Trending Assets

Top investors this month

Trending Assets

Top investors this month

Lennar: Earnings Watch

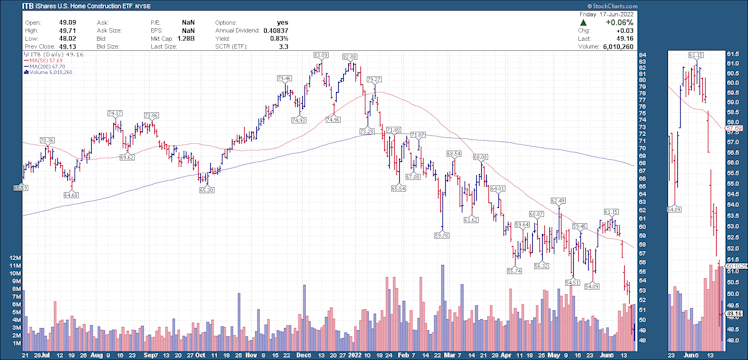

Homebuilders are in trouble. Just when you think the index can’t go any lower, it takes another dip. I had invested in $NAIL last year. Sold out in February. But, I still get alerts on it because it was a holding and every second day, I keep getting an “all time low” alert. It is troubling.

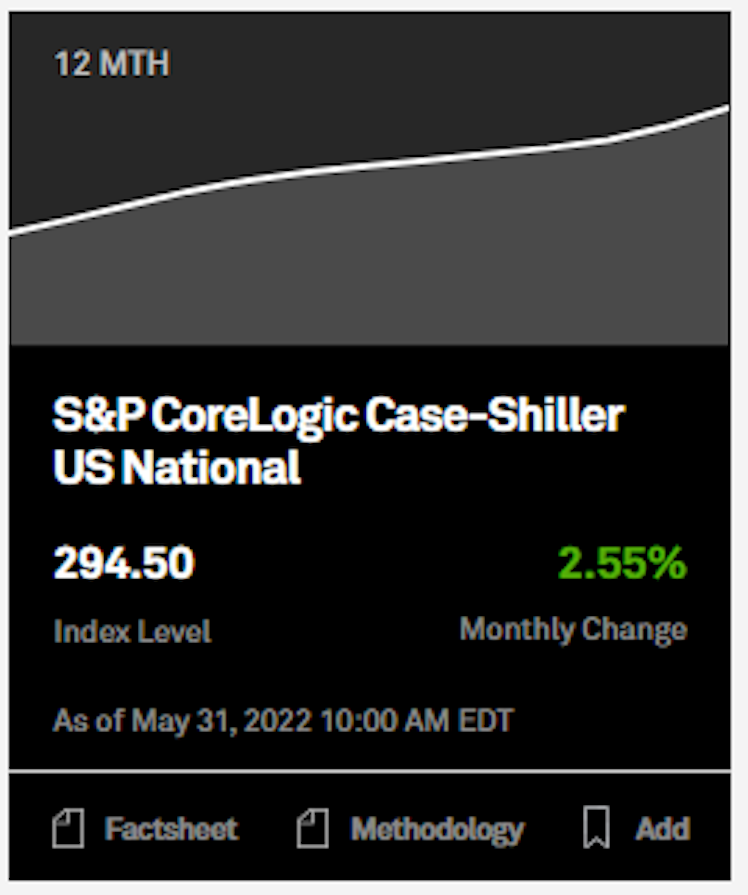

The housing market is supposedly still in a bubble. I feel like the market should not be in a bubble but I can’t deny the data. MoM the Case-Shiller US National Index continues to go up and the 1-year change still remains 20.55%. That’s enormous!

Lennar, one of the biggest homebuilders, reports Tuesday, June 21, 2022. While I’m no longer invested in Homebuilders, I still like following the earnings calls because you learn a lot about the current environment and what they are seeing.

Lennar got a few steep PT downgrades in the last couple of weeks. Analysts are foresee weakness in the housing market, which is no surprise with how mortgage rates continue to climb steadily climb and supply chains still remain under pressure.

UBS lowered their PT from $154 to $108 while still maintaining a BUY rating. They expect the market for new homes and single family housing starts to remain depressed until 2026 but, also expect only a “15% peak-to-trough decline” for 2022-2023.

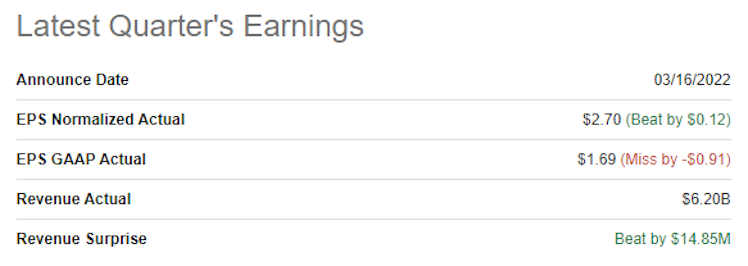

It remains to be seen whether this is how it pans out but, we will sure get some guidance on the call. Last quarter, Lennar missed EPS estimates last quarter and barely beat on revenue.

For what it worth, I still find them to be a solid company with strong cash flows and a decent valuation. I will hold on until the tide turns in this market but, I have my eye on them.

Already have an account?