Trending Assets

Top investors this month

Trending Assets

Top investors this month

Economic Update

Stocks are lower today as we wait for the FOMC rate decision later. The Fed is expected to announce a 25 bps increase, though traders are far more interested in the comments of Fed Chair Jerome Powell.

Domestic stocks had a strong January, with the S&P 500 posting its best January since 2019 and the Nasdaq its best January in 22 years.

For economic data, the ADP Employment Report showed private payrolls grew by 106k in Jan, below the 190k expected. However, the chief economist for ADP said the slowdown was likely related to weather and job growth is not as weak as the report indicates. December saw an upward revision to 253k.

The ISM Manufacturing Index fell more than expected to 47.4 in Jan, the 3rd straight month the index contracted. The Dec reading was 48.4. New orders and production contracted, prices increased, and employment edged lower to 50.6, nearing contraction territory. The final print of the January S&P Global Manufacturing PMI came in at 46.9, just above the initial reading of 46.8.

Wrapping up data, the Dec JOLTS report showed job openings jumped to 11.0 million, versus expectations of declining to 10.3 million. Quits were flat and layoffs edged higher. Lastly, construction spending fell 0.4% in Dec, versus expectations of remaining flat for the month.

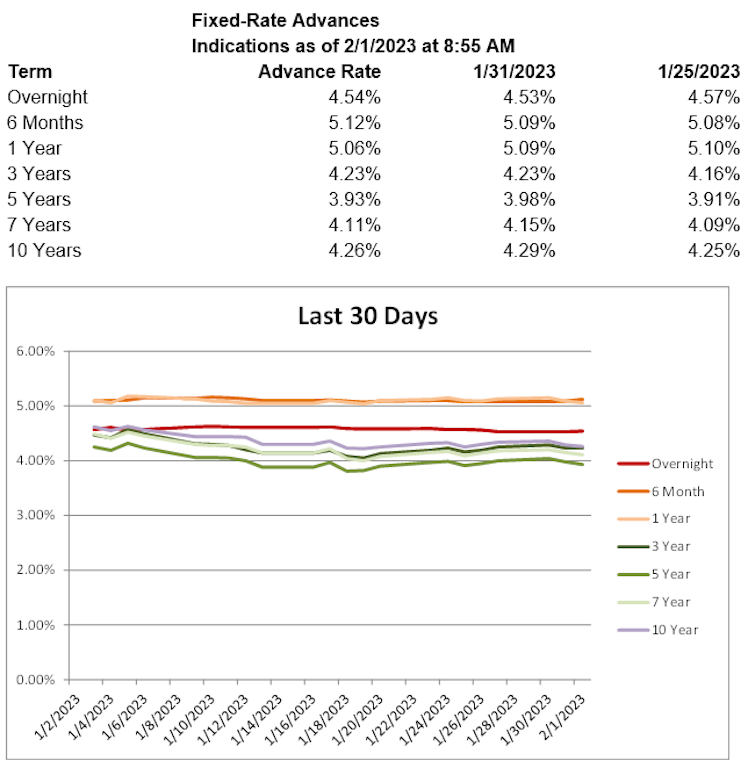

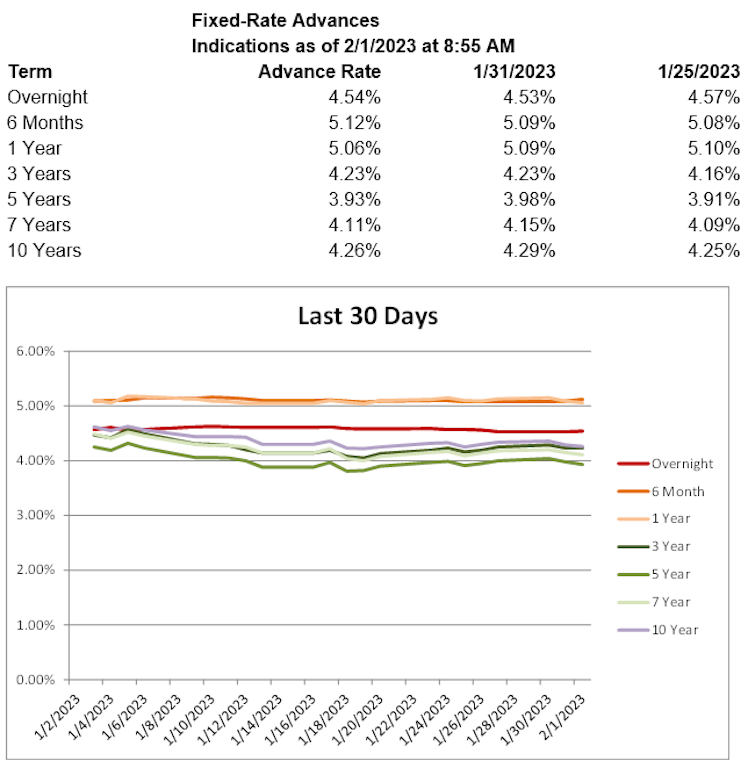

Treasury yields are flatter, with the 2-year T yield up 0.9 basis points to 4.22%, the 5-year T yield down 1.9 basis points to 3.62%, and the 10-year T yield down 2.0 basis points to 3.51%. Shorter-term advance rates are higher, while longer-term rates are lower today.

Already have an account?