Trending Assets

Top investors this month

Trending Assets

Top investors this month

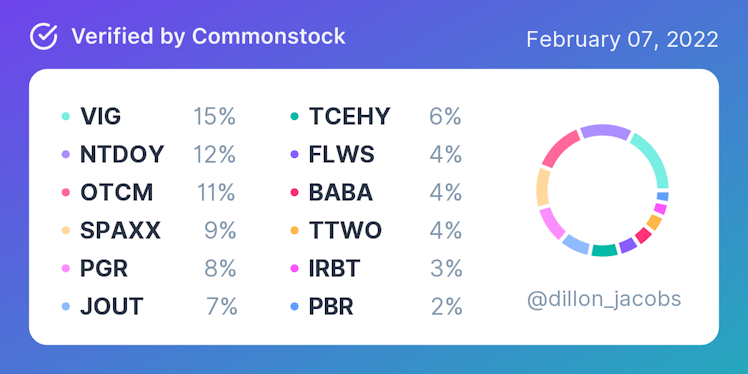

Portfolio Update: 7 February 2022

The sell-offs this year prompted a lot of action in my portfolio. I've probably done more work this month than I did all year in 2021.

TBD on whether that's good or bad!

Here's what I've been up to so far this year.

Sold:

$ELP: Nothing wrong with the stock or thesis, just wanted to add more liquidity with other buying opportunities. The stock provided some very juicy dividends, and I was up around 6% when I sold. In addition, I wanted to limit my Brazilian exposure since I bought another very large Brazilian company (see below).

$PAM: Same story as $ELP; wanted to limit risk and lock in a gain. I was up nearly 30% when I sold, and I wanted to limit my exposure to Argentina, which is extremely volatile.

$BAH: I still love this company and didn't want to sell, but it has been aggravating to be a shareholder in this company. Management didn't make bad decisions per se, but I thought they would eliminate some risk by buying down some debt, but it seems their priorities lie elsewhere. Locked in around a 9% gain.

$BEPC: When I bought this stock, I was a bit more bullish than I should have been. This was the classic "did the research over a week and talked myself into it" purchase. There's nothing wrong with the company, I just wanted to invest in a company that I had more confidence in.

I broke even on this trade.

Bought:

$JOUT: Just like a lot of businesses right now, the company is having supply problems and slowing post-pandemic sales, which caused the stock to plummet. Over the last quarter, this company's stock has fallen below $90 a share.

I averaged down a bit during this period, but I haven't bought anymore since it's already a big chunk of my portfolio. I have no concerns here because the management is great.

$PBR: After doing my own research and reading an excellent report from Sven Lorenz at Undervaluedshares.com, I decided to buy some shares of Brazilian oil giant $PBR.

In the next five years, the company seems very well positioned to return tons of cash to shareholders through dividends. While elections in Brazil may prove volatile later this year, I believe I will benefit from shareholder-friendly dividends and a huge demand due to current and future energy shortages.

$FLWS: A week or two ago, $FLWS reported some pretty negative quarterly earnings, and the stock price got pummeled. Just like $JOUT, $FLWS is suffering from short term supply chain and labor costs.

As usual, I took advantage of the downturn by buying more. Management is firing on all cylinders despite supply chain problems.

$TROW: One of the top public asset managers. Due to the market overreacting to somewhat negative earnings, I consider this stock to be a steal under $200 per share. It has a great business model, stable growth, a flawless balance sheet, pays a decent dividend, and buys back its shares.

It may not be going to the moon, but $TROW is a solid cornerstone for any portfolio.

$NVR: similar to $TROW, with the exception of no price declines. It took me a long time to decide to buy stock, but now I'm happy I did. $NVR is the safest and most shareholder friendly homebuilder to take advantage of the housing boom.

$GOOGL: You can see my previous post on this I did last week, but it's the same story as $NVR; great business at a fair price. My fear of big numbers was preventing me from owning one of the best businesses in the world, but I quickly changed course.

$PYPL & $FB: Established (small) positions during the large sell off last week. I like both for the same reason: cash cow networks.

Even if both companies lose market share and their FCF declines, the risks (to my mind) are baked into these valuations. Providing the companies continue to hold decent market share, shareholders will receive significant cash flows for many years to come.

For me, everything else (metaverse, crypto, VR, etc.) is free chicken.

Already have an account?