Trending Assets

Top investors this month

Trending Assets

Top investors this month

Dividend Portfolio Update

As you may know, I write many updates, economic analysis, and opinion pieces on my website, you can read my most recent full portfolio update here. However, it's been a while since I've shared an update on Commonstock so let's do one!

To date, I have invested $11,050 into the account the total value of all positions plus any cash on hand is $10,540. That’s a total loss of -4.62% The account is down $310.76 for the week which is a -2.86% loss.

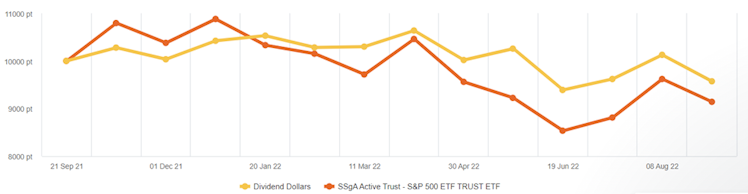

We started building this portfolio on 9/24/2021 and, even with this rough last week, when compared to the S&P 500 we are outperforming the market so far! Within that same timeframe, the S&P 500 is down -11.92% whereas our portfolio is down 4.62%! I love tracking my portfolio against a benchmark like the S&P. The above chart comes from Sharesight which makes portfolio and dividend management a breeze!

We added $250 in cash to the account over the last two weeks.

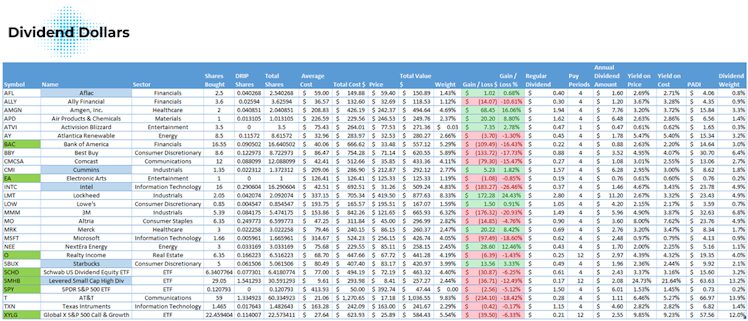

Below is a table of everything we are invested in so far. There you can see my number of shares, shares bought through dividend reinvestments, average cost, gains, and more. The tickers in green are positions that I bought shares in this week and the blue ones are positions that I reinvested dividends into. The positions that we added to increased our annual dividend income by $8 at a yield of 4.54%.

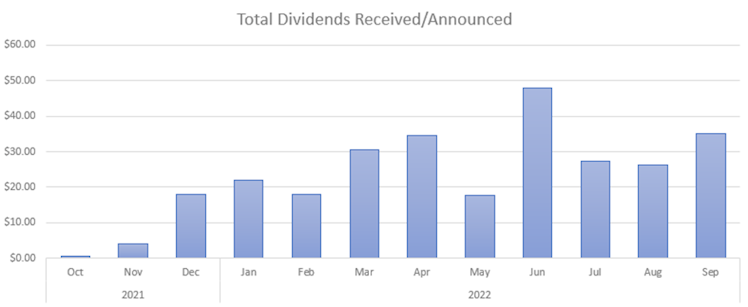

For the last two weeks we received $13.78 from five dividends: $2.29 from $SMHB, $2.47 from Starbucks ($SBUX), $1.01 from Aflac ($AFL), $5.88 from Intel ($INTC), and $2.14 from Cummins ($CMI).

In my portfolio, all positions have dividend reinvestment enabled. I don’t hold onto the dividend, I don’t try to time the reinvestment, I just let my broker do it automatically.

Dividends received for 2022: $237.97

Portfolio’s Lifetime Dividends: $255.90

You can see my trades on my profile and next week I will continue to add $10 into each ETF ($SPY, $XYLG, and $SCHD) and will look at deploying the rest of the money either into $MO or $BBY for the upcoming ex-dividend date.

That is it for the update this week. Let’s kill it next week. Stay patient and be ready to buy income producing assets at a discount!

Read the weekly market review to get a recap of the week and what economic events are

coming in order to help arm yourself with a strategy for your future buys!

Dividend Dollars

Stock Market Week in Review – 9/2/22 | Dividend Dollars

The red streak continues as the Fed stays hawkish and jobs show some weakness! Read the market recap here!

Already have an account?