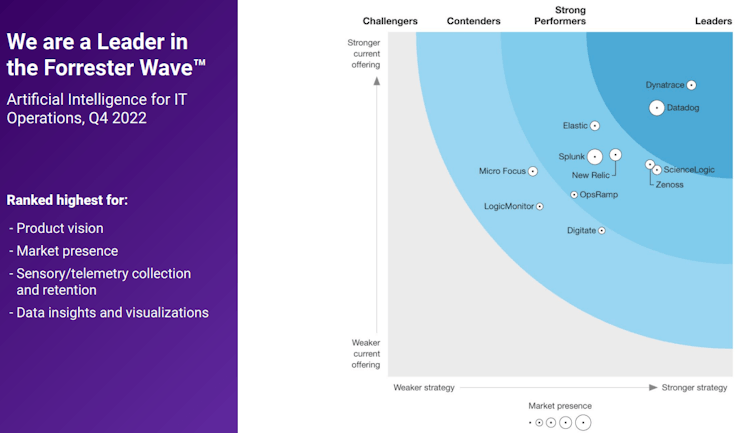

The Forrester Wave publishes an annual report evaluating observability providers for their ability to integrate AI into IT operations and monitoring. This capability is important, as customers are looking for solutions that incorporate more automation and intelligence into their observability tools. They prefer solutions that can mine telemetry data for indicators of issues before they occur and recommendations for addressing active service interruptions. AI can help operators with this, improving productivity and saving money.

Datadog provides AI capabilities through its Watchdog service. Like APM, the Datadog team has been iterating on this capability for several years. In 2020, Datadog was placed in the Strong Performers category by the Forrester Wave team for AIOps. For the Q4 2022 report, they now occupy the Leaders segment with Dynatrace. Notably, Forrester labels Datadog with a much larger market presence score than Dynatrace.

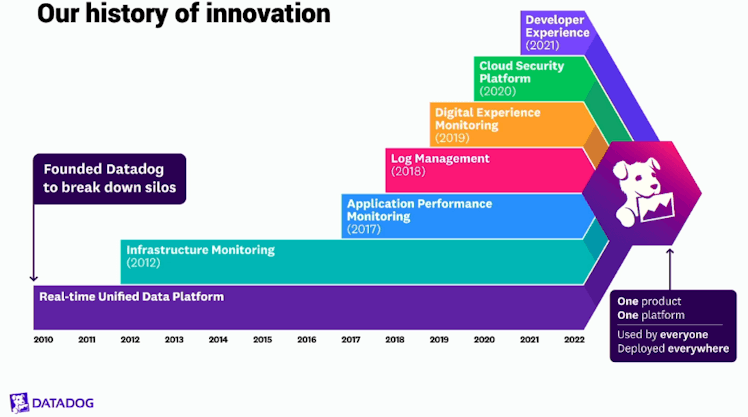

As Datadog evolves, they are not limiting themselves to just DevOps. They built the observability foundation on the three pillars of Infrastructure (launched in 2012), APM (in 2017) and Log Management (in 2018). Since then, they have been adding new slices of functionality that appeal to additional audiences. Digital Experience Monitoring is relevant for QA engineers and product managers. Security offerings were introduced in 2020, as a further extension into DevSecOps. Similarly, they began building out tools for developers in 2021.

Going forward, a lot of product development effort will be invested in rounding out capabilities across DevSecOps, with security and developer tooling getting a lot of attention. Philosophically, I can see security being a natural expansion area. This primarily applies to digital native companies where the nexus of technology decision making lies within the engineering team. These organizations are heavily DevOps focused, often led by a CTO or VP Engineering. In these organizations, the Security function can report into the technology group, versus being a separate department or reporting into a corporate CIO.

For this case, security would nicely tuck into the DevOps organization and be engineering led. This would provide the following benefits:

- Single tool and data set for both observability and security. Datadog’s original value proposition revolved around eliminating the “swivel chair” inefficiency of toggling between separate apps to monitor logs, metrics and traces. They stand to do the same for security and operations monitoring. Being able to link cloud workload or application security events to observability data is very useful (and vice-versa).

