Trending Assets

Top investors this month

Trending Assets

Top investors this month

Focus on the business, not too much on multiples

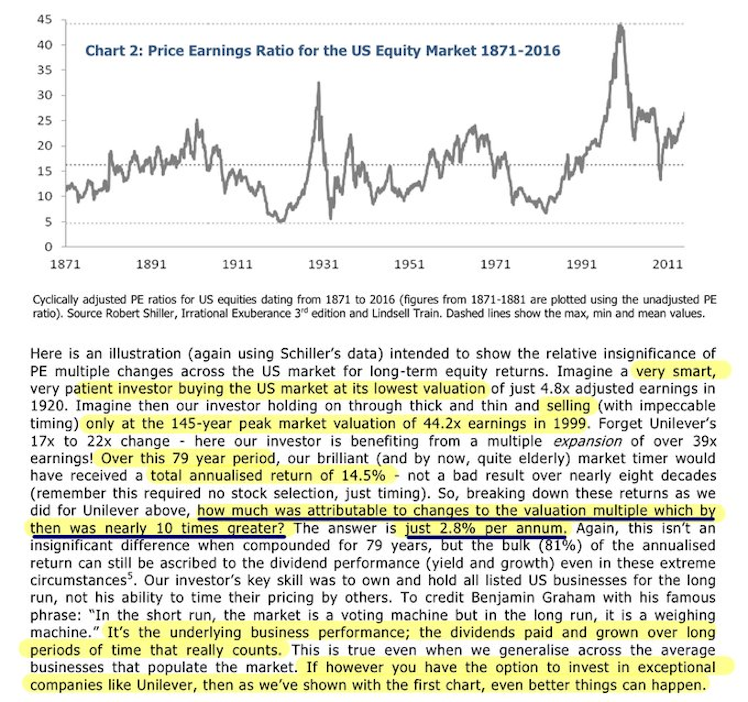

A perfect market timer who bought the market at its lowest PE in 1920 (4.8x) and sold at peak PE (44.2x) in 1999 would've realized a 14.5% 79-year CAGR.

From this 14.5%...

- 2.8%/year was attributable to multiple expansion

- 11.7%/year was attributable to biz performance

This is an extreme example where even a 9x multiple expansion "only" accounted for 19% of total returns.

Even if you are timing the market to perfection, it's the business' performance that matters the most over long periods.

Investors have to allocate their time accordingly.

If you are a long term investor, you are better off getting a grasp of the LT opportunity than focusing on what the right multiple is (extremes aside).

Will your LT returns differ much if you buy something for 21x instead of 19x? Seems pretty unlikely.

Valuation should never be disregarded, but it should be given the necessary context. What matters most depending on your investment horizon? Find out and focus on that.

Source of the image above: https://lindselltrain.com/application/files/2116/2377/0165/ConfoundingCompounding-_February_2017.pdf

Already have an account?