Trending Assets

Top investors this month

Trending Assets

Top investors this month

Economic Update - PPI

Stock opened higher and have since flushed strongly in the red.

The PPI reading was yet another sign that inflation may have peaked and is beginning to ease. The report also increased hope that the Fed will again slow the pace of tightening at the first meeting of 2023.

For economic data, the Producer Price Index (PPI) fell 0.5% in Dec, beating expectations of a 0.1% drop. The PPI was up 6.2% YoY, down from 7.3% last month and the slowest pace since March 2021. Core PPI (excludes food and energy) was up 0.1% for the month, matching expectations. Core prices were up 5.5% YoY, just below the 5.6% expected.

Retail sales fell 1.1% in Dec, versus expectations of falling 1.0% during the month. Core sales fell 0.7% for the month. It is the 2nd straight month retail sales declined, indicating the consumer spending component of GDP will likely disappoint during the 4th quarter.

Industrial production fell 0.7% in Dec, a bigger drop than the 0.1% decline expected. Manufacturing production was down 1.3% during the month and capacity utilization unexpectedly fell to 78.8%. Wrapping up data, the NAHB Homebuilder Sentiment Index unexpectedly rose to a reading of 35 in Jan, the 1st increase in a year. All 3 components were higher during the month.

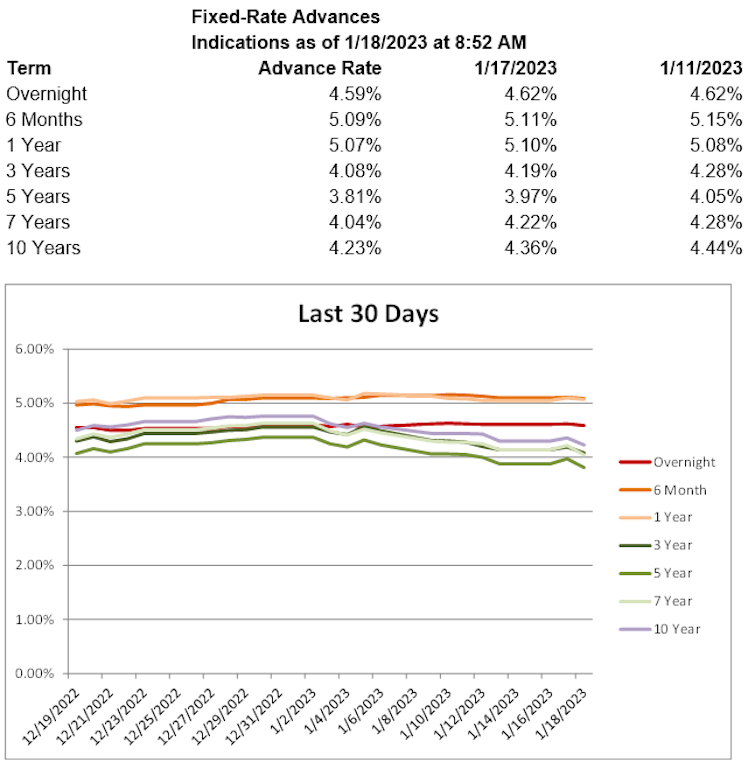

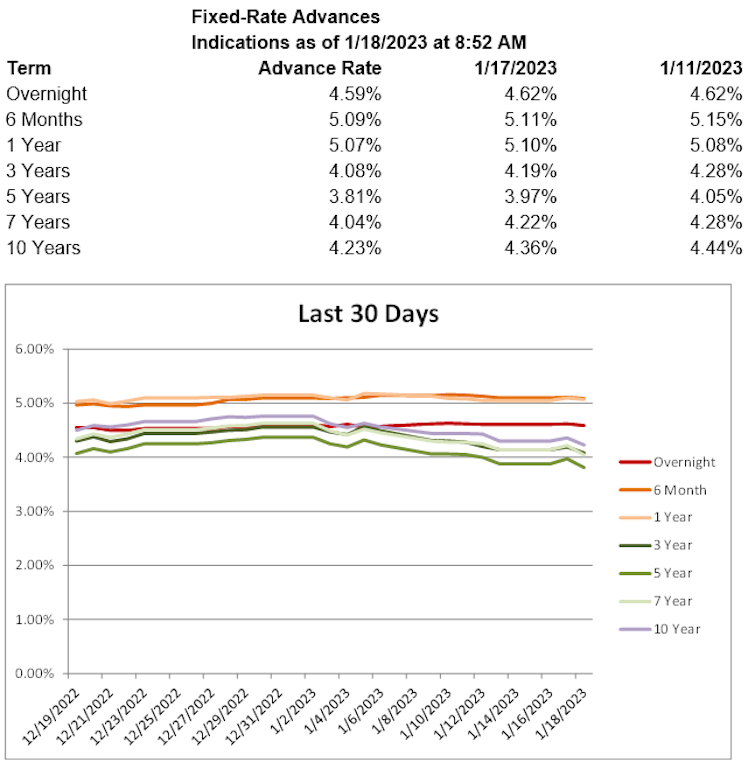

Treasury yields are lower, with the 2-year T yield down 9.3 basis points to 4.10%, the 5-year T yield down 15.2 basis points to 3.46%, and the 10-year T yield down 14.5 basis points to 3.39%. Advance rates are lower throughout the curve today.

I think at this point the talk is more focus on will the FED overtighten or read the data right.

Already have an account?