- Cost synergy from consolidation onto a single platform for DevSecOps. Removing separate tools for each function creates efficiencies and cost savings for enterprise customers. At least two of the multi-million dollar highlighted customer deals cited by the CEO in the Q4 earnings prepared remarks provided examples of adoption of 12+ products spanning observability, security and developer experience. Cost savings through consolidation was an important customer benefit.

- Tie in with developer tools as Datadog pursues a “shift left” strategy. The source of most application security issues is associated with vulnerabilities introduced by code. Datadog can connect observed security exploits to code changes and provide feedback to developers as they test new code commits.

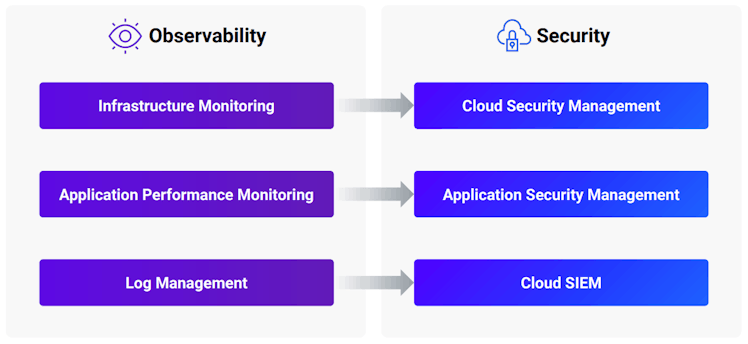

Datadog’s foundation in observability provides them with competitive advantages as they enter the security space. They are selectively applying these in the security segments that have a clear parallel. Fundamentally, the large volumes of data they collect in metrics (Infrastructure), traces (APM) and logs (Log Management) can be uniquely applied to improve the effectiveness of their Cloud Security, Application Security and SIEM products.

In the long run, this full data scope will provide advantages over purchasing a CNAPP / cloud security tool from a stand-alone security provider that doesn’t have access to a rich observability platform. This likely explains the recent moves by some security providers (like Crowdstrike) to introduce observability tools. In the same way that they are moving from security into observability, Datadog can logically expand in the opposite direction.

Architecturally, the platforms of observability and security vendors are similar. They both have agents for data collection, rely on heavy centralized data processing, leverage AI/ML to generate insights from volumes of data and deliver a rich UI for event correlation to operators. The only difference is the context. I don’t underestimate the value of security expertise, but that is primarily a staffing exercise, which Datadog has been addressing through aqui-hiring.

Datadog is also being thoughtful about where it chooses to compete in the security space. For example, they don’t intend to address endpoints (like employee devices) outside of cloud infrastructure. That makes sense, as it drifts beyond their competitive moat. Because of this, Datadog wouldn’t be relevant as the full-featured security platform for a Global 2000 company with a large employee base that has a smaller application footprint. On the other hand, a digital native that derives the majority of its revenue from online operations (Airbnb, Uber, Doordash, etc.) would find the combined security and observability platform appealing.

Beyond DevSecOps, however, I see opportunities for Datadog to pursue other business audiences and functions. That is because observability isn’t constrained to just monitoring IT systems. In a generic sense, observability represents adding instrumentation and monitoring to improve a business system. There are many more business processes that would benefit from observability, providing other expansion opportunities. The brand name “Datadog” could be applied broadly.

A parallel might be found in the evolution of ServiceNow. That company started as a specialized ITSM provider over a decade ago, initially focusing on helpdesk tickets. Over time, they expanded into other IT functions, applying the same workflow automation approach to service more and more business processes. Looking outside of IT, ServiceNow found similar opportunities to automate common business workflows. They added new workflows for HR, customer service, procurement, financial services and many more.

ServiceNow applies the same approach to digitize common business workflows, making them more automated and efficient. At their Investor Event in May 2022, they highlighted the number of new product modules released in each of the last three years. The volume of releases increased in each year as their R&D investment expanded.

