Trending Assets

Top investors this month

Trending Assets

Top investors this month

$CRM Q3 FY23 earnings

Benioff said he is currently seeing buying behavior comparable to '08-'09 and '01 crisis:

Going back to 2009, let's see what Salesforce noted on its earning call:

A similar buying behavior to today. However, they noted the level of predictability improved in that 2009 call vs. today they still do not have improving visibility. See the guidance from Q3 FY23:

$CRM guidance for cRPO was lower than expected at +10% CC. Cash flow guide is at low end of range due to lower billings. Did not provide FY24 guidance due to lack of visibility.

In addition, Bret Taylor is stepping down at the end of the year. He was promoted to co-CEO last November. Benioff is very upset. This follows Gavin Patterson and Keith Block both leaving.

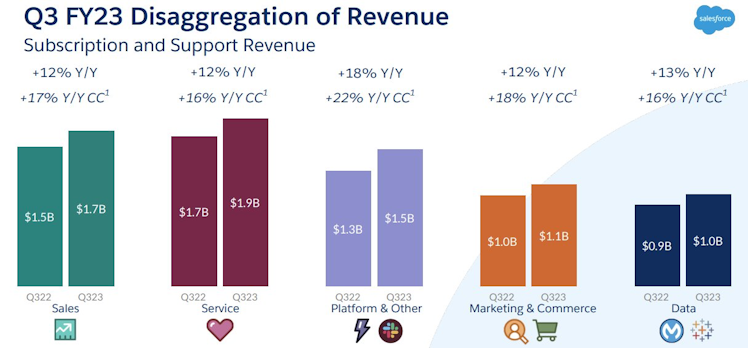

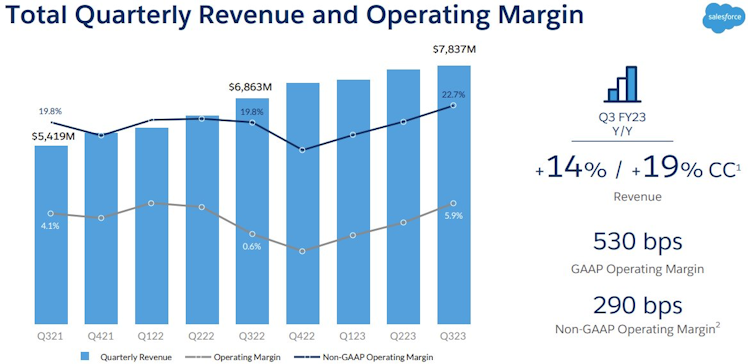

$CRM growth remains strong across all segments. Non-GAAP profitability is improving.

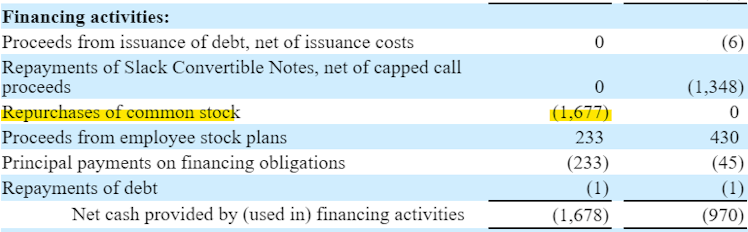

$CRM bought back $1.677B worth of stock in Q3. Plan is to buy $10B over time.

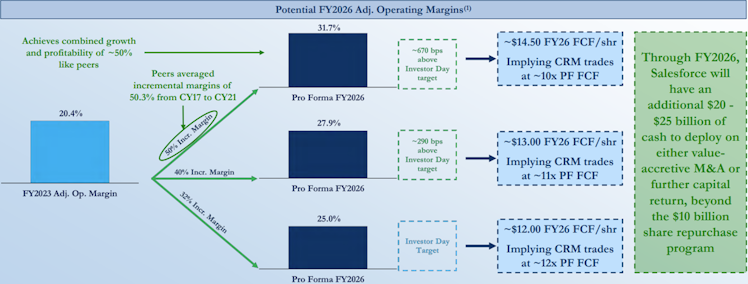

Lastly, Starboard recently took a stake in Salesforce. See their presentation here.

Starboard says $CRM is trading at a discount to peers and needs to do more to improve profit margins.

Already have an account?