Trending Assets

Top investors this month

Trending Assets

Top investors this month

A look at Tesla's BoD + a look at Tesla's legal department

In the wake of the FTX scandal, many are looking at the firm's board of directors and executive team and found the organization to be filled with people who have a history of cheating at poker tournaments and had other criminal records. Many on the board lack experience with running exchanges and handling securities.

A company that I have avoided and remain suspicious of is $TSLA. I followed TSLAQ for years and even though the stock has surged immensely since the days of "production hell," the fake buyout, and the executive exodus, I remain suspicious of the business and its financial results.

I saw this tweet screenshot in my camera roll. The significance of this tweet was that it confirmed that I'm not alone in questioning the competency of Tesla's BoD.

And after going through all the board members, I've verified his claims and concerns.

- Robyn M. Denholm, chairwoman of the board, is a VC.

- Ira Ehrenpreis is a VC.

- Hiro Mizuno was a UN Special Envoy on Innovative Finance and Sustainable Investments

- James Murdoch was once big in the media industry

- Kathleen Wilson-Thompson was once an executive at Walgreens and Kellogg's

- Joe Gebbia co-founded $ABNB

Where are the manufacturing specialists? Where are the automotive specialists? Where are the solar and battery specialists? And no, being a special envoy at the UN for sustainable investments doesn't count as being a specialist in batteries and solar energy, in my view.

When you look at board members of other companies like Apple and Target, you'll find people that are experts in the industries that those big companies are in. In Target's BoD, you'll find many folks that are actual specialists in the retail space. In Apple's board of directors, you'll find people that are specialists in advanced technology. In both companies' board of directors, you'll find people that know how to manage and navigate through supply chains and manufacturing issues.

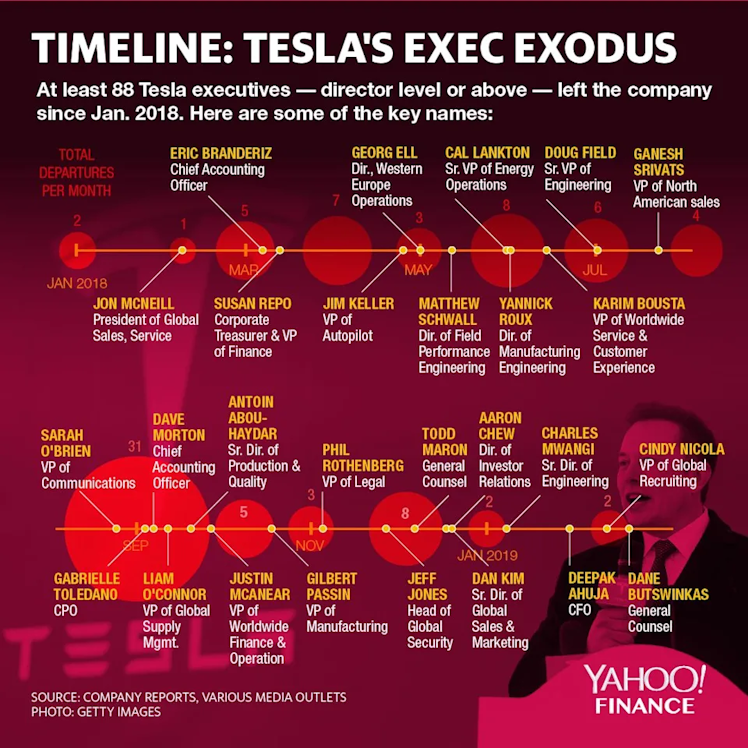

Besides board incompetency, the executive exodus at Tesla is unprecedented. This type of behavior is something you normally find in companies that have serious issues internally. Look at this chart from 2019:

From following the company's executive departures for years, I noted that after many of the experts left the company, Tesla replaced them with people from within the company. It's fair to say that the company is run by Elon Musk loyalists.

From December 2018 to December 2019, Tesla lost three general counsels. What type of company loses three general counsels in a single year? In August, a legal blog named Above The Law noted that many are confused on who exactly is the General Counsel of Tesla as well as whether the legal department at Tesla is functioning or not.

Are investors comfortable investing with a company that has a legal department running on autopilot? Are investors comfortable investing in a company whose board is filled with VCs and not experts of the auto industry, manufacturing, supply chains, etc.?

Above the Law

Tesla Legal Department On Self-Driving Mode... Or Maybe Not? Who's The GC Over There Anyway? - Above the Law

This seems entirely functional.

Already have an account?