Trending Assets

Top investors this month

Trending Assets

Top investors this month

We live in the world of anticipated rate hikes. The stock market does not seem to like that at all. Although there are many other factors such as war, unprecedented inflation, maybe even echos of pandemic I wanted to see how $SPY and $QQQ performed historically in the short term after the rate hikes.

To do so I have backtested Rate Hikes back from 2015-2018. Overall there were 9 hikes (I took data from bankrate website)

- 1 x 0.25 in 2015

- 1 x 0.25 in 2016

- 3 x 0.25 in 2017

- 4 x 0.25 in 2018

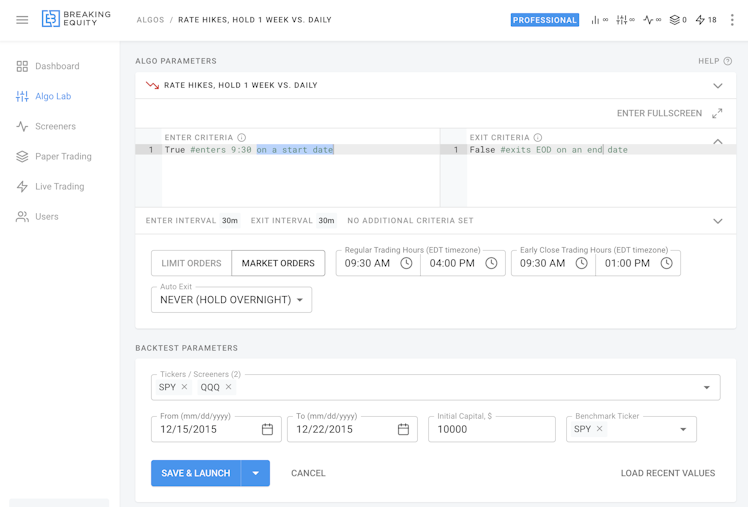

I have setup 2 strategies with http://breakingequity.com/. Each one trades/invests $10K every rate hike.

- Strategy 1: SHORT on the announcement date and hold 1 week

- Strategy 2: SHORT on the announcement date, exit EOD, repeat for 1 week

Strategy Setup ^

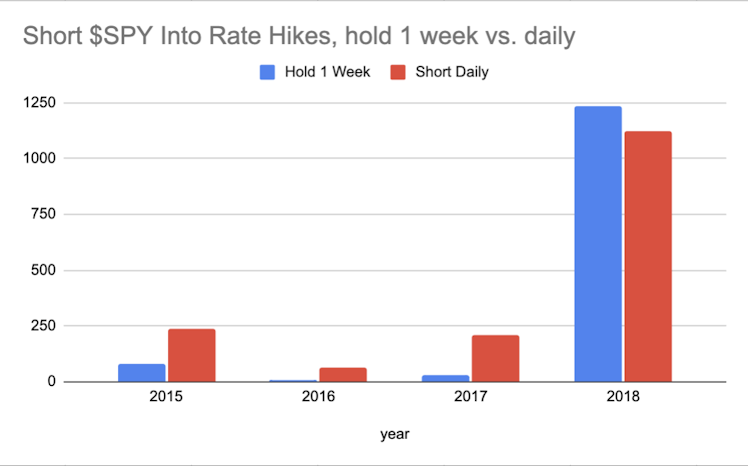

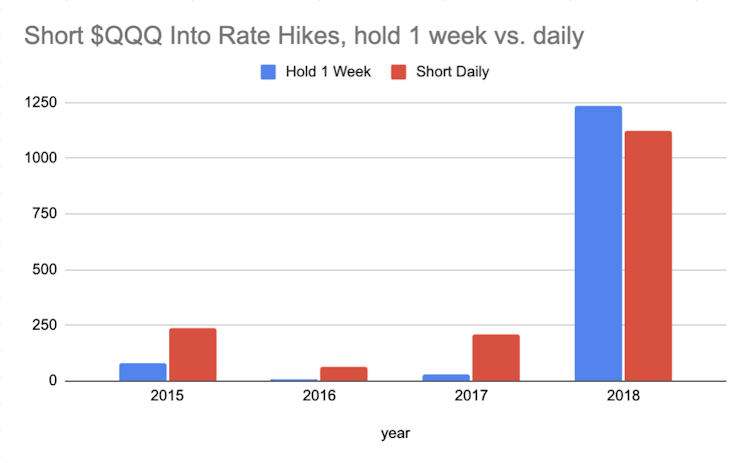

The Results

Shorting every day and closing the position EOD came out a bit better overall. It also protects you from sudden spikes overnight.

- SPY: $1,658.7 total gain vs. $1,626.9 for 2015-2018

- QQQ: $1,634.0 total gain vs. $1,353.3 for 2015-2018

Below is a breakdown by each year

breakingequity.com

Breaking Equity | Home

Operate active investments of any sophistication in just a few clicks.

Already have an account?