Trending Assets

Top investors this month

Trending Assets

Top investors this month

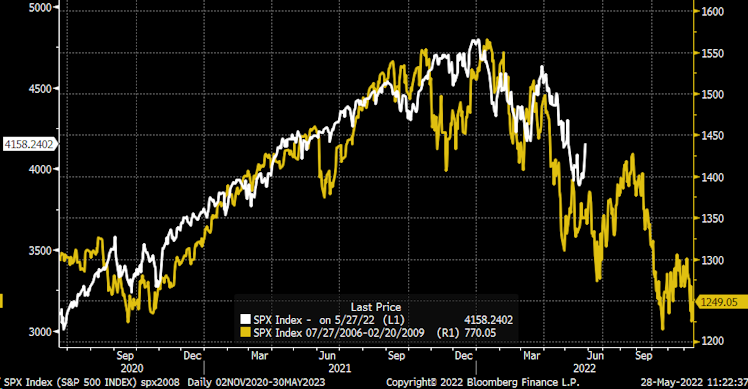

Comparing the 2008 decline to the 2022 decline: what will cause the decline to continue?

I give credit to Michael Kramer for finding a similarity between the S&P 500 decline from 2008 to the market decline of today. The image below was from late May and as of present day, the stock market movements continue to look identical

Today

Many wonder what will cause the market decline to continue.

From the people that are focused on the stock market, all I've seen are chatter about a higher CPI or consumer sentiment continuing to worsen. However, looking at the price of commodities, they've come down considerably to the point where Elon Musk is saying that inflation has peaked.

One thing that I've been paying attention to for the past few months is the growing tensions between China and Taiwan. With 90% of the world's advanced semiconductors being produced in Taiwan, an attack on Taiwan is detrimental to the world. Taiwan conducts the majority of exports through airfreight. With the Chinese air force and navy doing drills around Taiwan, it looks like the country is seeing a blockade disguised as a "military exercise" from China.

If an attack does happen, which I see happening soon, then I wouldn't be surprised to see the markets plunge in response to the news.

Contrarians and optimists will point out that Taiwan is only vital in terms of manufacturing capacity. With $ASML $LRCX $AMAT $KLAC and other semiconductor equipment firms being non-Taiwanese, as well as the fact that we have other chip foundry companies that don't produce chips in Taiwan, like $GFS and $INTC, the world will still be alright.

Wrong.

As I mentioned earlier, with nearly the entire production capacity of our advanced chips being wiped out, the tech sector, which has been the driver of economic growth and who has a strong influence over the rest of the world economy, will be struggling like never before. The damage from the tech sector will leak into other sectors. Demand for goods and services will plunge.

Even if things will be alright with the existing infrastructure we have, the world would have a harder time creating jobs in general. Innovation creates jobs. Without having a larger driver of innovation, it will be hard to create jobs in general. World War 3 would inspire countries to draft citizens into the military and that can be seen as a way to create job growth during a crisis. Defense spending will surge as nations will need to buy weapons and equipment for their new soldiers. However, many of the communication equipment, missiles, vehicles, etc. that the military needs to successfully complete missions depends on whether defense firms can secure a sufficient supply of chips or not. And with nearly all of the production of advanced chips wiped out, soldiers will have to fight old school.

In sum, pay attention to the growing tensions between China and Taiwan. The impacts of those tensions are currently sending small shockwaves to the world. Once war happens, the shockwaves will be big. The chances of a major shockwave coming are higher than many think.

www.bbc.com

China-Taiwan: What we learned from Beijing's drills around the island

Beijing redefines what is "acceptable" even as Taiwanese attitudes appear to be hardening further.

Whew, dark morning🤣🤣 I think it would take that type of catastrophic shock of an event to make the markets continue matching the 2008 trajectory. Russia invading Ukraine is one thing; China & Taiwan would significantly compound the economic shock globally, adding tech issues to the fuel & grain commodity issues were hearing about already (sure its much worse, just the two I’ve heard most about).

Already have an account?