Datadog could evolve in a similar way to add observability to business functions outside of IT. As they continue to expand their product footprint incrementally, Datadog could apply their efficient sales motion. Customer spend expansion would fuel more R&D. Even if selling into departments outside of IT required additional sales support, Datadog has room to increase investment in S&M for each new audience.

Q4 Earnings Highlights

Datadog’s Q4 revenue came in at $469M, up 44% y/y and 7.5% sequentially. This represented a decent beat of just over $21M from their prior guidance in the Q3 report for 37% annual growth. Left to just this quarter, the market may have been happy with the results. While the sequential growth rate was lower than in the past, on an annualized basis, it would return 33.5%. Pretty good in this environment.

Datadog’s annual revenue growth rate has been decelerating rapidly as 2022 has progressed, peaking at 83% in Q1 and then 74% in Q2 and 61% in Q3, and finally reaching at 44% in Q4. Looking forward, management expects further deceleration.

The preliminary estimate for Q1 revenue is for a range of $466M to $470M, which is up 29% annually and inline with the $469M in revenue for Q4. A preliminary guide for 0% sequential growth is unusual for Datadog. In the last two years, the initial Q1 guide was 3.2% and 4.8% over Q4’s actual revenue. In these cases, the actual sequential growth was 11.3% and 11.8%, representing beats of about 7-8%. Assuming Datadog management is incorporating a similar guidance philosophy (which they broadly intimated on the call), then we could expect an actual sequential growth rate of 7-8% for Q1. That would be linear with Q4, implying an annualized growth rate in the low 30% range.

For the full year of 2023, Datadog management guided to revenue in a range of $2.07B to $2.09B for growth of 23.8% above 2022’s actual revenue of $1.68B. This estimate came in far below the analyst consensus for $2.195B, which represented growth of 32.6% above their estimate for 2022 revenue. An annual growth rate of 24% for the full year would be far below anything delivered previously and represent nearly 40% of deceleration from 2022.

At the beginning of 2022, Datadog management projected revenue of $1.51B – $1.53B for annual growth of 48% over 2021’s revenue of $1.03B. They ended the year with actual revenue of $1.68B for 63% growth. This means that Datadog exceeded their original annual guidance by 15% over the course of the year, through a series of beats and raises.

I think it’s fair to assume that Datadog’s 2023 full year guidance is conservative. The key question is by how much. An optimistic view would add the 15% of outperformance from 2022 to the 2023 preliminary guide and get a target for almost 40% growth. Given the trajectory of sequential growth rates, a growth rate higher than 24% is supportable. I think a little less outperformance is a reasonable estimate, implying that Datadog ends the year with revenue growth in the low to mid-30% range.

Billings and RPO provide some supporting signals, but management cautions against relying on them too heavily. Q4 billings were $536M, up 31% y/y. Total RPO was $1.06B, up 30% y/y. Current RPO growth, defined as that portion of RPO expected to close in the next 12 months, was in the high 30% range. That is probably the most relevant indicator for future growth among these.

Profitability

For Q4, Datadog management had projected Non-GAAP operating income of $56M to $60M. The actual result was $83M, for an operating margin of 17.7%. A year ago, Datadog delivered almost $71M in operating income for a Non-GAAP operating margin of 22%. At that time, Datadog even achieved positive operating margin of 3% on a GAAP basis, which is unheard of for a growth company. This quarter, GAAP operating margin dropped to -7%.

The underperformance of operating margin year/year is attributable to the resumption of in-person activity in 2022 versus 2021. This included expenses associated with travel, sales events and office support. For the full year, Non-GAAP operating margin was 19%.

Looking forward to Q1, Datadog management estimates Non-GAAP operating income of $68M – $72M, which would represent an operating margin of about 15% at the midpoint. In Q1 2022, operating margin was 23%. Management did point back to the lifting of Covid restrictions as an explanation for the year/year decrease and we can expect some outperformance, similar to Q4.

