Trending Assets

Top investors this month

Trending Assets

Top investors this month

HEICO reported Q3 EPS $0.60 vs FactSet $0.65 [12 est, $0.60-0.69]

HEICO's effective tax rate was 27% in Q3 vs. 15.7% in Q3 last year. Management believes the actual cash tax rate is 21% which would have resulted in EPS of $0.65-0.66 in Q3.

FSG segment sales were 5% better than expected. FSG sales topped pre-covid levels for the first time. FSG organic growth >20% the last five quarters.

ETG segment sales missed by 1%. Defense was weak within ETG due to delayed US Gov outlays. ETG saw about $25M of orders pushed into Q4 and Q1 FY23.

(see our public viz for HEICO segment trend analysis)

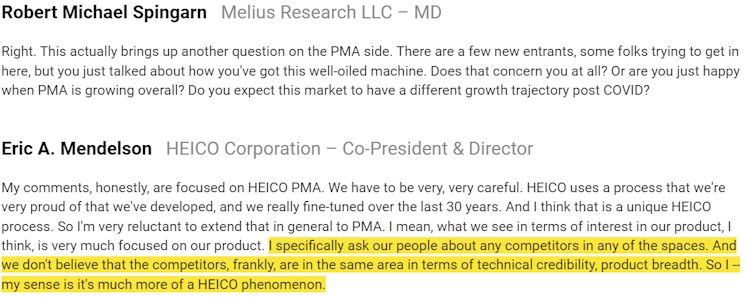

New entrants on PMA side are not competitive in terms of HEICO's technical credibility and product breadth. HEICO has fine-tuned its process over the last 30 years:

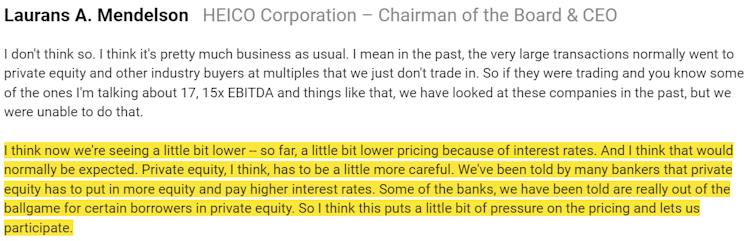

Interest rates are reducing prices, letting HEICO participate in more M&A:

Recent acquisitions include:

HEICO's largest acquisition ever-

HEICO announces its Electronic Technologies Group entered a put option agreement to acquire Exxelia International for €453M in cash

A French electronics (Hi-Rel = High-Reliability) company for aero & defense mainly. Expected to close Q1 of FY23. Revenue is E190M (about $193M USD) in CY2022. Revenue is 60% in Europe and 40% in US and other. EBIT margin is slightly less than ETG’s margin.

This acquisition would boost HEICO’s total revenue about 8% from $2.4 billion in FY23 to $2.6 billion. For ETG, revs should go from $1.02 billion in FY23 to $1.22 billion (+20%)

The company announced its Flight Support Group has acquired 96% of Accurate Metal Machining, Inc. for cash at closing, plus potential additional cash consideration to be paid if certain post-closing earnings levels are attained. Additional financial details were not disclosed.

-HEICO stated that it expects the acquisition to be accretive to its earnings within the year following closing

-Cleveland-based Accurate Metal Machining is a manufacturer of high-reliability components and assemblies

-Accurate employs ~250 people at its Cleveland production facility

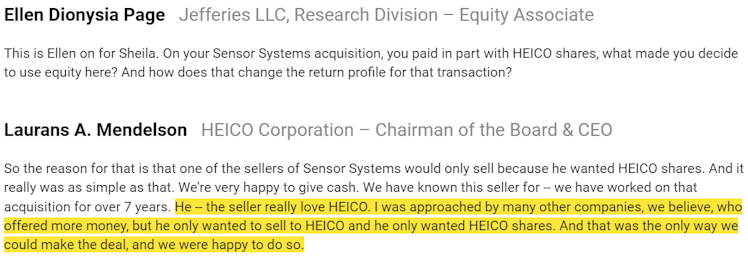

HEICO Corporation announced that its Electronic Technologies Group acquired all of the stock of Sensor Systems, Inc. for a combination of cash and approximately 575,000 HEICO Class A common shares. Further financial details were not disclosed.

-HEICO stated that it expects the acquisition to be accretive to its earnings in the year following the acquisition.

-Sensor's products include, among others, Aircraft Direction Finding, Altimeter, Glideslope, Global Positioning System, L-Band, Marker Beacon, satellite communications, Total Collision Avoidance System, Very High Frequency and Very High Frequency Omni-directional Range antennas.

-HEICO Corporation announced that its dB Control subsidiary acquired 100% of the stock of Charter Engineering, Inc. for cash at closing.

-Further financial details were not disclosed.

-dB Control is part of HEICO's Electronic Technologies Group.

HEICO Corporation announced that its Electronic Technologies Group acquired approximately 80% of the capital stock of technology component company Ironwood Electronics, Inc. for cash paid at closing, plus additional cash consideration to be paid if Ironwood meets certain earnings targets.

The balance of Ironwood's shares will continue to be owned by Ironwood's CEO, David Struyk, and other key managers. Further financial information was not disclosed.

Eagan, MN-based Ironwood employs approximately 75 people in the design, manufacture, and sale of its products.

HEICO stated that it expects the acquisition to be accretive to its earnings within the year following acquisition.

Tableau Public

HEICO data

HEICO data

Already have an account?