Trending Assets

Top investors this month

Trending Assets

Top investors this month

SLT Core Portfolio: Arista Networks ($ANET) - Update

Arista Networks, a leading cloud networking company, experienced a significant setback as its stock dropped by 12% after its last earnings call at the beginning of the month. Analysts raised concerns about the company's lack of visibility for the second half of the year, particularly regarding its "Cloud Titan" customers. Despite reporting strong first-quarter results and providing a positive forecast for the second quarter, ANET's future prospects were called into question. We wanted to provide you with our thoughts and an update on the company, held in our SLT Core Portfolio.

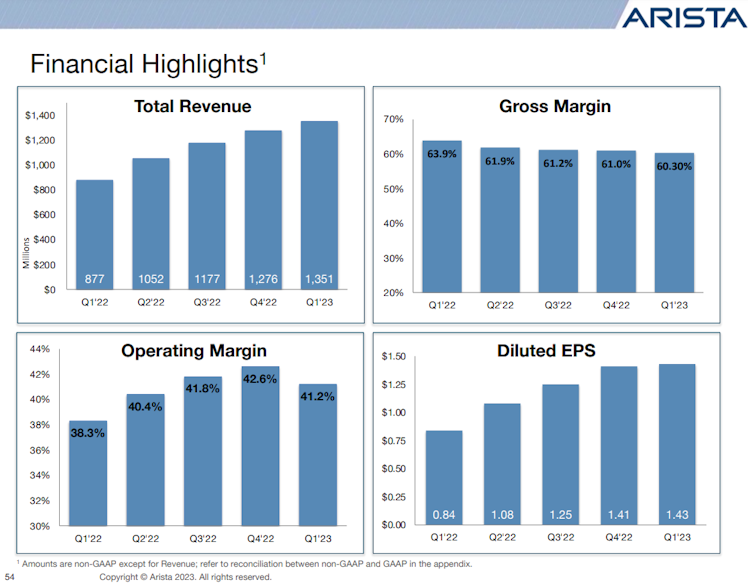

Looking at the company's first-quarter results, the company reported an adjusted EPS of $1.43, marking an increase from 84 cents YoY and surpassing estimates. ANET's revenue for the quarter reached $1.35bn, representing a 54% YoY growth and outperforming the estimated $1.31bn. Product revenue amounted to $1.17bn, indicating a 62% YoY increase, while service revenue stood at $179.3mn, showing an 18% YoY growth. The cost of revenue also experienced an upward trend, with a total of $546.8mn, a 69% increase compared to the previous year. Hence, adjusted gross margin for the quarter was 60.3%, slightly lower than the 63.9% achieved in the same period last year, but exceeding the estimated 60.1%. Additionally, the adjusted operating margin improved to 41.2%, up from 38.3% YoY and surpassing the estimated 40.3%.

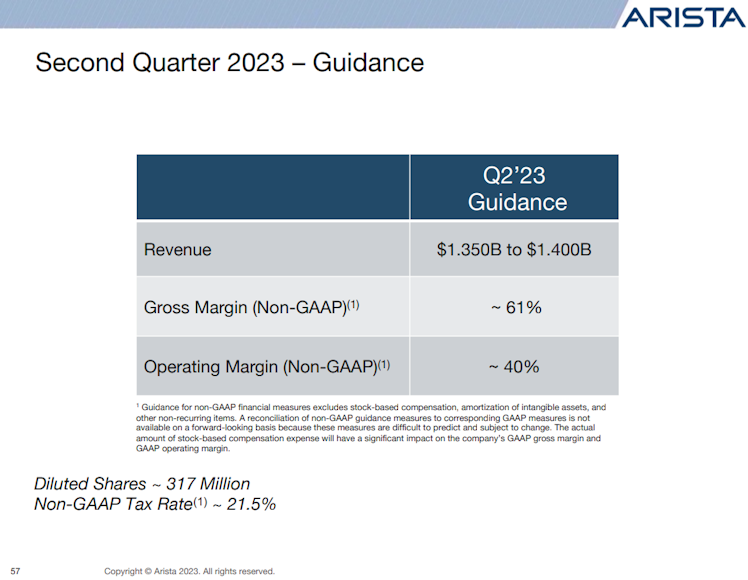

For the second quarter, the company projects revenue between $1.35bn and $1.40bn, in line with the consensus estimate of $1.35bn. The company expects an adjusted gross margin of 61%, matching the estimated 61%, and an adjusted operating margin of 40%, slightly lower than the estimated 40.5%. The company indicated that gross margins likely reached a trough in the first quarter and are expected to improve in the second quarter, with a further upward trend in the third and fourth quarters.

ANET demonstrated strong near-term execution, surpassing revenue expectations in the first quarter of 2023 and providing a positive revenue outlook for the second quarter. The company's performance was driven by improvements in the supply backdrop, allowing ANET to manage its backlog more efficiently and achieve higher margins by reducing reliance on expensive broker parts. Management guided for further improvement in gross margins throughout the year. Despite concerns surrounding the macroeconomic environment and potential headwinds in various customer verticals, management stated that the balance between headwinds and tailwinds is currently favorable, mitigating demand concerns for the remainder of the year.

