Trending Assets

Top investors this month

Trending Assets

Top investors this month

How $STOR Wins

STORE Capital is a real estate company, unlike many others. From the smaller deal sizes to the massive acquisition pipeline and the co-founder-based leadership team $STOR is a REIT certainly worth looking into.

STORE buys individual real estate from smaller businesses in exchange for long-term leases at a broad level. This specific approach allows the company to win in a lot of different areas.

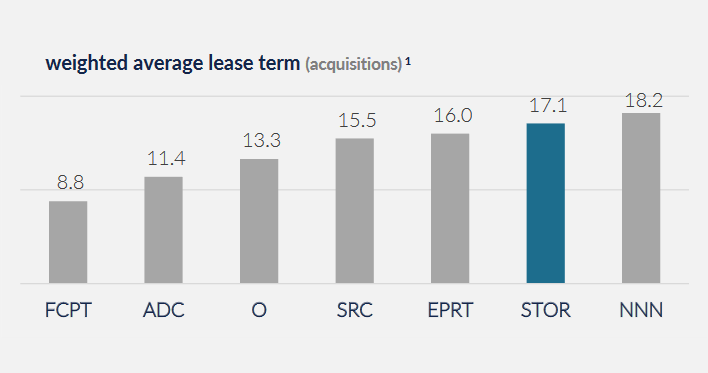

The lease terms tend to be much longer than competitors. This is most likely due to the smaller deal sizes. Generally, the big box stores that Realty Income makes deals with tend to want more flexibility in lease terms.

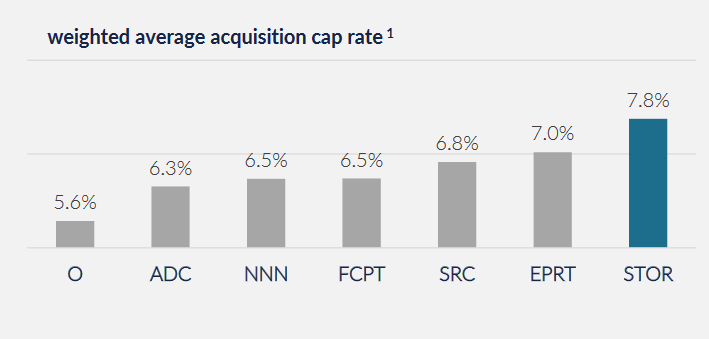

Next is a cap rate much higher than competitors. Again, the cap rate is operating income divided by property cost given the smaller deals, STORE gets higher income while not spending as much on properties.

Using this business model the company has grown to over $11b in assets over the last 11 years.

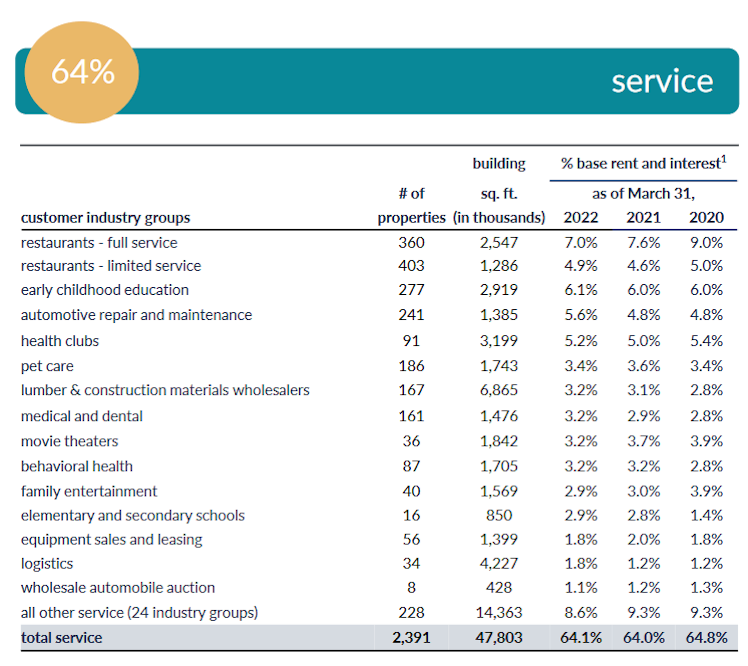

While $STOR is heavily concentrated in the service industry it is still fairly diversified across that field.

STORE still manages to be incredibly diversified across its top customers. STOREs top10 accounts for roughly ~12% of the total rent. In contrast, $O's top10 accounts for nearly 20% of their total rent.

And even though most of STOREs properties are owned by smaller businesses the majority of its business comes from the larger tenants. Along with these many new deals come from these existing businesses expanding.

Overall STOREs got a lot of good things going for it. While there certainly are concerns from the sudden departure of the founder Chris Volk to Credit rating risk from their smaller tenants I believe STORE is worth the risk.

And if you want a much deeper dive into the company from its history to an expanded bull case and a closer look at the downsides it is the subject of my newest video.

YouTube

BEAT Inflation with this Real Estate Stock

Today we are exploring the limitless REIT that is STORE Capital. Going back to the beginning and seeing how the founder's vision led to a company that is rap...

This is my kind of venture. I am building a REIT watchlist at the moment, with the eventual aim of adding 5 to 10% of exposure to REITs sometime in the next year. This one will fit nicely into that.

Already have an account?