Trending Assets

Top investors this month

Trending Assets

Top investors this month

Dividend Stock #2 - $ESS

Hello fellow investors

this is post #2 out of #50, where I introduce you to all the dividend stocks in my portfolio

Today we talk about ESSEX Property Trust - $ESS

>> investor relation link

This Company is a REIT; if you are not familiar with that, REITs are a type of company that owns, operates, or finances income-generating real estate. They act a bit different from a normal company, and if you want to dig into it, I suggest you check out the Alexis Assadi podcast about REITs.

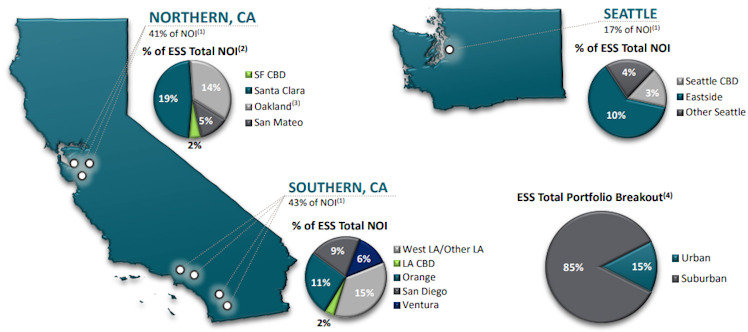

$ESS own and manage properties on the US West Coast, mostly California and Settle. Such properties are home to the thousands of employees of the Tech and BioTech industry; for this reason, the performance of $ESS is in some way linked to Tech Stocks.

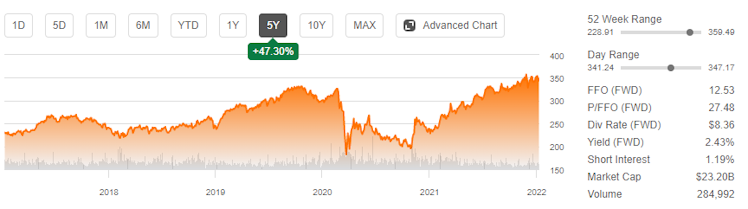

It was the first REIT I bought, and even when Covid first hit the US, they could collect most of their rent, and the Company didn't suffer much; the dividend was paid regularly, and the stock price is now completely recovered.

REITs are a great way to generate cash flow income and can be considered a substitute to own property directly. Unfortunately, there is no easy way to invest in the Californian housing market if you are an international investor, and REITs are probably the best solution.

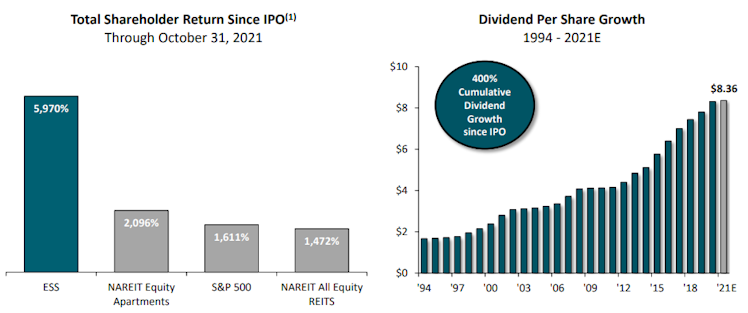

The Company has an outstanding track record of price appreciation and dividend growth. I was lucky enough to average down my position in $ESS exactly during April '20, so I benefited from the recovery.

ESSEX is the biggest REIT-holding of my portfolio. I am not planning to increase my exposure, but I am ready to buy more if the price decreases.

Do you like such posts?

Give it an upvote, and follow me for more.

Income Investing With Alexis Assadi

Income Investing With Alexis Assadi

NOTE: This podcast was discontinued in 2018. Thank you for listening. *************** Income Investing With Alexis Assadi is a podcast that explores income and dividend-producing assets. We cover everything from REITs, investment funds, p2p lending, mortgage lending, credit instruments, dividend stocks, tax lien certificates, real estate, crowdfunding and more. The show emphasizes monthly cash flow, but it also includes investments that pay quarterly. In addition, Income Investing dives into related subjects, such as government policy and economics. For example, mortgage funds are a common income investment (Ep.27) and will often invest in "Fannie Mae" bonds. But what is Fannie Mae? What is Freddie Mac? Didn't they play a role in the 2008 economic meltdown? Episode 28 provides the answers to those questions! The podcast aims to help income-oriented investors make more informed choices by delivering high-quality information. Published every Wednesday, Income Investing is hosted by Alexis Assadi. Alexis is ...

Already have an account?