For the full year of 2023, management projects Non-GAAP operating income of $300M – $320M for an operating margin of 14.9% at the midpoint, which is roughly linear with Q1’s target. This compares to 19% actual operating margin for 2022. At the beginning of 2022, management had estimated an operating margin of 11.2%, so there is likely some conservatism baked into this measure as well.

On an Non-GAAP EPS basis, Datadog delivered $0.26 in Q4, beating analyst expectations for $0.19. In spite of the lower revenue guidance in Q1, Datadog management projects EPS for a range of $0.22 to $0.24, inline with analyst expectations for $0.24 at the high end. Finally, for the full year, the preliminary estimate is for $1.02 to $1.09, versus the analyst consensus for $1.13. This compares with the full year 2022 EPS of $0.98.

Shifting to cash flow, Datadog is demonstrating its ability to generate high FCF margins. For Q4, they delivered operating cash flow of $114.4M, for an OCF margin of 24.4%. Backing out capital expenditures, free cash flow was $96.4M for a FCF margin of 20.5%. While healthy, compared to Q4 2022, this actually a step down. In Q4 2022, Datadog delivered record total FCF of $106.7M for a FCF margin of 33.%. They did enjoy a surge in revenue a year ago.

For the full year, the comparison is more favorable. In 2022, Datadog finished the year with $354M in FCF, which was 41% higher than the $251M delivered in 2021. The full year FCF margin for 2022 was 21%, versus 24% in 2021.

"First, regarding our fiscal year 2023 investments, we continue to balance near-term financial strength with investment in our large long-term opportunities. Our non-GAAP operating income guidance reflects this discipline. We will continue to grow our R&D and go-to-market teams as we broaden our platform in service of our customer needs, albeit at a slower pace than in previous years. As a result, we are planning to grow our operating expenses, including COGS, in the fiscal year 2023 in the low 30s percent range year over year. We plan to grow our headcount in fiscal year 2023 in the mid-20s percent range year over year. This compares to fiscal 2022 headcount growth of approximately 50% year over year." Datadog Q4 2022 Earnings Call

Looking forward, Datadog management does plan to temper spending to match the lower revenue forecast. While headcount grew 50% in 2022, they are targeting an increase of mid-20% for 2023. Since they increased revenue by 63% in 2022, half as much growth puts them in the low 30% range. The reduced investment in staff should align with the lowered expectations for revenue growth, as the reductions are proportional.

Customer Activity

Customer activity provided mixed signals. First, as we would expect, customer spend expansion is showing pressure, as growth in large customer counts is slowing down and DBNRR will likely drop below 130% at some point this year. On the other hand, Datadog reported a record level of new logo ARR bookings for the quarter and is maintaining a fairly linear addition of total customers.

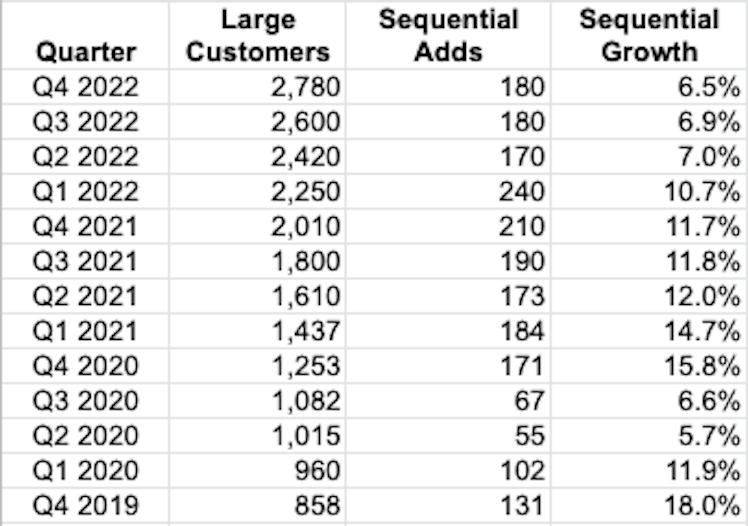

Datadog ended the quarter with 23,200 total customers. New customer growth has been relatively linear for the past two quarters at about 1,000 additions each. This is in the range of 1,000 to 1,400 additions per quarter going back two years. The health of the new customer adds is an important signal (albeit on the lower end of the range), even if spending expansion is under pressure.

