Trending Assets

Top investors this month

Trending Assets

Top investors this month

Chart of the Day - worried.

We had our annual Ryder Cup like event this weekend. I was on Team USA & unlike real-life, we did not win. A fun aspect of the event is that you can socialize with a number of people that you might not normally over the course of the year. They run the gamut from C-suite to fincl advisors to experts in real estate or logistics. I wrote about this in my Substack blog this week (Anecdotal evidence - stayvigilant.substack.com) & suffice it to say, they were all very worried.

These people are not the only ones that are worried. BAML has consistently pointed out that cash balances are very high. We see from the Committment of Traders that leveraged or speculative accounts are short the most economically sensitive futures markets. NYSE short interest is back to levels last seen in 2008. Emerging Mkts are failing. Currency traders see a series of rolling devaluations.

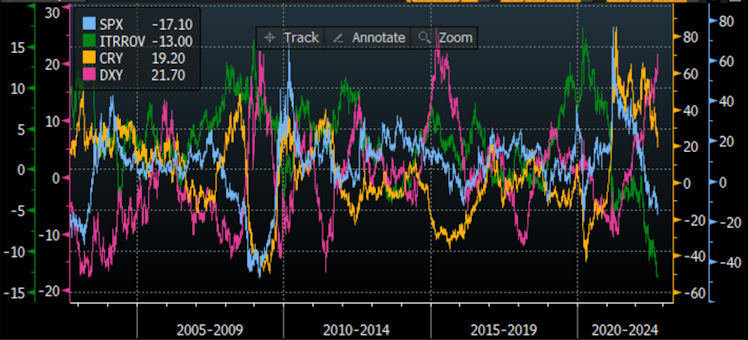

Which of these has you most worried though? We can start with the equity mkt. It is, after all, a leading indicator of the economy, & we surmise that via wealth effects, the performance of stocks impacts consumption. The blue line is the rolling 12 month yoy performance, we can see SPX is down 17% yoy, slightly less than YTD. People are feeling these losses. That is worrying in itself.

The pink line is the dollar wrecking ball (not sure who coined the term but I like it). The $ has been on a one-way train higher, leaving damage in its wake. There are $12 trillion of USD loans overseas. The higher dollar crushes those borrowers. The higher dollar is contributing to the pain we are seeing in EMs, in China, in Europe & in the UK. Saw someone on LinkedIn joke that the British currency is now being quoted in ounces & not pounds. Quite clever. Also see the new meme that 1 Bitcoin = 1 Bitcoin, an attempt to say 'focus on the number of coins you hold and not the price' but implicitly telling all that the dollar is crushing even crypto. Remember when we were worried that too many dollars were printed and the dollar would be debased? I am sure the dollar has some worried.

Commodities are in yellow & while they peaked earlier this year, the yoy is coming lower. Worried, but maybe becoming less worried if the trend continues. Gas prices are lower in the US even if food is not. Stay tuned.

The chart that has me the most worried is the green line, the yoy change in the US Treasuries. We are off to the worst start in 50 yrs in the bond mkt. These securities are a core part of every portfolio, particularly those in retirement that are no longer earning & can't afford to lose. Treasuries are also the underpinning of the pricing of all assets - corp credit, other soverign debt, equities & futures. Treasuries becoming unhinged, breaks all mkts. The inability to catch a bid here has me the most worried.

Hate to be so negative, but there are times when risk management is more important than return expectation.

Stay Vigilant

Already have an account?