Trending Assets

Top investors this month

Trending Assets

Top investors this month

Quick Guide to Canadian Stock Exchanges

If you're investing in companies listed on Canadian exchanges, it's important to be aware of the differences. Understanding how listing requirements vary is critical when evaluating risk factors. Each exchange serves a distinct purpose, so I thought it may be helpful to some to provide a quick overview (particularly noting the contrast in listing requirements for the high-risk mining sector, as ~43% of the world's public mining companies are listed on the TSX/TSX-V):

EDITED JUNE 9, 2023 - NEO BECOMES "Cboe Canada"

Over the past few years, Cboe has expanded into several new markets. It boosted its presence outside the US through the acquisition of Aequitas Innovations Inc., parent of Toronto-based NEO Exchange.

Initial post on the NEO below for context:

NEO Exchange is a 'next generation stock exchange focused on fairness, liquidity, transparency and efficiency that brings together investors and capital-raisers, serving as a central force driving the Canadian capital markets forward.'

The goal of the CSE is to provide a modern and efficient alternative for small- and mid-cap companies looking to access the Canadian public capital markets. Unlike other major exchanges, the CSE has simplified reporting requirements and reduces listing barriers.

The Toronto Stock Exchange is the senior equity market, while the TSX Venture Exchange is a public venture capital marketplace for emerging companies.

NEO Exchange

Founded 2015

Marketed as Canada's New Stock Exchange, NEO aims to help companies, dealers, and investors by creating a better listing experience, eliminating predatory behaviours such as high-frequency trading. NEO Exchange is the third most active marketplace in Canada, consistently representing close to 15% of all volume traded in Canadian-listed securities.

Listings: >170 unique public listings, including public companies, ETFs, SPACs, Growth Acquisition Corporations (G-Corps™), and Closed-End Funds (CEFs).

Listings on the NEO:

Listing requirements:

Canadian Securities Exchange (CSE)

Founded 2001

- Focused on working with entrepreneurs to access the public capital markets in Canada and internationally

- Lists <800 securities; as of January 2022, more than 25% of these were companies involved in the cannabis industry.

- CSE Composite Index (CSECOMP) is uniquely positioned to gauge the Canadian small cap market.

Listings on the CSE:

Listing requirements for mining companies:

- Minimum cash in the treasury: must be adequate to carry out stated work plan or execute business plan for 12 months following listing

- Minimum working capital: C$200,000

- Property: must hold a significant interest in real property

- Prior Expenditure & Work Program: C$75,000 in the last three years in qualifying expenditures

- Minimum Free Trading Public Float: 500,000

- Minimum % of issued & Outstanding Listed Shares Held by Public: 10%

- Market value of Issued Securities to be Listed: No minimum

- Minimum IPO Price Conducted: C$0.10

- Other: NI 43-101 Report recommending a first phase program of at least $100,000

TSX Venture Exchange (TSX-V)

Founded 1999

A public venture capital marketplace for emerging companies, there are two tiers on the TSX-V. Tier One is aimed at larger more established companies. Tier One companies have certain listing benefits not available to more junior companies listed on Tier Two of the TSX-V. Tier Two companies are generally early stage companies which the TSX-V believes need a bit more guidance than Tier One companies. For the purposes of this post, I will list the minimum requirements for Tier Two to demonstrate the levels required to upgrade from the CSE.

Listings: over 1,600 mostly small-cap companies

Listings on the TSX-V:

Listing requirements for mining companies:

- Net Tangible Assets or Revenue or Arm’s Length Financing: C$750,000 net tangible assets; or C$500,000 revenue; or C$2,000,000 arm’s length financing. If no revenue, two year management plan demonstrating reasonable likelihood of revenue within 24 months

- Minimum cash in the treasury: Adequate to carry out stated work plan or execute business plan for 12 months following listing.

- Minimum additional working capital: C$100,000

- Property: Significant interest in business or primary assets used to carry on business

- Prior Expenditure & Work Program: History of operations or validation of business.

- Minimum Free Trading Public Float: 500,000

- Minimum % of issued & Outstanding Listed Shares Held by Public: 20%

- Market value of Issued Securities to be Listed: No minimum

- Minimum IPO Price Conducted: C$0.10

The listing committee for the TSX Venture Exchange will also conduct a public interest standard review of all listing candidates looking at such things as:

- the reputation and past conduct of all directors, officers and majority stockholders;

- at minimum of two independent directors;

- characteristics unique to the company or its business;

- the distribution and spread of the stock of the company (capital structure); and

- less than 20% of the issued and outstanding stock of the company held by pro-groups at the time of listing

Toronto Stock Exchange (TSX)

Founded 1861

The TSX, for the trading of senior equities, is the 11th largest exchange in the world and the third largest in North America based on market cap. More mining and oil and gas companies are listed on the TSX than on any other stock exchange.

Listings: >1500 companies

Listings on the TSX:

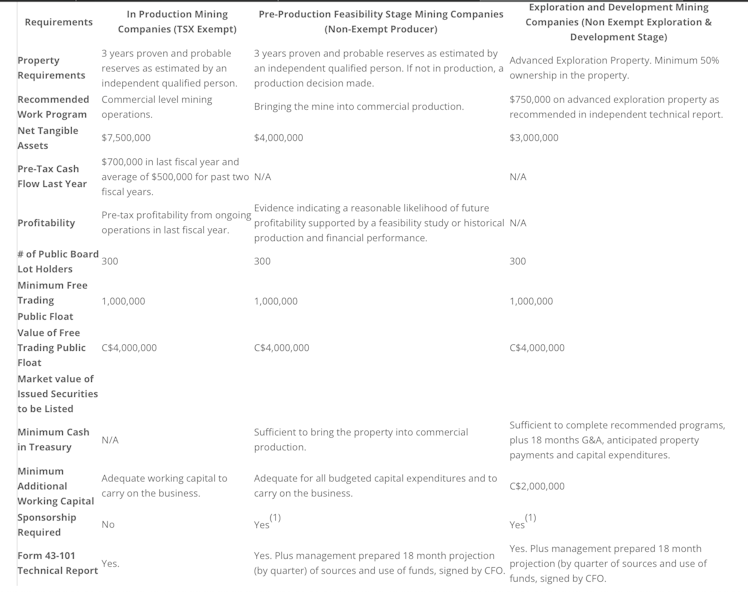

Listing requirements for mining companies:

venturelawcorp.com

Listing Requirements of the Toronto Stock Exchange – Industrial, Tech., Research & Dev. Issuers – Venture Law Corporation

Already have an account?