Large customer additions are tracking as well, defined as customers with ARR over $100k. After breaking 200 additions for two quarters in late 2021, net additions have settled in a range of 170 to 180 for the remainder of 2022. As another data point, Datadog management announces $1M+ ARR customer counts annually. They ended 2022 with 317 customers with ARR over $1M, up 101 or 47% from 216 at the end of 2021.

Datadog reflects this expansion through the dollar-based net retention rate (DBNRR), which once again was above 130% and has been since the IPO. However, with the revenue growth slowdown, management is signaling that DBNRR could drop below 130% this year.

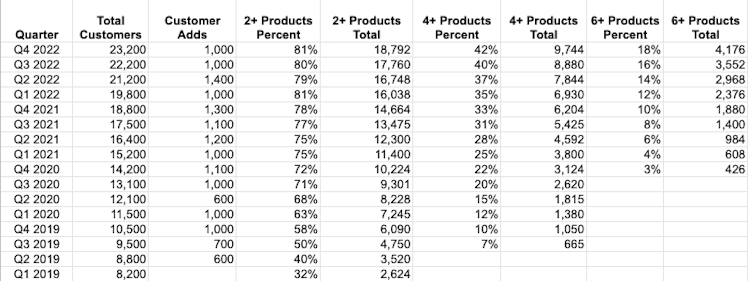

Most important to me is growth of product module adoption proceeding in an almost linear fashion. As I described earlier, the growth engine for Datadog is their “land and expand… and expand” model. Not only do they need to bring new customers onto their platform, but they need to sell these customers an increasing number of product modules. This is a standard SaaS land and expand model.

Datadog adds a third dimension to the standard SaaS “land and expand” motion, which is driven by their rapid product development velocity. Datadog is adding new monetized product modules at a rapid clip. From January 2021 to January 2023, they almost doubled the number of modules for sale on their pricing page.

Many of the newer modules are in adjacent product categories, like developer experience and security. Some analysts have argued that Datadog will have difficulty breaking into security and developer operations, given entrenched competitors in those areas. I actually think the opposite will happen, as I discussed earlier. Datadog’s foundation in observability applied to application workloads provides a natural extension into security and developer operations.

Putting aside the reasons why I think they will compete effectively, if there were an issue with these product expansions, they would show up in the product module adoption counts. Yet, they aren’t, at least not at this point. Additionally, anecdotal evidence from customer wins indicate large enterprises are adopting newer modules in application security and developer tools.

Looking forward, Datadog management is placing a lot of emphasis on security as a future expansion area. Like with APM, I expect them to continue to build out the solution and move upmarket in feature parity. During the prepared remarks, the CEO highlighted a couple of customer wins that included new security features, as well as some developer tools.

- Fortune 500 industrial, 7-figure land: 13 products across observability, security and developer experience.

- Leading insurance company, 7-figure expansion: 12 products total, adding database monitoring, cloud security management and application security.

- Japanese system integrator, 7-figure land: 15 products total, which implies some would be in security and developer experience.

Investment Plan

Datadog’s Q4 results were overshadowed by the weak full year 2023 revenue guidance. A deceleration to annual growth of 24% this year is not what investors were expecting, following 63% growth in 2022. Similar to the behavior with the hyperscalers, revenue is being impacted in the near term by customers looking for ways to optimize their cloud workloads and normalize spend. This follows two years of unrestrained investment during Covid, further exacerbated by a flurry of VC-backed start-ups building new digital channels at a high rate.

As I mentioned in a prior review of hyperscaler results, I think these optimization exercises are creating a negative headwind, masking continued enterprise investment in digital transformation and cloud migration. Optimization mechanics involve one-time adjustments to cloud infrastructure and are generally front-loaded for financial impact. I expect the bulk of optimization exercises to occur in first half of 2023, tailing off in the second half. As that headwind subsides, we should see sequential growth pick up again, supported by the underlying current of continued cloud migration and resumption of spend expansion by enterprises already on the cloud.