However, some concerns emerged from the earnings report. Firstly, the magnitude of revenue beats is moderating, with the first-quarter results and second-quarter guidance showing the smallest beats since the first quarter of 2022, which was significantly impacted by supply constraints. Additionally, the company's elevated inventory position, resulting from long-term supply contracts despite reduced demand visibility, may limit the company's ability to quickly return to normalized gross margins compared to its peers. The company noted that easing supply chain dynamics are leading to shortened visibility among its larger Cloud Titan customers, returning to historical levels. This customer segment accounted for 46% of Arista's 2022 revenues and experienced triple-digit growth last year. As the sense of urgency to purchase well ahead of time diminishes and spending enters a digestion phase after two years of outsized growth, decelerating growth is expected in upcoming periods.

To conclude, the company delivered results that were in line with our expectations, with a modest beat on revenues, strong operating margins, and a significant beat on EPS. The company also provided carefully crafted and conservative guidance. Despite the strong performance, and in our opinion, the market overreacted with a sell-off due to concerns over reduced visibility from over 12 months during the pandemic to around 6 months currently. While concerns over reduced visibility are founded, we believe it is more accurate to view this as a normalization of the supply chain and lead times. As the supply chain improves, visibility is returning to a more typical state (6 months visibility with Cloud Titans is aligned with historical levels prior to 2020).

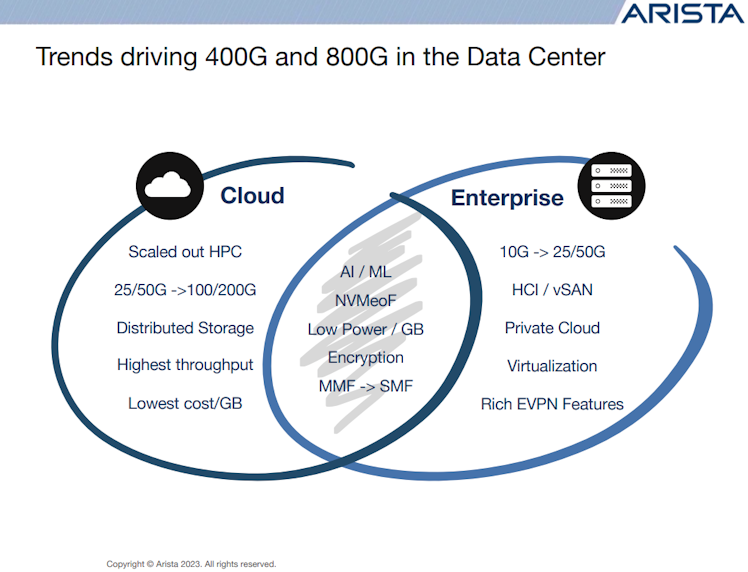

Our thesis remained unchanged. The boom in AI also represents a major build cycle, and ANET is well-positioned to benefit from this trend. Networking is expected to gain a larger share of the Cloud Titan wallet spend as networking becomes increasingly crucial in delivering data to GPUs. ANET's strong position in high-speed networking is likely to allow it to capture the majority of this market. The company has already demonstrated its advantages, and it is expected to capitalize on them in the coming years.

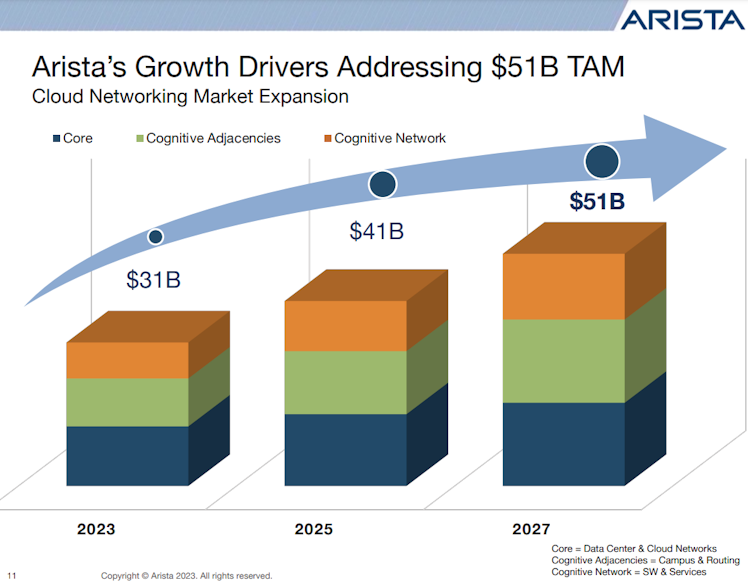

The company shared a longer term TAM of $51bn by 2027. It is interesting to note that ANET also raised its 2025 TAM to $41bn, from $35bn when we published our full analysis of the company at the end of October last year.

Already have an account?