Trending Assets

Top investors this month

Trending Assets

Top investors this month

New Weekly Paid Newsletter 11/09 is out

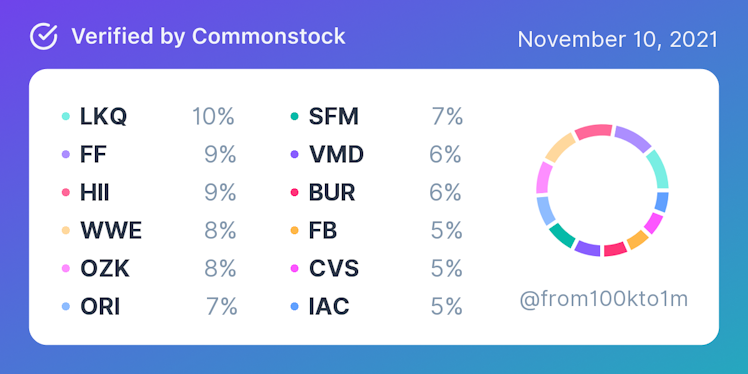

Holdings as of 11/09: $FF $LKQ $HII $WWE $OZK $ORI $SFM $VMD $FB $BUR $IAC $CVS $TWTR $OPFI ( $OPRA via call options )

Topics of The Week: Portfolio Update, Commentary, Exiting $OPBK, & More Earnings.

I also wanted to share part of this week's newsletter free of charge for "commonstock family"

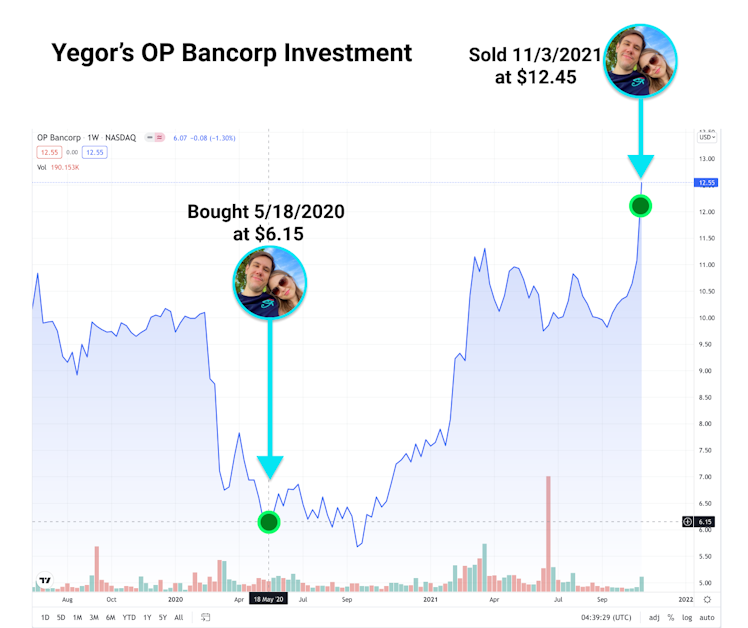

**Exiting Op Bancorp ($OPBK):**

I said it before, but this time it happened!

I exited $OPBK at about 100% profit.

Image courtesy of @nathanworden (Thank you)

Originally I was buying because during pandemic this bank had no debt, right metrics, and the most important thing… management was buying LIKE CRAZY lots and lots of shares while the whole world was preparing for doom and gloom.

Crazy part some are still buying (although not as much as

before) but I will be leaving this train…

Although I think this potentially has room to go higher with interesting rates going up. I just don’t feel as good with this being mainly niche play in California (one of the reasons why I bought $ORI and not $FAF) and I already have Bank OZK as my “Bank play”.

from100kto1m.substack.com

11.09.2021 Portfolio Update (Weekly Edition)

Topics for this Week: Portfolio Update, Commentary, Exiting $OPBK, and More Earnings.

Already have an account?