This should drive a stabilization and even re-acceleration of revenue growth for software infrastructure providers. I don’t think we will return to the heyday of 2021-2022 (although if AI really takes off, cloud workloads will explode), but I could see spend expansion for cloud infrastructure return to the 20-30% range annually.

Given Datadog’s ability to grow at a faster rate than the hyperscalers (mainly due to smaller scale), their annual growth rate could settle into the 30% range. This would be driven by Datadog’s continued increases in new customer lands, expansion of product adoption and seamless introduction of new products to sell. I think that Datadog’s “land and expand and expand” model is the flywheel for durable revenue growth.

Datadog’s competitive advantage lies in their ability to spend 1.5x more GAAP dollars on R&D than S&M and still maintain higher growth rates than peers. No other competitor comes close to this ratio – allocating more gross profit to sales and marketing in order to keep driving revenue. Datadog’s outsized R&D spend is thoughtfully applied towards new product development, yielding an accelerating pipeline of monetized products to offer customers. The product development organization is disciplined, only building new products in response to customer feedback.

As the number of products expands, the risk to Datadog’s growth would be that newer products are less relevant, as Datadog addresses market segments outside of their core in observability. However, the product module adoption data does not show this to be the case. The percent of customers adopting 4+ and 6+ products has been increasing linearly through 2022. If Datadog were having a product adoption or competitive issue, it would show up there (and new customer additions).

The driver of projected revenue growth deceleration for 2023 is current customers identifying opportunities to reduce utilization and ramping up existing workloads more slowly. This effect is similar to that experienced by the hyperscalers. As this headwind abates, sequential growth should pick up again.

This optimization of existing customer usage may also be creating an air pocket for Datadog’s revenue growth. The velocity of revenue growth from older products is slowed down by optimization. At the same time, the flood of new product offerings will take time to reach escape velocity. Datadog’s CEO highlighted this interim state during the earnings call.

"We have been investing heavily in product innovation. We have a lot of products today. Thanks to this acceleration of product and innovation over the past few years, are early in their life cycle. What we see in the current environment is that it is actually helping us get to these consolidation deals that were mentioned a little bit earlier because we can cover more of what our customers need to do and drive more efficiencies.

Again, it’s still early in that because many of those products are early in their life cycle, so they might not be applicable to every single type of customer and every single type of situation. But I think this is validating our destination there. And it shows we need to do more of that, not less. At a time where larger customers are very, very careful about their spend, it might be more difficult for some of those products to gain a lot of adoption with any particular customer at a very high level of spend. So, we’re focusing today on getting a maximum number of those customers to adopt those products and plant the seeds of future growth as they further consolidate and move to the cloud." Datadog Q4 2022 Earnings Call

This sales approach supports the idea that Datadog spend could re-accelerate as optimization impact tapers off and enterprise IT budgets return to steady state. While Datadog occupies an increasingly large position on an IT budget, it can be justified by spanning more product categories. Consolidation isn’t just moving more tools onto a single vendor, it also raises the ceiling for budget tolerance with that vendor.

This is why Palo Alto Networks reported a 140% increase in $10M+ deals in their latest quarter. The CEO commented that almost all of their $10M+ deals involve multiple platforms and vendor consolidation. As Datadog expands into additional product segments, their average deal size should increase in a similar fashion. A perception of “overspending” on Datadog as a line item in an IT budget would be justified by broader functional reach.

While I had hoped for a stronger revenue guide for 2023, I am comfortable with Datadog’s long-term growth trajectory and favorable operating leverage. I plan to maintain my portfolio allocation to DDOG, anticipating an improved spend environment as we transition to 2024. With their inherent competitive advantages in product development and sales efficiency, I expect Datadog to maintain durable revenue growth rates above peers.

The Motley Fool

Palo Alto Networks (PANW) Q2 2023 Earnings Call Transcript | The Motley Fool

PANW earnings call for the period ending December 31, 2022.

Already have an account?